Are We At The Peak Of Employment And Wages?

Talk about volatility!

The unemployment rate stayed at 3.7%, but the expected 190,000 non-farm jobs missed the bar by 35,000, only managing 155,000.

To add to that misery, October jobs were revised lower by 14,000 jobs.

Wage growth also missed the mark by rising only 0.2% rather than the expected 0.3%. On the year, wages rose 3.1%.

It wasn’t a horrible employment report. But job creation is slowing, and wages aren’t moving as much as expected.

This won’t take December’s expected rate hike off the table.

Remember, the jobs report is a lagging indicator. When we see a reversal or a rise in the unemployment rate and falling wages, it’ll be too late for the Fed to react.

And talk about a reaction!

After the report, the Dow Jones Industrial fell by over 550 points, over 2%. The S&P 500 was also down over 2%, and the Nasdaq dropped over 3%. Overreactions like this are our bread and butter in Treasury Profit Accelerator.

A Quick Recap of Last Week

Last week started off with a bang as the markets were encouraged by a temporary truce in the Trade War with China. Stocks bounced sharply higher to the news.

But it was short lived…

The markets soured because President Trump conceded the trade deal might fall through. Stocks fell more than 3% and yields fell sharply as money flowed into the safety of Treasury bonds.

With the markets closed last Wednesday in honor of the late President George H.W. Bush, the Federal Reserve Chair Jerome Powell’s scheduled testimony before Congress was cancelled.

And on Thursday, the markets opened sharply lower, continuing the fall.

The founder and CFO of Huawei Technologies, a Chinese company, was arrested when Trump was meant to meet with China’s leader at the G20 summit. That’ll throw a wrench in any possible trade deal with China!

The Dow Jones Industrial stock index was down by as much as 800 points before reversing on a Wall Street Journal report that the Fed is considering a pause in rate hikes next year.

The Journal didn’t cite any sources, but if the Fed is considering a pause in hiking rates 2019, I’m sure we’ll get more clarity in a couple weeks after its policy meeting.

A Flattening Yield Curve…

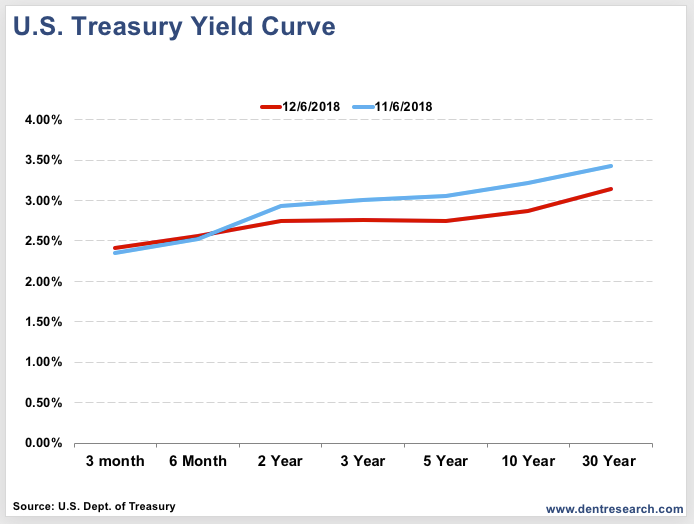

I talked about my concern with the Treasury yield curve in last Wednesday’s Economy & Markets. Let’s look at how flat the yield curve has become in just a month:

(Click on image to enlarge)

Notice how the yield curve was pretty flat a month ago.

In other words, investors are getting paid the same yield to hold the investment for two years or seven.

The closely watched difference of the two-year to 10-year was only 11 basis points. If we see that go to zero or invert, we’ll likely be in a recession.

Bond investors are telling us that the outlook for the future of our economy is grim. When the yield curve flattens and when it inverts, something’s gotta give…

So, despite what the Fed does in December and into next year, the market isn’t seeing multiple rate hikes.

What it does see is trouble.

And we’ll be ready to take advantage of all the overreactions. Will you be?

Treasury Profits Accelerator subscribers are well positioned and ready to profit – from more