AUD/USD Outlook: Aussie Neutral Amid Mixed Economic Signals

The AUD/USD outlook showcased a neutral outlook as the Australian dollar danced after the unveiling of mixed economic data. Meanwhile, investors were cautious ahead of fresh inflation data from the US that will guide the outlook for interest rates.

Data on Thursday revealed that Australia’s retail sales recovered at the start of 2024 after falling in December. However, the increase of 1.1% missed forecasts of a 1.5% increase. Moreover, sales growth annually remained low due to high interest rates.

Meanwhile, another report indicated a 0.8% increase in business investment in Q4. This increase came due to growth in the mining sector, which is positive for the economy. The RBA is still unconvinced that its fight to tame inflation is over. As a result, policymakers said at the last meeting that there was a chance the central bank would hike interest rates.

However, after Tuesday’s inflation report, traders are more convinced that the RBA’s rate hike cycle is over. Notably, Australia’s inflation held at a two-year low in January.

Meanwhile, markets were gearing up for another US inflation report on Thursday. The core PCE price index is a significant report as the Fed uses it as the best measure for inflation in the country. Therefore, it carries a lot of weight and will likely impact the outlook for interest rate cuts in the US.

AUD/USD key events today

- US core PCE price index

- US initial jobless claims

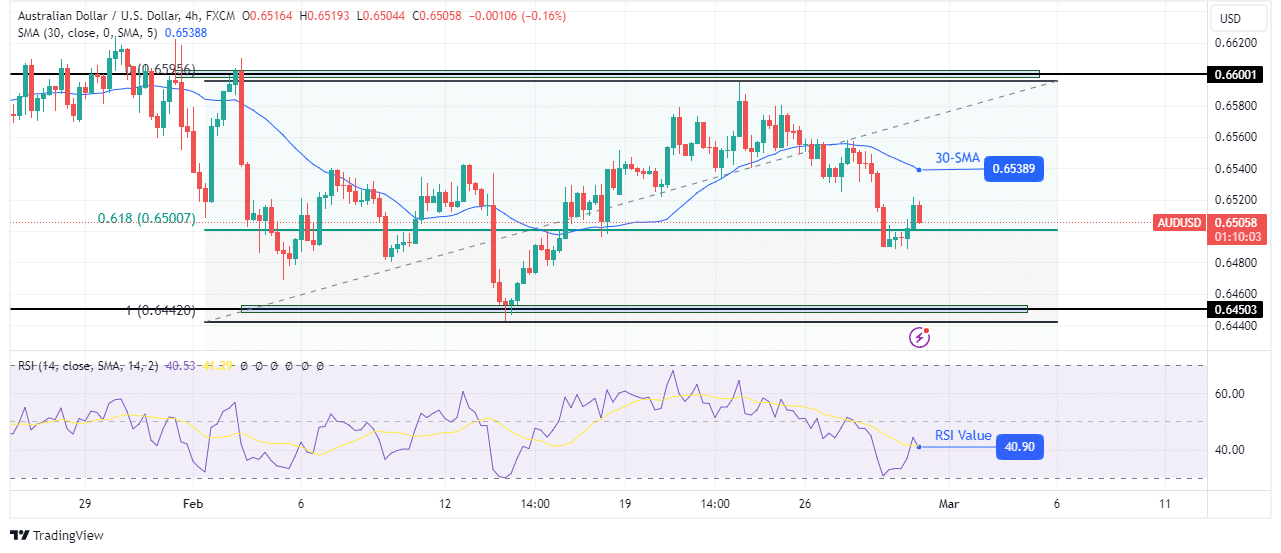

AUD/USD technical outlook: Price halts at 0.618 Fib and 0.6500 psychological barrier

(Click on image to enlarge)

AUD/USD 4-hour chart

On the technical side, AUD/USD has paused at the 0.618 Fib level, which also lies at the 0.6500 key psychological level. Meanwhile, the bias is bearish as the price trades well below the 30-SMA with the RSI under 50, supporting bearish momentum.

Although bears tried to break below this strong support zone, the price pulled back above. This is a sign that it was rejected below the support zone. However, the bearish bias is strong. Therefore, even if the price consolidates at this support, it might eventually break below. A break below would allow bears to retest the 0.6450 support level.

More By This Author:

USD/JPY Forecast: Yen Surges On Hawkish BoJ RemarksGBP/USD Forecast: Sellers Emerge Ahead Of US Core PCE Data

AUD/USD Price Analysis: Aussie Slides On Softer Inflation

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more