Asia Morning Bites For Wednesday, July 24

Image Source: Unsplash

Global Macro and Markets

- Global Markets: It was another fairly quiet day in US Treasury markets on Tuesday, which isn’t all that surprising since there was very little going on in terms of macro data and with investors presumably waiting for the US GDP and PCE releases out over the coming days. 2Y US Treasury yields fell by about 2 basis points, while 10Y yields were virtually unchanged at 4.251%. EURUSD slid further, dropping to 1.0851 and dragging the AUD down to the low 66-cent level. Cable was a little softer, but is holding 1.29 for now. However, the JPY has continued to show some strength, and USDJPY is now down at 155.76. It was quieter in the Asian FX space, and outside the G-10 Asian currencies, there hasn’t been much action. US stocks were also fairly rangebound on Tuesday and neither the S&P 500 nor the Nasdaq moved significantly from the previous day’s close. Chinese stocks had a worse day. The Hang Seng fell 0.94% and the CSI 300 fell 2.13%.

- G-7 Macro: There wasn’t much on the G-7 calendar yesterday, but what there was looked weak. A pair of regional business surveys in the US came in very soft. PMI data today for the US will shed more light on business conditions. Otherwise, it is also a fairly quiet day with just some inventory data, home sales and mortgage applications. We do get a Bank of Canada rate decision, and the market is looking for a 25bp rate cut there. The Eurozone also releases PMI data for July.

- Australia: PMI data for Australia showed the service sector slowing a little further. The service sector PMI dropped to 50.8 from 51.2, though it remains in positive territory, while the manufacturing PMI rose slightly to 47.4 from 47.2, though still indicates a contraction in that sector. Weaker activity data makes the RBA’s decision on August 6 harder, as it is not being backed up with softer inflation data. We are still looking for them to hike the cash rate target by 25bp to 4.60%.

- Japan: The flash PMI composite rebounded to 52.6 in July after a temporary drop in June (49.7). The gain was mostly from the service sector as its PMI jumped to 53.4 (vs 49.4 in June). We believe this reflects the recovery in the domestic economy and should support the BoJ's policy normalisation. However, the manufacturing PMI fell to 49.2 (vs 50.0 in June), reflecting weakening global demand.

- India: PMI data for the manufacturing and service sectors will likely continue to indicate both sectors of the economy growing strongly. We don’t expect major deviations from the 58.3 (mfg) and 60.5 (services) results last month.

- South Korea: Consumer sentiment improved more than expected in July. The composite CSI index rose to 103 (vs 100.9 in June, 102 INGf’) with all subcomponents rising. The index has been above 100 for six out of seven months this year. We expected sentiment to improve on the back of solid gains in asset markets (both equities and housing market), but it is rather puzzling that consumers have quite such a positive outlook. In contrast, quite a few activity data releases have shown domestic growth conditions softening in recent months.

We believe that this positive outlook for the asset market puts the BoK in a more difficult position when it comes to policy decisions. Governor Ree Chang Yong has already warned that market expectations of rate cuts are too high and if this leads to a further acceleration in house prices and household debt, it would increase risks to financial stability.

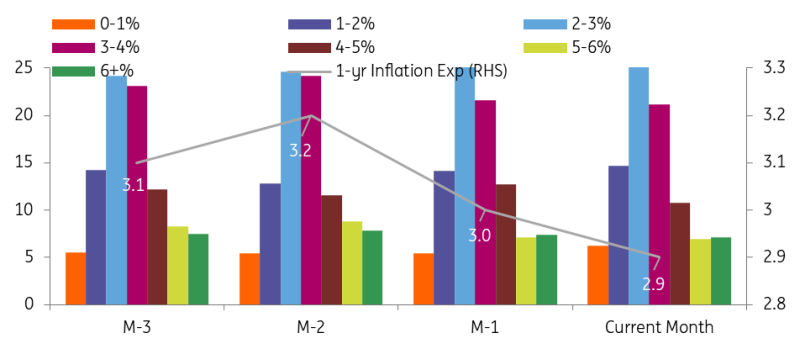

Today's survey showed that inflation expectations fell to 2.9%, which should give the BoK more confidence that inflation is cooling. From now on, we think that financial market stability will be more of a concern for the BoK, and this could delay the BoK’s rate cut a bit longer. We currently expect the BoK to cut by 25bp in October.

Korea's inflation expectations have cooled recently

Source: CEIC

What to look out for: Jibun Bank PMI, S Korea Consumer Sentiment Index

July 24th

Japan: Jibun bank Japan Flash PMI

S Korea: July Consumer sentiment index

Philippines: June budget balance PHP

July 25th

Vietnam: July CPI, Trade balance, Exports and Imports (By 31st July 2024)

S Korea: 2Q24 GDP

Japan: PI services

Singapore: July MAS Monetary Policy Statement

Australia: Judo Bank PMIs

India: HSBC PMIs

July 26th

Japan: July Tokyo CPI, Leading index CI

Singapore: June Industrial production

US: U. of Mich. Sentiment

More By This Author:

China Cuts 7-Day Reverse Repo Rate And Loan Prime Rates In Move To Support GrowthFX Daily: The Return Of The Magnificent Seven

The Commodities Feed: Further Downward Pressure

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more