AUD/USD Forecast: Continues To March Towards 0.68

At the end of the day, the Australian dollar's recent performance suggests continued upward momentum.

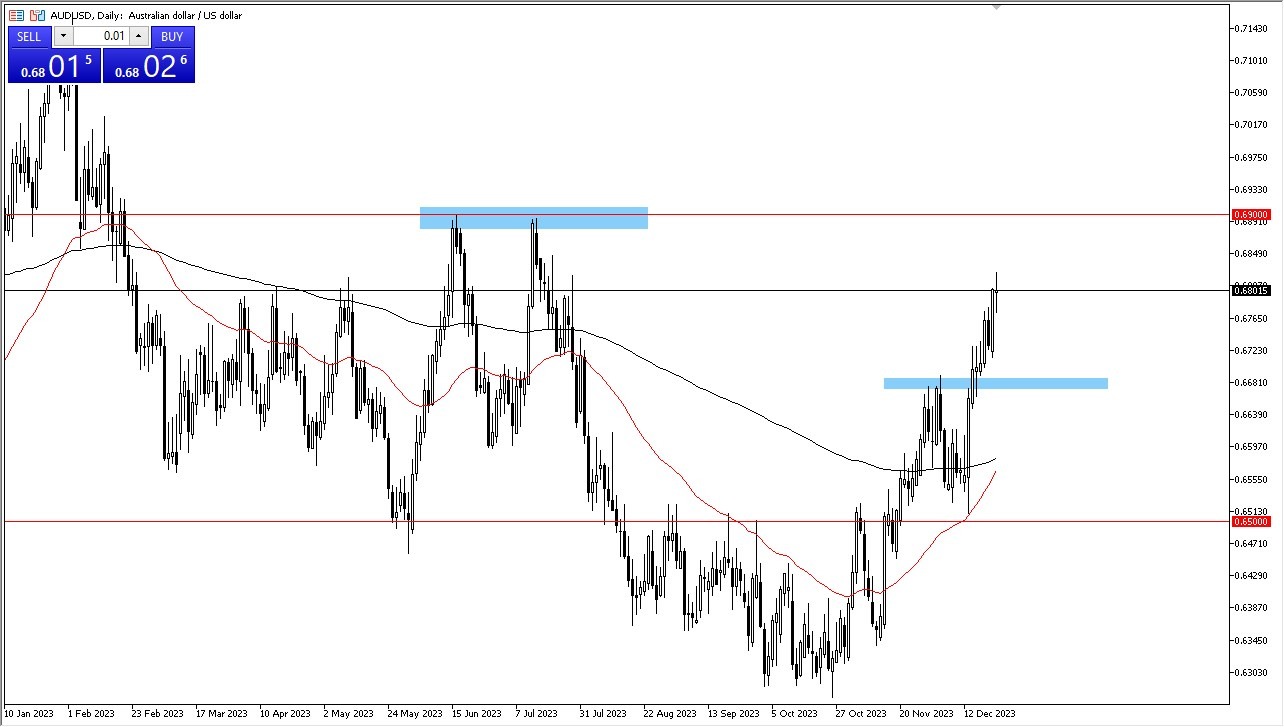

The AUD/USD experienced an initial pullback during Friday's session but then quickly reversed course, displaying signs of vitality. In simple terms, this suggests that the market is likely to continue its upward trajectory. Traders are factoring in the idea that the Federal Reserve will reduce interest rates through 2024, which is contributing to the positive sentiment. When we analyze the technical aspects, they align with this perspective. In the previous session, the market surged significantly, and now it appears to be gathering further momentum. However, it's important to bear in mind that the holiday season tends to drain liquidity, but I anticipate that buyers will step in whenever there is a dip.

The Next Barrier Gets Broken

- As I'm writing this, the market is testing the 0.68 level, and I believe that we will eventually reach the 0.69 level.

- This level had previously served as a significant barrier, and the recent upward movement indicates a growing presence of value-seeking traders.

- Whether we can surpass the 0.69 level remains to be seen, but if we manage to break through, the next logical target would be the 0.70 level, which holds immense psychological significance due to its round-number nature.

Beneath the current price action, the 0.67 level appears as a potential support zone. Even in the event of a downturn below this level, the 200-day Exponential Moving Average might offer a safety net, although such a scenario seems unlikely. The imminent "golden cross," where the 50-day EMA is about to cross above the 200-day EMA, is a bullish signal favored by longer-term traders. While it may not always be a guarantee, it adds another incentive for traders to adopt a long position.

At the end of the day, the Australian dollar's recent performance suggests continued upward momentum. The anticipation of the Federal Reserve's interest rate cuts is a prominent driver of this trend. Technical analysis further reinforces this outlook, and the holiday season, while potentially causing some turbulence and choppiness due to lower liquidity, is unlikely to deter the overall bullish sentiment. That being said, it is probably only a matter of time before we go higher, especially as traders come back from the holidays and price in the Federal Reserve actions for 2024.

(Click on image to enlarge)

More By This Author:

Gold Forecast: Looks For Higher LevelsS&P 500 Forecast: Sees Pressure to Upside into the Holidays

Pairs In Focus This Week – AUD/USD, USD/JPY, S&P 500, Oil, Silver, Gold, EUR/USD, ETH/USD

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more