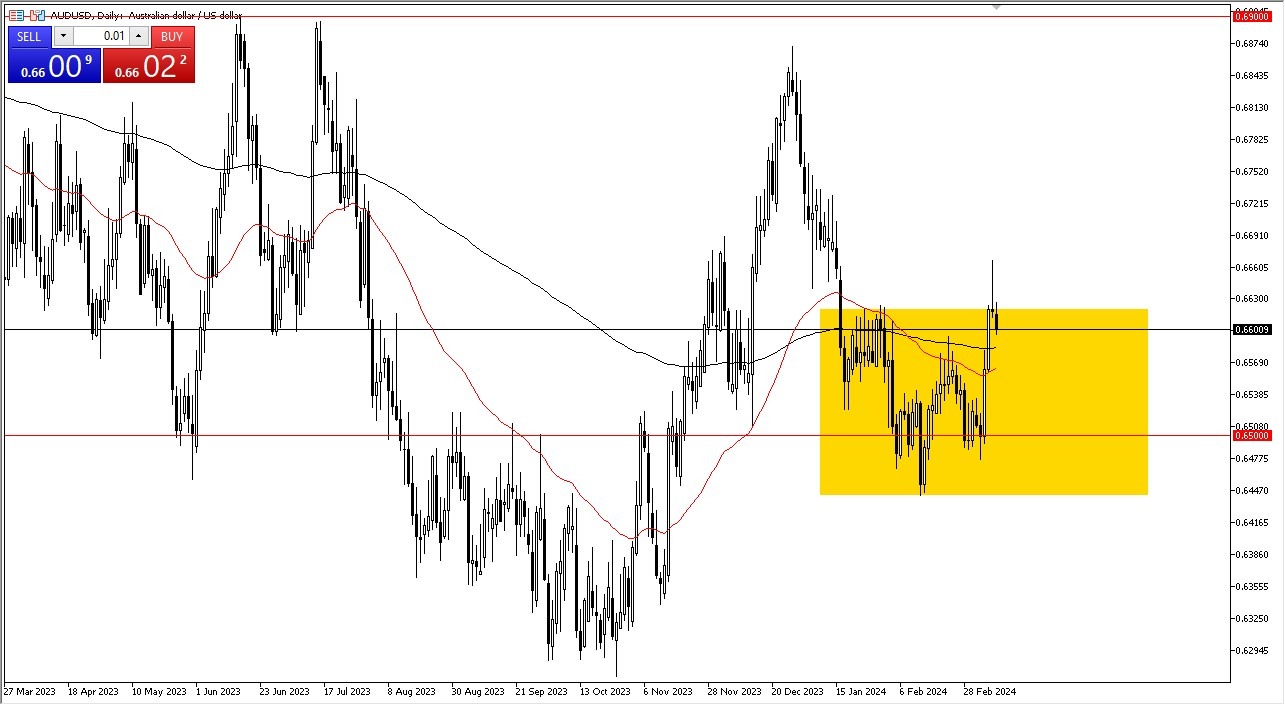

AUD/USD Forecast: Hesitation Suggests Potential Retreat

There's a chance the market will reach the 0.69 mark, a significant resistance level.

- When traders returned to work on Monday morning, they were focused on the enormous shooting star that formed on Friday, which resulted in a dull trading session for the Australian dollar.

- Naturally, this gives off a very bad impression, indicating that people will be watching to see if there is any action taken.

AUD/USD Hesitant

The AUD/USD has exhibited some hesitancy on Monday morning, suggesting that a potential retreat may be in the works. Given that the Friday session was a huge success, it is inevitable that this will draw a lot of attention because it is an indication of fatigue.

I believe there will be more momentum to look toward the 200-day EMA and eventually the 50-day EMA underneath the candlestick if we close the session below the bottom of the candlestick. The market will then drop to the 0.65 level at that point. However, it would be extremely bullish if we reverse course and break above the peak of the shooting star for the Friday session.

In that case, the Australian dollar might try to find support at the 0.6750 level, which is where a lot of prior trading has occurred. Above that, there's a chance the market will reach the 0.69 mark, a significant resistance level. Generally speaking, you need to remember that the Australian dollar is heavily impacted by global trade and risk appetite since the Australian economy is so closely tied to the commodities markets, which are inevitably linked to the expansion of world economies. Additionally, it is closely related to the Asian market, so keep an eye on their performance.

(Click on image to enlarge)

All things considered, I believe that this market is likely in need of a slight retreat or, at the absolute least, some sideways movement. Because of this, even though I don't necessarily think this pair will fall apart, I am viewing it as one that is probably likely to drop. As a result, I am currently leaning slightly negative but I don't think it's necessary to invest a lot of money in this market given the state of affairs.

More By This Author:

Natural Gas: Market Stabilizes Amidst Noise And Long-Term OutlookCrude Oil Forecast: Likely to Rally Further

AUD/USD Forecast: The Australian Dollar Is Still Under Pressure To Rise