Are Bank Stocks A Buy Ahead Of Quarterly Results?

Image Source: Pexels

JPMorgan (JPM - Free Report) shares have lost roughly -7% of their value since the end of August when they reached their 52-week high. Wells Fargo (WFC - Free Report) , which joins JPMorgan in kicking off the Q3 earnings season for the Finance sector on Friday, October 11th, is down only half that much in that period.

The performance of these two bank stocks since August 30th contrasts the S&P 500 index, which gained +0.8% over that time window.

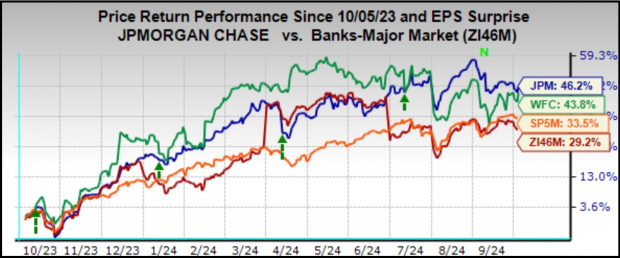

The recent underperformance of JPMorgan and Wells Fargo shares notwithstanding, these two stocks have been standout performers over the past year, as shown in the chart below tracking the one-year relative performance of JPMorgan, Wells Fargo, the S&P 500 index, and the mezzanine level Zacks Major Banks Industry.

Image Source: Zacks Investment Research

Driving these stocks’ recent underperformance is the combination of renewed economic growth worries and the impact of lower interest rates on near-term net interest incomes.

The economic growth overhang is a far more significant issue for banks like JPMorgan and Wells Fargo as it not only drives the demand for credit but also the health of the existing loan portfolio.

Loan demand has been anemic in recent quarters, with industry data suggesting loan growth of about +1% in Q3. The start of the Fed’s easing cycle is unlikely to have an immediate impact on this score, but we can reasonably expect an improving loan demand outlook in 2025, particularly if the economy can avoid the feared recessionary outcome.

Concerning credit quality, the problems in the commercial real estate (CRE) market are well known and already adequately provisioned for at the major banks. Beyond CRE, aggregate bankruptcies in the U.S. are up significantly from the Covid-driven low of early 2022, but the growth rate has been leveling off in recent months. With current bankruptcy levels roughly 30% below pre-Covid averages, the recent slowing of the bankruptcy growth pace is likely indicative of improved household balance sheets. But as with the outlook for loan demand, a benign credit quality outlook needs the Fed’s easing cycle to help the economy avoid negative growth outcomes.

With respect to investment banking, revenues should be up in the low to mid-teens percentage range, with year-over-year gains in the debt and equity capital markets activities offset by continued weakness on the M&A side. The outlook for M&A should perk up once the election uncertainty is in the rearview mirror and clarity about the political and regulatory environment emerges.

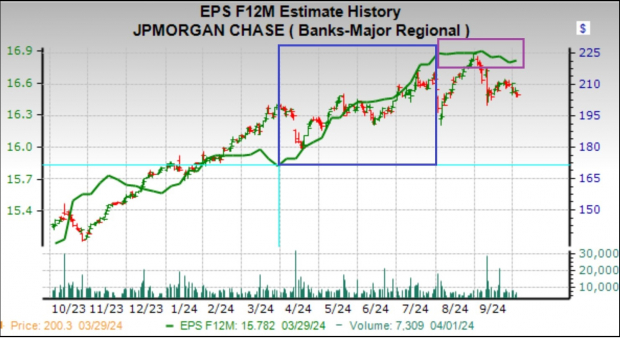

JPMorgan is expected to report $4.04 per share in earnings (down -6.7% year-over-year) on $41.01 billion in revenues (up +2.9% YoY). The stock was modestly up on the last earnings release on July 12th but was down in response to each of the preceding two quarterly releases in April and January 2024. Estimates have modestly come down lately, with the current $4.04 EPS estimate down from $4.05 a week back and $4.06 a month back.

The chart below shows the JPM stock price performance relative to how the forward 12-month consensus EPS estimate has evolved.

Image Source: Zacks Investment Research

The dark green line in this chart represents the forward EPS estimate, which we have highlighted in two colors, with the blue highlight representing the period from April 1st through 30th and the purple highlight depicting the period since then. As you can see above, estimates were steadily going up in the first period and have been flat to modestly down since the start of September 2024.

