Asia Morning Bites For Thursday, Aug 15

Image Source: Unsplash

Global Macro and Markets

-

Global Markets: US Treasuries didn’t know what to make of yesterday’s CPI release, which was close to consensus. 2Y yields rose slightly (+2.6 basis points), while the yield on the 10Y fell (-0.8bp) to 3.835%. EURUSD pushed up through 1.10 and held the level, though it reached as high as 1.1047 at one point. Other G-10 currencies were mixed. The AUD has fallen back from an intraday high yesterday of 0.6643 to just 0.6594 now. Cable is also lower at 1.2824 after a downside miss to July inflation, though James Smith doesn't think this will unlock a September rate cut from the Bank of England. And the JPY has also softened slightly, rising to 147.34.

-

Asian FX had a stronger day yesterday, though it’s not clear that this will carry through today. The IDR had another strong day and has gapped down to 15678. The THB, MYR and TWD also made decent gains. The PHP lagged the pack ahead of the BSP meeting today, where there is a narrow majority looking for a 25bp cut. US equities made weak gains in the case of the S&P 500, or traded sideways (Nasdaq). Markets will now focus from inflation to activity as retail sales for July are today’s key release. Chinese stocks fell again.

-

G-7 Macro: On the face of it, the US CPI release was a bit of a non-event. Both headline and core CPI rose 0.2%, in line with expectations, though both measures managed to generate a 0.1pp decline in the annual inflation rates. Actually, the data were better than look at first glance. Both month-on-month figures were “low” 0.2’s, more accurately, 0.154 for the headline and 0.165 for the core (to 3 decimal places) and both undershot last year’s month-on-month increase, providing a bit more evidence that inflation really is cooling. However, there were also some interesting increases in some sub-sectors such as rents, so you can make whatever story you want out of the data. Here is James Knightley with more detail.

Today, the main focus will be on US July retail sales data. The consensus view is for a 0.4% MoM rise in the headline sales figure, up from the flat reading for June. The control group spending growth is only expected to rise 0.1% after a 0.9% surge in June. Some of the recent consumer credit figures have been quite soft, which may tilt the odds in favour of a weaker release. Preliminary 2Q24 UK GDP data is also released today. The consensus is for a fairly solid 0.6% QoQ increase.

-

Philippines: BSP decides on rate policy today. The consensus is quite split as to the result, with a small majority looking for a 25bp cut in the policy rate from 6.5% to 6.25%. In favour of such a move, the PHP’s recent resilience (USD weakness) makes it more probable. Against, the recent higher-than-expected inflation print, and recent market turmoil. If there is no cut today, we anticipate it will not be long before inflation drops meaningfully and offers further rate-cutting opportunities, so lower rates really are just a matter of time.

-

Australia: The random number generator that is Australian employment data is due at 0930 SGT/HKT. After last month’s strong full-time employment change (+43.3K) and weak part-time figures (+6.8K), we anticipate a reversal in the July numbers, though where this leaves the total employment figure is anyone’s guess. The consensus, which is very flat and has wide spread has a median of +20K, with a low of -5K and a high of +50K.

- China: This morning will be busy in terms of incoming China macro data, starting off with the PBOC announcing the MLF rate, which we expect to remain unchanged after last month’s rate cuts. The National Bureau of Statistics will then publish the 70-city housing price data, and the key economic activity data of industrial production, retail sales, and fixed asset investment. We are watching to see if there are any signs of stabilisation in the housing price data, with a smaller overall decline or more cities seeing an uptick as potential positive signs to look for. Retail sales should see a bit of recovery after hitting a post-pandemic low last month on technical factors, and industrial production and FAI may be relatively stable this month as well.

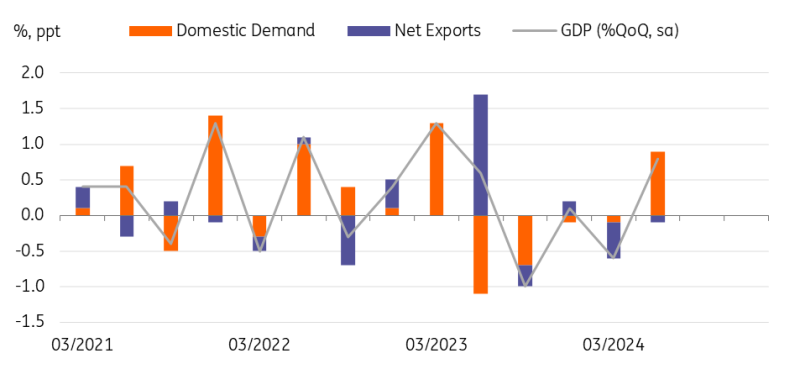

- Japan : 2Q24 GDP expanded more than expected (0.8% QoQ sa) in 2Q24 (vs revised -0.6% in 1Q24, 0.6% market consensus). Most of the attention will be on the private consumption figure, which rebounded 1.0%, registering the first increase in five quarters. Business spending also recorded a solid 0.9% growth (vs -0.4% 1Q24, 0.8% market consensus). The net export contribution to GDP remains negative, but that’s because imports (1.7%) rose faster than exports (1.4%).

Today's GDP data signal that the virtuous cycle between income and spending has become more pronounced but uncertainty surrounding macro policies has heightened.

Japanese Prime Minister, Fumio Kishida, announced yesterday his intention to resign as leader of the ruling LDP Party in September. Given his low approval ratings, this wasn’t a complete surprise. However, there is no strong contender to take over Kishida’s role, making it difficult to estimate the policy direction of the next government. The LDP’s chances of winning a General Election are quite high regardless of Kishida's resignation. Also, although the political spectrum within the LDP is broad, the LDP itself is seen as a typical conservative and pro-business party, so in that sense, no sudden surprises are expected.

On the other hand, monetary policy uncertainty is more pronounced than in July. Stronger-than-expected GDP growth in the second quarter supports the BoJ's view that the economy is recovering, and the rebound in household consumption after four consecutive quarters of contraction is also broadly in line with the BoJ's view. In the coming months, wage growth should remain robust, and inflation is likely to hover around 2%. Technical payback for auto production losses is expected to boost production. And higher imports and lower inventory conditions in last quarter's GDP should also boost the current quarter’s GDP growth.

-

However, all of this is likely to be used to vindicate the BoJ’s July rate hike and may not give confidence to the BoJ for further rate hikes. The BoJ's policy stance is likely to have become more risk-averse amid the recent market jitters surrounding the rollercoaster ride of the JPY and equities. And we think that Kishida's recent announcement is also unwelcome for the BoJ's rate decision. As a result, we believe that the probability of a rate hike in October has become very low. However, we will wait for the data development in Japan and the US, the Fed's decision and the market reaction and then decide whether the BoJ's next action will be either in December or later in 1Q25.

Japan: Domestic demand recovered meaningfully in 2Q24

Source: CEIC

What to look out for: Japan 2Q GDP, China activity data, BSP rates decision

August 15th

Japan: 2Q preliminary GDP, June industrial production

Australia: July employment change, unemployment rate

China: July industrial production, retail sales, fixed assets Ex rural

Indonesia: July imports, exports, trade balance

Philippines: BSP overnight borrowing rate, June Overseas cash remittance

August 16th

Singapore: July non-oil domestic exports

Japan: June tertiary industry index

Taiwan: 2Q preliminary GDP

US: U. of Mich. sentiment

More By This Author:

Cooling US Inflation Keeps The Fed On Track For Rate CutsPolish GDP Growth Beats Expectations As Core Inflation Rises

The Commodities Feed: Oil Rises Amid Declining US Inventories

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more