Asia Morning Bites For Tuesday, July 2

Image Source: Unsplash

Global Macro and Markets

- Global Markets: Yields at the back end of the US Treasury curve continued to rise on Monday, though the front end was much more subdued. 2Y yields are roughly unchanged from yesterday, giving back earlier increases, but 10Y yields are up a further 6.5 basis points to 4.461%. The USD weakened again yesterday but pulled back from its intraday highs to trade at 1.0737 currently. The AUD is slightly weaker at 0.6654. Cable is unchanged and the JPY has pushed up through 161 to 161.43. Asian FX was quite mixed. The IDR made some modest gains, helped by better inflation figures yesterday. But the rest of the Asia pack was flat or lost ground to the US. The KRW was the weakest yesterday, along with the TWD. USDCNY was fairly flat at 7.2684. US equities made modest gains on Monday. The S&P 500 rose 0.27%, while the Nasdaq gained 0.83%. In China, the Hang Seng finished almost unchanged, but the CSI 300 rose almost half a percent.

- G-7 Macro: Yesterday’s US manufacturing ISM index softened. The headline index fell from an already weak 48.7 to 48.5. There was a sharp drop in the prices paid component to 52.1 from 57.1, and the employment index fell from 51.1 to 49.3. The US doesn’t have any notable releases today apart from the backward-looking JOLTS labour survey, but the Eurozone publishes June inflation numbers, which are expected to edge down slightly.

-

Australia: The minutes of the June RBA meeting need scrutinizing for any talk of rate hikes. We know they were talked about, the question is, what is the trigger? Released at 0930 SGT/HKT. We are leaning towards forecasting a hike at the August meeting.

-

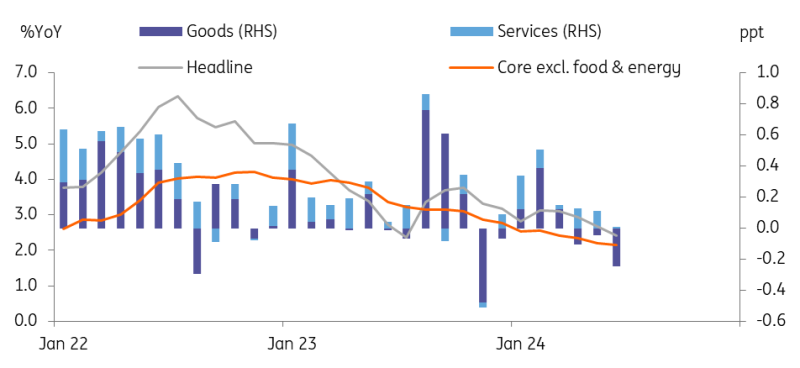

South Korea: Consumer inflation eased more than expected to 2.4% YoY in June (vs 2.7% in May, 2.6% market consensus), while core inflation excluding food and energy held steady at 2.2% for a second month, in line with market consensus. Fresh food prices moderated more than expected from 17.4% in May to 11.7% in June. On a month-on-month comparison, its prices fell -5.4% MoM nsa. This is probably due to continued government efforts to curb fresh food prices. The government has expanded the number of directly imported fruit items, applied a quota duty for some fresh food, and provided discount voucher programmes. Gasoline prices rose 4.3% YoY, but only due to a high base last year. For petrol prices, the fuel tax cut has been also extended, but the rate of reduction was slightly reduced (gasoline 25% to 20%, diesel 37% to 30%) from July 1st, so petrol prices will rise from July.

It is clear that inflation has moderated gradually over the past three months, as headline inflation has fallen from a recent high of 3.1% in February. As a result, we believe that the Bank of Korea will shift its communication tone from hawkish to neutral from its July meeting. We think there could be a minor vote against a hold decision as early as July with more board members open to a rate cut in three months. However, there are upside risks to inflation in the near term. For example, petrol prices are likely to rise from July, and some utility rates administered by local governments are scheduled to rise from July. Consequently, the Bank of Korea will likely wait and see how inflation evolves in the coming months. Also, as the pace of household debt growth has reaccelerated recently, the BoK will remain vigilant about this. We expect the Bank of Korea’s first rate cut in October 2024.

South Korea: inflation dropped mostly due to fresh food prices

Source: CEIC

What to look out for: South Korea's CPI, RBA meeting minutes, Singapore PMI

July 2nd

- S Korea: June CPI

- Australia: June RBA meeting minutes

- Eurozone: Preliminary June CPI

- Singapore: June PMI index

- US: May JOLTS job openings

July 3rd

- Australia: June Judo Bank Services PMI

- Japan: June Services PMI

- Australia: May building approvals

- China: June Caixin service sector PMI

- India: June Service sector PMI

- US: June ADP employment change, May trade balance, Weekly jobless claims, June service sector PMI index, June ISM service sector index, FOMC minutes

July 4th

- Australia: May Trade balance

- Germany: May Factory orders

July 5th

- S Korea: May Current account balance

- Japan: May Household spending

- Philippines: June CPI

- Thailand: June CPI

- Singapore: May retail sales

- Germany: May industrial production

- Taiwan: June CPI

- Eurozone: May retail sales

- US: June non-farm payrolls, June unemployment rate, June average hourly earnings

More By This Author:

Soft U.S. Manufacturing And Construction Numbers Emphasise The Dependency On ServicesCzech Manufacturing PMI Loses Momentum

FX Daily: French Politics Can Still Cap The Euro

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more