AUD/USD Falls Amid Sour Sentiment, PBOC Rate Decision

Image Source: Unsplash

The Aussie Dollar (AUD) dropped during the North American session by some 0.42% against the US Dollar (USD) due to sentiment deterioration and low volume conditions, as the financial markets in the United States (US) remained closed on Martin Luther King (MLK) holiday. The AUD/USD trades at 0.6655 after hitting a high of 0.6705.

AUD/USD driven by risk aversion at the beginning of the week

AUD/USD was hurt by risk appetite as well as the People’s Bank of China (PBOC) keeping rates unchanged at 2.50%, coughing traders off guard, even though China’s economy crawls to grow at the levels expected by China’s President Xi Jinping.

Meanwhile, economic conditions in Australia continued to be challenging, as most of its PMIs remained in contractionary territory despite a slight improvement. Further data was positive, with Retail Sales exceeding the forecast of 1.2%, coming at 2% on January 6, adding to inflationary pressures, which were dissipated by the latest report. On January 9, the Australian Bureau of Statistics (ABS) revealed that headline inflation hit 4.3%, diving for the third straight month, which could deter the Reserve Bank of Australia (RBA) from hiking rates.

Ahead of the week, Australia’s economic docket will feature Westpac Consumer Confidence alongside housing data release. On the US front, the calendar would feature the NY Empire State Manufacturing Index on Tuesday, along with the Federal Reserve Governor Christoper Waller's speech.

AUD/USD Price Analysis: Technical outlook

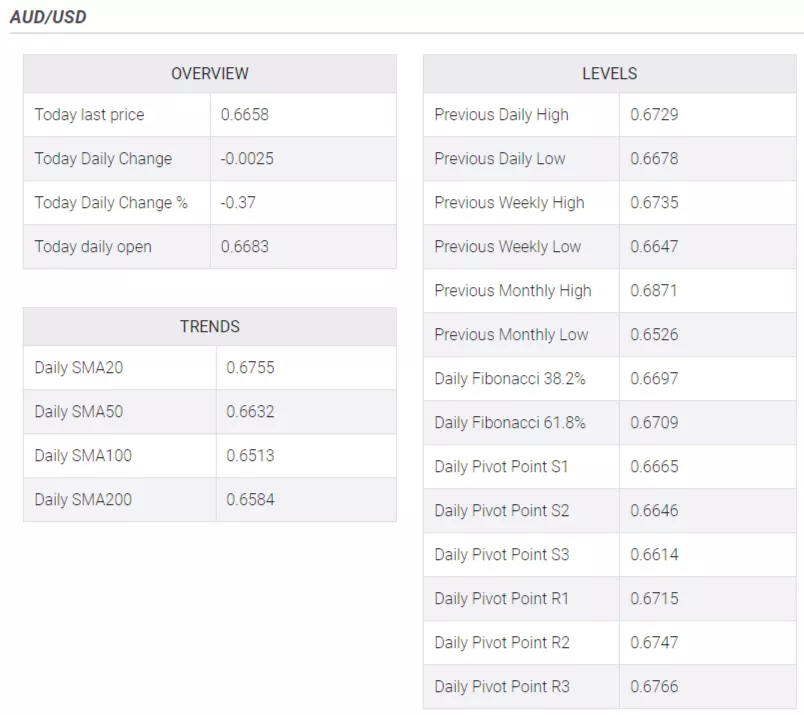

The daily chart portrays the pair as neutral to upward biased, but in the last week, it has been trading sideways, unable to gather direction. If buyers lift the AUD/USD past the first resistance seen at 0.6700, they will face the next ceiling at the January 12 high of 0.6727. Once hurdled, the next stop would be the January 5 high of 0.6747, ahead of 0.6800. on the flip side, downside risks remain at the January 5 low of 0.6640, followed by the 0.6600 threshold.

(Click on image to enlarge)

More By This Author:

USD/CHF Edges Up On Risk-off Trading, Aiming For 0.8575Pound Sterling Turns Sideways Ahead Of UK Labor Market Data

Gold Price Forecast: XAU/USD Flat-Lines Below $2,050, Focus On Geopolitical Tensions

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more