AUDUSD: Sell Trade Hits Targets

Since the start of February 2023, AUDUSD has been trending to the downside making lower lows and lower highs. Knowing that the pair is on a down trend it would only make sense for a trader to look for possible sell trade setups.

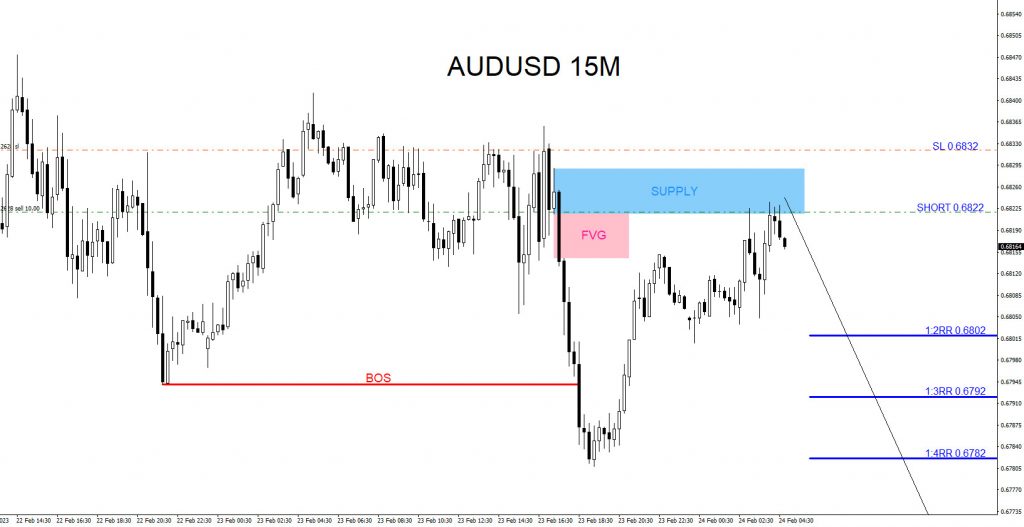

On February 23 2023 I posted the AUDUSD 15 Minute chart on social media @AidanFX calling for the pair to sell off and continue the trend lower and make a newer lower low .

SELL Trade Setup

1. Trending to the downside since February 1 2023 signalling to only look for selling opportunities.

2. Price makes a new lower low (BOS=Break of Structure) on the 15 minute chart signalling bullish weakness and bearish continuation.

3. Price retraces higher and reacts lower from supply zone (Light Blue Box) signalling rejection and tagging in the sell entry.

AUDUSD 15 Minute Chart February 23 2023

(Click on image to enlarge)

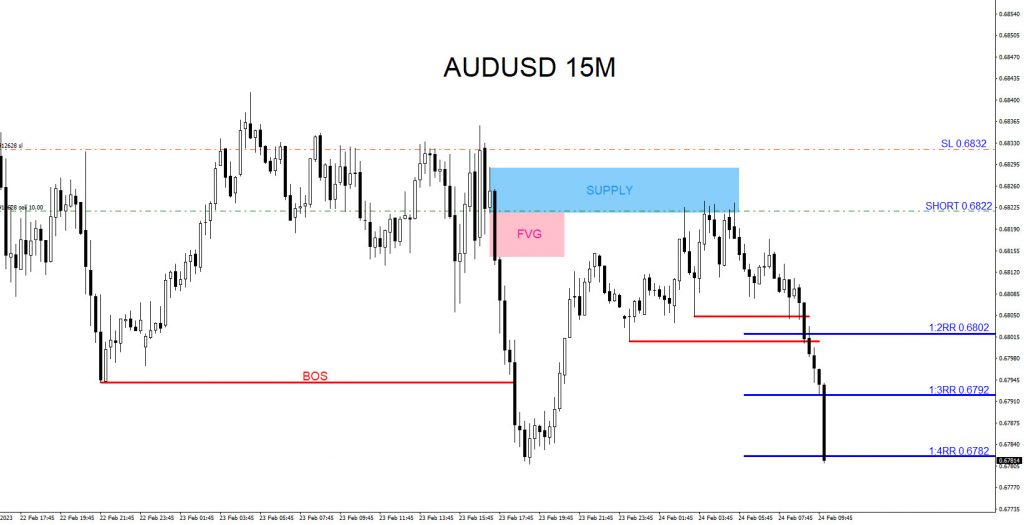

AUDUSD 15 Minute Chart February 24 2023

(Click on image to enlarge)

SELL trade entered at 0.6822 with Stop Loss at 0.6832 and on February 24 2023 AUDUSD moved lower to the proposed maximum target at 0.6782 for a +40 pip move and a 1:4 Risk/Reward winning trade. (Risking 1% on every trade)

A trader should always have multiple strategies all lined up before entering a trade. Never trade off one simple strategy. When multiple strategies all line up it allows a trader to see a clearer trade setup. If you followed me on social media you too could have caught the AUDUSD move lower. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100%, is that we are RIGHT more than we are WRONG.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Cryptos, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Hour Chat Room. Our clients are always in the loop for the next market move.

More By This Author:

Advanced Micro Devices Perfect Reaction Higher from Blue Box Area

Coke (KO) Long Term Structures And Key Levels

Novo Nordisk: Impulsive Sequence Favors Upside & Remain Supported

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more