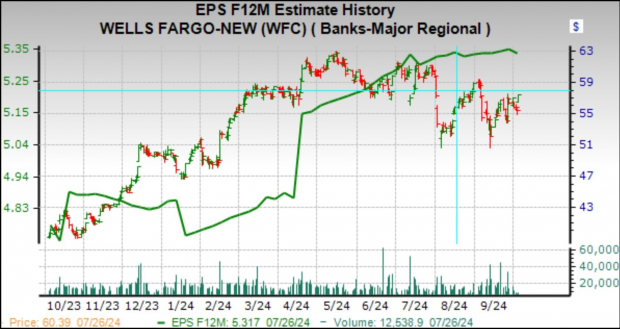

Wells Fargo is expected to report EPS of $1.27 (down -8.6% year-over-year) on $20.38 billion in revenues (down -2.3% YOY). Estimates for Q3 have largely been unchanged since the period got underway, with the relatively long-term revisions trend on the positive side, as shown in the chart below of stock price relative to the forward 12-month consensus EPS estimates.

Image Source: Zacks Investment Research

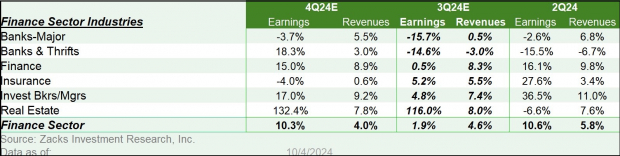

The Zacks Major Banks industry, of which JPMorgan and Wells Fargo are a part, is expected to earn -15.7% less earnings in 2024 Q3 on +0.5% higher revenues. Please note that this industry brought in roughly 50% of the Zacks Finance sector’s total earnings over the trailing four-quarter period.

Image Source: Zacks Investment Research

As you can see above, Q3 earnings for the Zacks Finance sector are expected to be up +1.9% from the same period last year on +4.6% higher revenues.

Despite the big bank stocks’ outperformance over the past year, they are still cheap on most conventional valuation metrics. The chart below shows a 10-year history of the Zacks Major Banks industry for a forward 12-month P/E basis.

Admittedly, the industry isn’t as cheap as in October 2022 when it traded at 7.1X. But the current 9.1X multiple compares to a 10-year high of 12.3X, a low of 7.1X, and a median of 9.9X.

Looking relative to the market as a whole, the Zacks Major Banks industry is currently trading at 42% of the S&P 500 forward 12-month P/E multiple. Over the last ten years, the industry has traded as high as 69% of the index, as low as 39%, and a median of 53%, as the chart below shows.

Image Source: Zacks Investment Research

At a time when the S&P 500 index is at or near its record level, the Finance sector’s discounted valuation has to be one of the most attractive investment spots in the market.

This is particularly so for those investors who believe that the economy is headed towards a soft landing that will have all the beneficial knock-on effects on this economically sensitive space regarding credit losses and loan demand.

The Earnings Big Picture

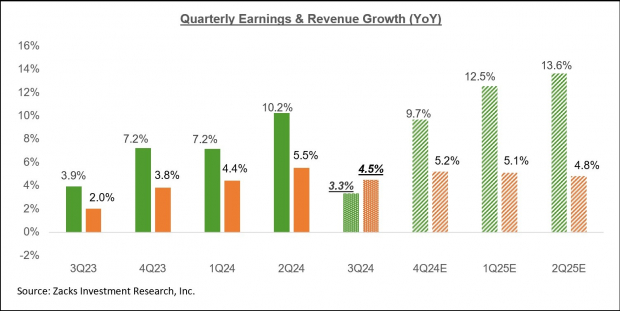

Total Q3 earnings for the S&P 500 index are expected to be up +3.3% from the same period last year on +4.5% higher revenues. This would follow the +10.2% earnings growth for the index in the preceding period on +5.5% higher revenues.

Regular readers of our earnings commentary are familiar with our sanguine view on corporate profitability; the earnings picture isn’t great, but it isn’t bad either.

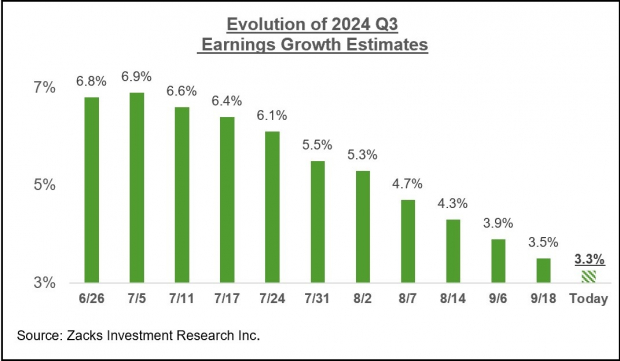

The one recent negative development on this front is the reversal of the earlier favorable revisions trend that we have regularly flagged in our commentary. This negative revisions trend is particularly notable concerning expectations for 2024 Q3, with earnings estimates for the period getting revised down much more than we had seen in other recent periods. You can see this in the chart below, which tracks the evolution of Q3 earnings growth expectations over the last couple of months.

