Asia Morning Bites For Friday, January 12

Image Source: Unsplash

Global Macro and Markets

- Global markets: Disappointing US inflation data initially caused US Treasuries to sell off. The 2Y yield shot up to 4.391% at one point. But it didn’t last long, and yields quickly started to tumble. The 2Y yield ended down about 11bp at 4.25% while the 10Y dropped 6.2bp taking it back below the 4% handle to 3.966%. The causes for this are unclear. The planned joint US/UK military strikes on Houthi rebels may be a factor. And there was also a strong 30Y auction though that will be more of a symptom of strong bond demand than a cause. Whatever the reason, the fall in US yields doesn’t seem to have done the USD much harm, and EURUSD rose only slightly to 1.0977. The AUD lost ground yesterday after some more encouraging inflation data, though regained all of this to reach 0.6695. And in truth, the run-rate of inflation is still too high in Australia too – all the hard work is being done by base effects. Cable is a little stronger too at 1.2722, and the JPY is fractionally stronger, with USDJPY nosing down to just above 145. Most of the Asian currencies made gains against the USD on Thursday – led by the KRW and PHP. The VND and THB bucked the regional trend, weakening slightly. US equities didn’t like the implications of the disappointing inflation print. They may have to wait longer for rate cuts than they were hoping. We are halfway through January, and markets are still pricing in a 70% chance of a March Fed cut. That simply looks wrong. The S&P 500 and NASDAQ were basically unchanged on the day, though were sharply down at one point before recovering as bond yields fell.

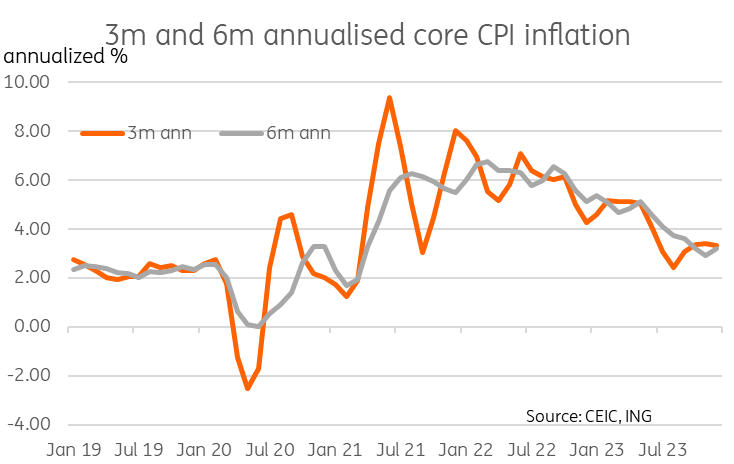

- G-7 macro: As mentioned, the December US inflation print was disappointing. Headline CPI rose 0.3% MoM (0.2% expected) taking the inflation rate up from 3.1% to 3.4%. And the core rate rose 0.3% - which was in line, but it was obviously a “high” 0.3 and this meant that core inflation only dropped 0.1pp to 3.9% YoY rather than the 3.8% expected. Here’s our US economist’s thoughts on the release. Looked at in terms of annualised inflation, this leaves core inflation tracking at about a 3.2% rate for both 3m and 6m measures – obviously, still much too high to reach the Fed’s target rate on a medium-term basis. Lower weekly jobless claims figures also hint that the Fed’s work is not over and that at the least, the current policy settings need to stay where they are for longer. Today is quieter, with just US PPI inflation numbers and a raft of UK data on activity and trade.

- China: CPI inflation data for December due at 0930 will likely show a small improvement, but the headline inflation rate will remain negative at about -0.4% YoY compared to the November -0.5% reading. This is better than it looks if it comes out this way, as it will imply a much less negative MoM change in the CPI than in November, with less of a drag from retail gasoline prices than last month. Over the next few months, the drag from last year’s high pork prices will drop out and we should see inflation pushing back towards, and then eventually back through the zero inflation mark. China also releases trade data today. There is an expectation for an increase in the trade surplus, as exports are forecast to rise slightly, and imports to drop. In theory, this should help the CNY, but the reflection of a weak domestic economy in the negative import numbers may dampen any support.

Annualized US CPI inflation

What to look out for: China trade and inflation, Taiwan elections

- Japan BOP current account balance (12 January)

- China CPI inflation and trade data (12 January)

- India CPI inflation (12 January)

- US PPI inflation (12 January)

- Fed’s Kashkari speaks (12 January)

More By This Author:

Rates Spark: Mean Reversion To 4% Can’t Last ForeverSticky US Inflation Reduces Chances Of An Early Fed Rate Cut

Asia Week Ahead: GDP Figures, Unemployment Data And A Bank Indonesia Decision

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!