Atlassian Could Slide On Lockup Expiration

Atlassian Corporation PLC (NASDAQ: TEAM) - Sell or Short Recommendation - PT $21.75

June 7, 2016 concludes the 180-day lockup period on Atlassian Corporation PLC . We previewed the event on our IPO Insights platform for those subscribers looking to gain an informational edge.

When the lockup period ends for Atlassian, its pre-IPO shareholders, directors, and executives will have the chance to sell ~155 million shares, as per company filings. The potential for a sudden increase in stock available in the open market may cause a significant decrease in Atlassian shares.

Business Summary: Software Developer of Programs that Promote Team Collaboration

As described in Atlassian's prospectus summary, the company writes and maintains software and hosting services designed to facilitate team-based collaboration. Its products include HipChat, a team communication and messaging tool; JIRA, a project management and team planning platform; Bitbucket, a team code sharing and management program; and Confluence, a team content creation and sharing tool. In addition, the company maintains the JIRA Service Desk, and offers programs including SourceTree, FishEye, Crucible, Bamboo and Clover. Currently, Atlassian offers over 2,000 add-ons to enhance and customize its programs.

The company has over 1,400 employees across five countries, and their client base exceeds 54,000. Big-name clients include Facebook, NASA, Cisco, Netflix, Kaiser Permanente, eBay, LinkedIn, Toyota, Volvo, Home Depot, Siemens, Pandora, Nordstrom, Puma, Zillow, Quicken Loans, Neiman Marcus and many more.

The company also notes that NASA used their software to design the Mars Rover and by Cochlear to develop aural implants.

Recent Business Highlights

Atlassian completed its second quarter of fiscal 2016 with a total client base of over 54,000 with either an active subscription or maintenance agreement. This represents a 27 percent increase over the same period in 2015. The company added over 2,600 new clients in the second quarter.

The company updated its primary JIRA product to include JIRA Service Desk for IT and service teams, JIRA Software for agile development teams, and JIRA Core for marketing, legal, finance and human resources. Atlassian also now allows third-party software developers to design full-featured apps for HipChat via HipChat Connect. Currently, the Atlassian Marketplace offers over 2,000 add-ons.

Notable Financial Highlights: Q3

On an International Financial Reporting Standards basis, Atlassian reported the following results for the third quarter of fiscal 2016:

- Revenue reached $117.9 million for the third quarter of fiscal 2016, an increase of 40 percent over the third quarter of 2015.

- Operating loss was $4.9 million, more than 3X the $1.5 million posted for the same period in 2015.

- Net loss was slightly up at $1.1 million, compared with $0.6 million for the same period in 2015.

Management Team Overview

As described in TEAM's SEC Filings, Co-founder, Co-CEO and Director Michael Cannon-Brookes also serves as an Adjunct Professor of Computer Science and Engineering at the University of New South Wales, Australia since 2014. He holds a Bachelor of Commerce in information systems from the University of New South Wales, Australia and received international acclaim as 'Australian IT Professional of the Year' (2004),

Chief Technology Officer Sri Viswanath has a background in collaboration software. His previous experience includes positions at Groupon, VMware, Ning, Inc., and Sun Microsystems. Mr. Viswanath holds an M.S. in Computer Science from Clemson and a management degree from Stanford Business School.

Competition: BMC Software, Zendesk, Google, and Microsoft Among Others

Atlassian Corporation offers complete software systems designed to facilitate collaboration, and its competition comes primarily from providers of software that offer individual programs. These include Rally Software (NYSE:RALY), GitHub, ServiceNow (NYSE:NOW), Zendesk (NYSE:ZEN), BMC Software (NASDAQ:BMC), Google (NASDAQ:GOOGL), Hewlett-Packard (NYSE:HPQ), Microsoft (NASDAQ:MSFT) and IBM (NYSE:IBM).

Early Market Performance: Strong Overall

Atlassian's IPO priced at $21 per share, significantly higher than the expected price range of $16.50 to $18.50. The stock opened on the first day of trading at $27.67 and closed at $27.78. Since then the stock has reached a high of $31.10 on December 19, 2015 and a low of $17.92 on February 8, 2016.

Conclusion: Short Opportunity

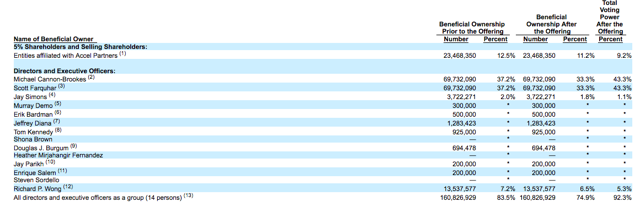

Despite some increases in financial losses, Atlassian has performed well on the market even amid volatile conditions in early 2016. Insiders could be ready to take profits, holding ~155 million shares (as noted above) since before the IPO. These 14 individuals and 1 firm are below (see SEC filings for more details).

We suggest shorting Atlassian ahead of the June 7th lockup expiration to take advantage of impending price pressures. Our team has found declines of over 4% in a two-week window, surrounding many IPO lockup expirations, particularly big tech ones, like Atlassian.

Disclosure: I am/we are short TEAM.

I wrote this article myself, and it expresses my own opinions. I am not ...

more