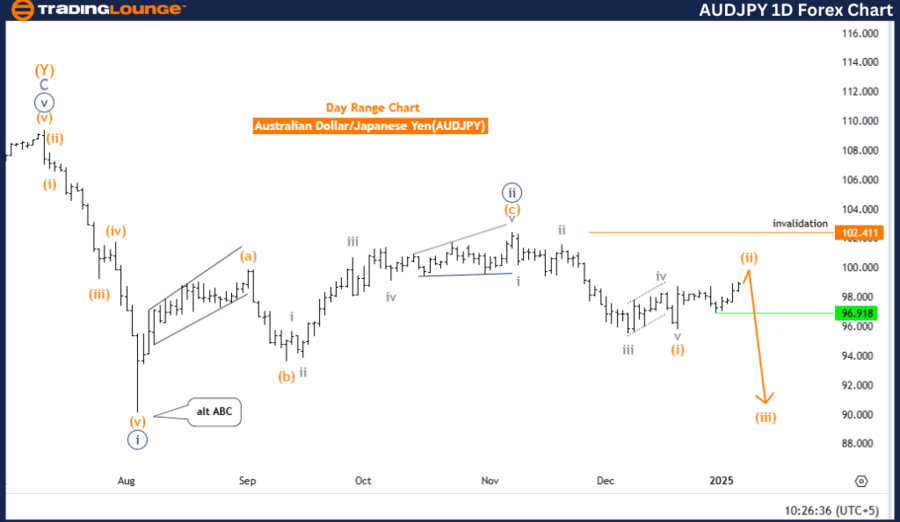

AUDJPY Forex Elliott Wave Technical Analysis - Tuesday, January 7

Australian Dollar / Japanese Yen (AUDJPY) Day Chart

AUDJPY Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Orange Wave 2

- Position: Navy Blue Wave 3

- Direction Next Lower Degrees: Orange Wave 3

- Details: Orange wave 1 appears completed; orange wave 2 is currently in progress.

Wave Cancel Invalidation Level: 102.411

The Australian Dollar to Japanese Yen (AUDJPY) currency pair is currently in a counter-trend corrective phase, as indicated by the Elliott Wave Analysis on the daily chart. This phase is defined by the ongoing progression of orange wave 2, which is part of the broader navy blue wave 3 structure. The completion of orange wave 1 suggests that orange wave 2 is now unfolding.

This corrective movement represents a temporary retracement within the larger upward trend. Following the conclusion of orange wave 2, the market is expected to shift into orange wave 3, advancing the overall navy blue wave 3 sequence. These wave patterns exhibit a natural alternation between corrective and impulsive behaviors, consistent with Elliott Wave principles.

An invalidation level has been set at 102.411. If the price exceeds this threshold, the current wave interpretation will be deemed invalid, necessitating a reevaluation of the wave structure. This invalidation point is a critical marker for confirming or rejecting the ongoing analysis.

In summary, the AUDJPY currency pair is experiencing a corrective phase characterized by orange wave 2 within navy blue wave 3. This stage reflects a short-term market adjustment before the expected progression into orange wave 3. The invalidation level serves as an essential benchmark for assessing the accuracy of the current wave structure and provides insights into potential future price movements.

(Click on image to enlarge)

Australian Dollar / Japanese Yen (AUDJPY) 4-Hour Chart

AUDJPY Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Orange Wave 2

- Position: Navy Blue Wave 3

- Direction Next Lower Degrees: Orange Wave 3

- Details: Orange wave 1 appears completed; orange wave 2 is currently unfolding.

Wave Cancel Invalidation Level: 102.411

The Australian Dollar to Japanese Yen (AUDJPY) currency pair is currently in a counter-trend corrective phase, as indicated by the Elliott Wave Analysis on the 4-hour chart. This phase involves the development of orange wave 2, which is part of the larger navy blue wave 3 structure. The conclusion of orange wave 1 suggests that orange wave 2 is now actively forming.

This corrective phase signifies a temporary pullback within the broader market trend. Upon the completion of orange wave 2, the market is expected to transition into orange wave 3, which will further the progression of navy blue wave 3. These waves reflect the natural alternation between impulsive and corrective phases in line with Elliott Wave principles.

A critical invalidation level has been set at 102.411. If the price surpasses this point, the current wave interpretation will be invalid, requiring a reevaluation of the structure. This invalidation level serves as a vital benchmark to confirm or refute the ongoing analysis.

Summary:

The AUDJPY currency pair is presently in a corrective phase, represented by orange wave 2 within the navy blue wave 3 framework. This stage reflects a short-term market adjustment before the anticipated progression into orange wave 3. The invalidation level at 102.411 is a key reference for ensuring the accuracy of the current wave structure and understanding the next potential market movements.

(Click on image to enlarge)

More By This Author:

Elliott Wave Technical Analysis: XRP Ripple Crypto Price News For Tuesday, Jan 7

XAUUSD Commodity Elliott Wave Technical Analysis - Monday, January 6

Dow Jones - DJI Index Elliott Wave Technical Analysis 9

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.ede449a97b1dbe3d5a6833c48df7c7fb.png)