Asia Morning Bites For Thursday, Sept 12

Image Source: Unsplash

Global Macro and Markets

- Global Markets: A disappointing set of inflation data from the US yesterday hasn’t dampened rate cut spirits too much, and the market is still pricing in 4+ cuts by the end of this year, pushing back the jumbo cuts to November and December. An additional 25bp on top of the first 25bp in September is just 17.5% priced in currently. 2Y Treasury yields rose a fairly modest 4.7 basis points, while the 10Y yield rose just 1.1bp to 3.653%. EURUSD is down slightly, at 1.1011, erasing its gains earlier in the day and a bit more ahead of today's ECB meeting. Markets seemed to award the Harris-Trump debate victory to Harris, and the USD weakened slightly during the debate. The AUD dropped as low as 0.6622 yesterday but has steadily recovered since then to 0.6678. Cable has dropped back to 1.3039 after some more weak activity data while the JPY remains roughly unchanged over the last 24 hours at 142.62, though it has also given back gains made earlier in the session. Most of the Asia pack made gains against the USD on Wednesday, led by the SE Asian currencies, PHP, IDR, VND and MYR, though the KRW and TWD also made gains. US stocks managed to make decent gains despite the setback on inflation. The S&P 500 rose 1.07% and the Nasdaq was up 2.17%. Chinese stocks struggled on Wednesday. The Hang Seng dropped 0.73% and the CSI 300 fell 0.30%.

-

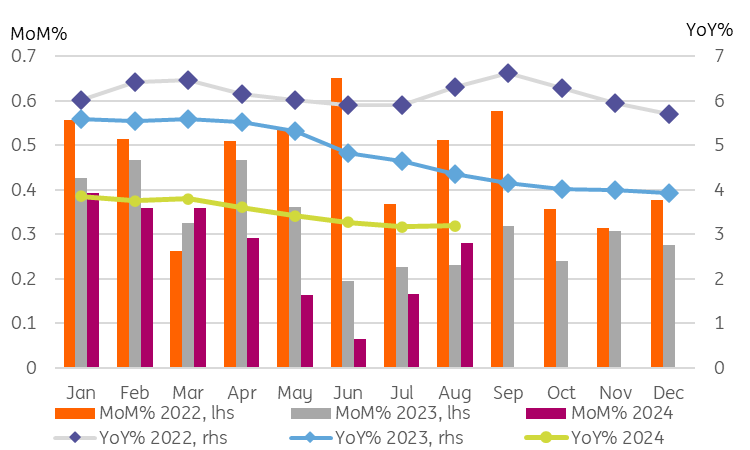

G-7 Macro: Headline August US CPI rose in line with expectations, up 0.2% MoM, and dropping to 2.5% YoY from 2.9% in July. It was the core measures where the disappointment lay. Core CPI rose 0.3% MoM rather than the 0.2% that had been expected. However, this left core inflation running at 3.2% YoY as expected, thanks to rounding. PPI data due today will also be worth a look as some of the PCE numbers derive from elements of this data, as well as the CPI release. There was disappointing activity data from the UK yesterday, where the monthly GDP numbers came in flat for a second consecutive month. 3Q24 GDP in the UK is shaping up to be soft as a result. Other than that, the big news for today will be an expected further 25bp rate cut from the ECB, taking the deposit rate down to 3.5%.

-

India: Consensus forecasts for Indian inflation for August show a further small decline from 3.54% to 3.47% YoY. We are at the low end of the consensus with a 3.10% forecast as falling food price inflation should have a bigger impact than the consensus numbers indicate.

-

Japan: Pipeline inflation showed that underlying inflationary pressures cooled in August thanks to falling commodity prices and the JPY's appreciation. Producer price inflation eased faster than expected to 2.5% YoY in August (vs 3.0% in July, 2.8% market consensus). The month-on-month change fell to -0.2% MoM sa as utility prices dropped for the first time in four months. Also, import prices moved down sharply to 2.6% YoY in August (vs 10.8% in July). Consumer price inflation for August, released next Friday, is expected to temporarily surge to 3.0% YoY. But we believe inflation will come down again from September, helped by the restart of the energy subsidy programme. The slowdown of pipeline prices will allow the BoJ to monitor financial market developments. But if growth, especially consumption conditions improve, the BoJ is likely to resume its rate hikes as early as December.

Evolution of US CPI inflation

Source: CEIC, ING

What to look out for: Japan PPI, India CPI, ECB meeting

September 12th

Japan: August PPI

India: August CPI, September industrial production

ECB rates meeting

US: August PPI final demand

US: August ADP employment change, ISM services index

September 13th

US: August monthly budget statement, import, export, trade balance

Japan: July industrial production

Thailand: September 6th gross international reserve

More By This Author:

Food And Services Prices Drive Czech InflationAsia Morning Bites For Tuesday, September 10

Improvement In Hungary’s Inflation Outlook

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more