AUD/USD Forecast - The Australian Dollar Remains Neutral

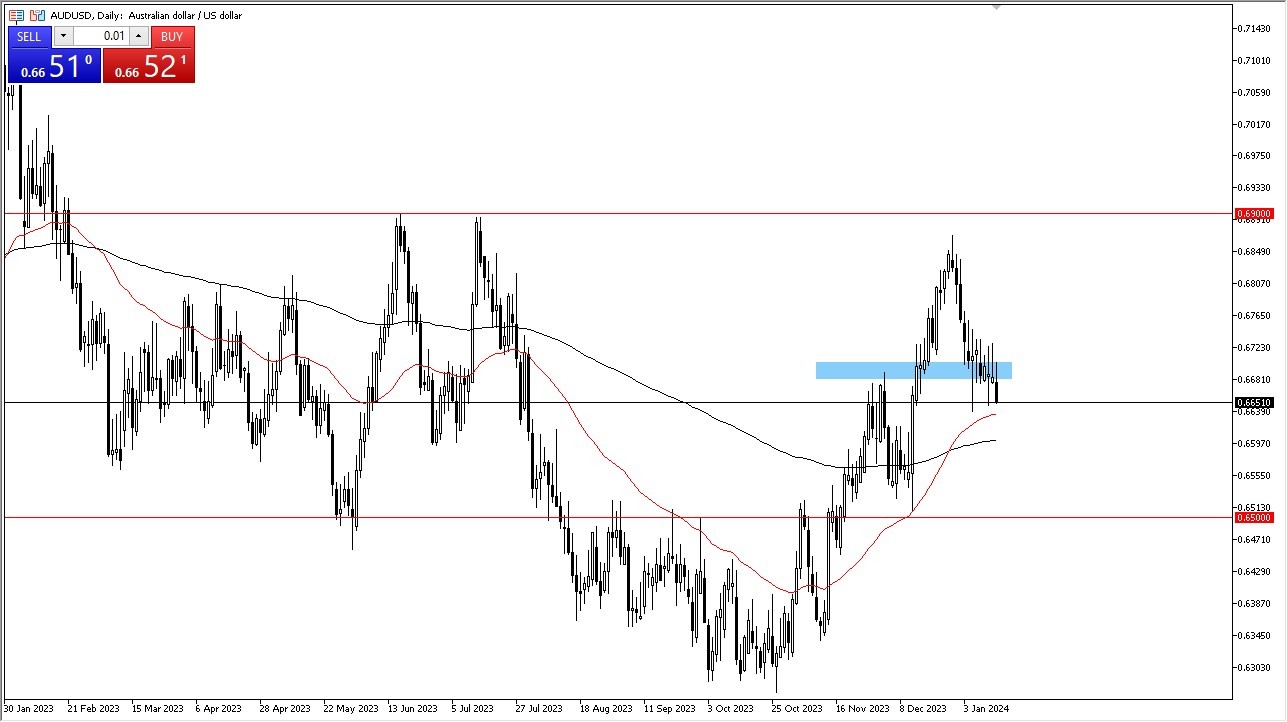

Conversely, a turnaround and a break above the 0.6750 level could propel the pair towards the 0.6850 and potentially the 0.69 level.

- The Australian dollar experienced a slight retreat in Monday's trading session, reflecting prevailing uncertainties surrounding global risk appetite.

- The AUD/USD pair, after a brief rally, faced a downturn, signaling prevalent negativity in the market.

- Amidst this sentiment, the potential for a breakdown is evident, although crucial support levels warrant attention.

- There are a few underneath that we need to pay close attention to as technical traders will have their say as well.

The 50-day Exponential Moving Average serves as a significant support barrier, positioned just below the current market levels. Further reinforcement comes from the 200-day EMA, creating a layer of support that, if breached, may lead to a test of the 0.65 level. This level holds significance as previous resistance, introducing a factor of market memory into the analysis.

Conversely, a turnaround and a break above the 0.6750 level could propel the pair towards the 0.6850 and potentially the 0.69 level. The directional movement of the Australian dollar price hinges on factors such as interest rates in America and the broader concept of risk appetite. Risk appetite is somewhat in flux at the moment, so it does make a certain amount of sense that the Australian dollar is relative neutral overall.

Australian dollar and risk appetite sensitivity

The Aussie dollar's sensitivity to risk appetite, given its status as a commodity currency and its strong ties to Asia, adds complexity to its market dynamics. Currently situated within a larger consolidation range spanning from 0.65 to 0.69, the Australian dollar appears close to what could be deemed fair value. This positioning prompts a pragmatic perspective, questioning the rationale for significant investment in the pair when better setups might emerge in the future.

(Click on image to enlarge)

Acknowledging this consolidation phase, the suggestion is to view the AUD/USD pair as a risk barometer indicator rather than a strong trading opportunity. The potential for substantial moves seems limited for now. The market's readiness for significant shifts may become apparent at the outer boundaries of the established trading range. Until then, exercising patience and monitoring risk sentiment through the Australian dollar can be a prudent approach, allowing for better-informed decisions when clearer setups materialize in the future. After all, this is a situation where the beginning of the year has been sluggish in general and therefore you need to let larger positions play out before trying to chase it with your account.

More By This Author:

Bitcoin Forecast: Bitcoin Continues To Pull Back After ETF AnnouncementNatural Gas Forecast: Natural Gas Stays Quiet On MLK Day

Crude Oil Markets Continue To See Resistance Above

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more