Monday, January 29, 2024 5:36 AM EST

The AUDUSD has been experiencing an ongoing downtrend, with the potential for significant market changes in the near future.

Persistence of Current Downtrend

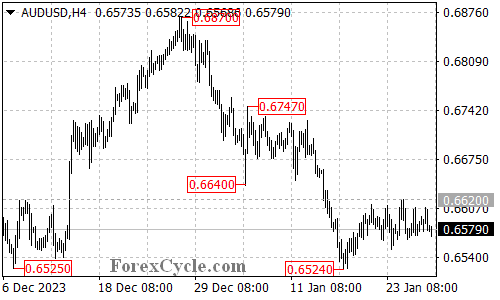

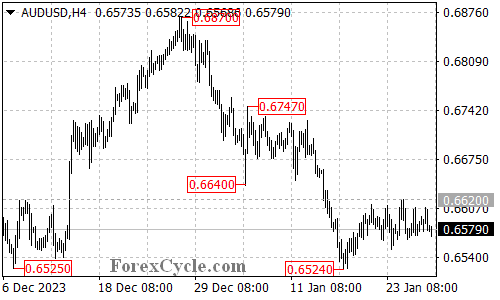

Originating from 0.6870, AUDUSD continues to remain in a downtrend. Price action within the trading range of 0.6524 and 0.6620 is believed to be an accumulation period for this continuing downtrend.

Potential Continuation Scenario on Downside

Supposing the 0.6620 resistance level maintains, we could predict a further continuation of this downside. In fact, a breakdown moving past the 0.6524 support level could likely spark another downside push towards the 0.6460 area, subsequently dropping to 0.6370.

Point of Reversal: Breaking Resistance

Conversely, should there be a breakout above the 0.6620 resistance level, it could indicate that the current downtrend has potentially concluded at 0.6524. In this scenario, the follow-up target would be positioned at the 0.6680 area.

The AUDUSD market is displaying a clear downtrend with upcoming crucial resistance and support areas that can significantly affect the market direction. Closely monitoring these key levels would help traders navigate the current downtrend and potentially predict any major changes in trend.

More By This Author:

USDCAD Trading Maze: Failed Breakouts And Possible LowsRallying EURUSD: A Shift From Downward Movement To Promising UptrendsGBPJPY Holds The Line: Resilience Within The Rising Price Channel

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.