Image Source: Zacks Investment Research

Not only is the magnitude of cuts to Q3 estimates bigger than what we saw in the comparable periods for the last three quarters, but it is also widespread and not concentrated in one or a few sectors.

Of the 16 Zacks sectors, estimates have been revised down for 14 sectors, with the Transportation, Energy, Business Services, and Aerospace sectors suffering the biggest declines. The Tech and Finance sectors are the only sectors whose estimates have modestly risen since the period got underway.

The chart below shows the Q3 earnings and revenue growth expectations in the context of what we saw in actual results over the preceding four quarters and what is expected over the following three quarters.

Image Source: Zacks Investment Research

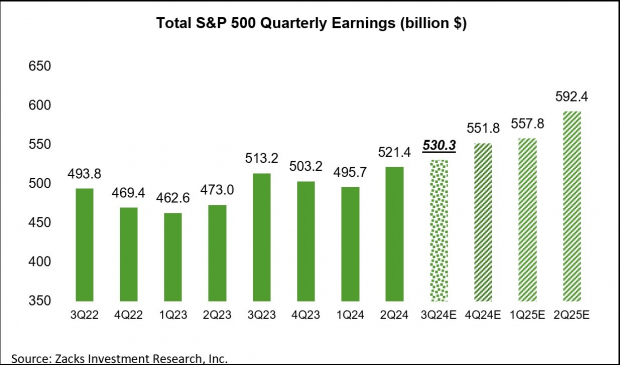

Notwithstanding the aforementioned negative revisions trend, the expectation is for an accelerating growth trend over the coming periods. Also, the aggregate earnings total for the period is expected to be a new all-time quarterly record, as the chart below shows.

Image Source: Zacks Investment Research

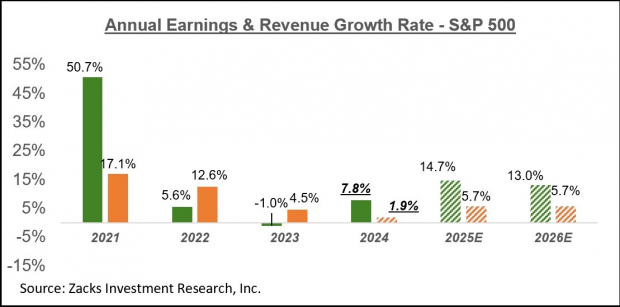

The chart below shows the overall earnings picture on a calendar-year basis, with +7.8% earnings growth this year followed by double-digit gains in 2025 and 2026.

Image Source: Zacks Investment Research

Please note that this year’s +7.8% earnings growth improves to +9.7% on an ex-Energy basis.

The Q3 Earnings Season Scorecard

The JPMorgan and Wells Fargo reports will not be the first Q3 results, as the quarterly reporting cycle has already begun. Companies with fiscal quarters ending in August have been releasing results in recent days, which all get clubbed with the September-quarter reporting tally. Through Friday, October 4th, we have such August-quarter results from 21 S&P 500 members.

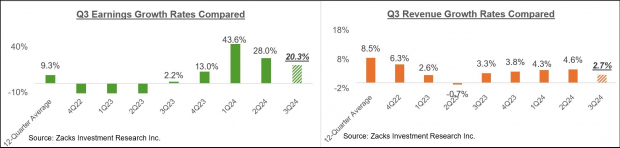

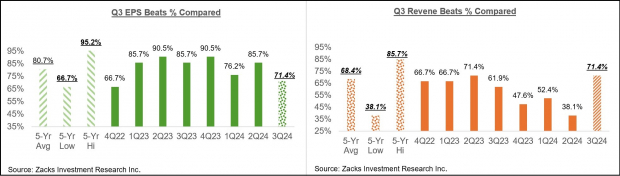

Total earnings for these 21 index members that have already reported results are up +20.3% from the same period last year on +2.7% higher revenues, with 71.4% beating EPS estimates and 71.4% beating revenue estimates.

The comparison charts below put the Q3 earnings and revenue growth rates in a historical context.

Image Source: Zacks Investment Research

The comparison charts below put the Q3 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

It is premature to identify any trends at this very early stage, but the favorable comparison of the revenue beats percentage will be significant if it endures through the rest of the Q3 reporting cycle.

More By This Author:

Earnings Growth Set To Accelerate

Previewing The Q3 Earnings Season - Saturday, Sept. 28

Q3 Earnings Season: A Look Ahead

All goodies are priced in!!! Bearish.