Applied Materials Continues To Dominate Nasdaq 100

We can use our data to track individual stocks, industries, sectors, and indices. For today's bulletin, we present key metrics for the top picks in the NASDAQ 100. The companies listed below represent the top-ten BUY and STRONG BUY stocks within the index. They are presented below according to their one-month forecast target prices.

As we also saw in our last report in August. we see very little turnover here. Once again, we have only two new companies in our top-ten list--Amgen and eBay. The newcomers replaced MicroChip Technology (MCHP) and Texas Instruments (TXN). Applied Materials is once again number one. Netease has moved up three spots to takeover the number two position. Cisco is also up from eighth-to-sixth. LAM Research, Broadcom, Facebook, and CA Inc have all declined a few spots this month. As is always the case, this tech-heavy index features a top-ten list dominated by computer and technology firms.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Retrn |

1-M Forecast Retn |

1-Yr Forecast Retn |

P/E Ratio |

Sector |

8-11-2016 Leaders |

|

APPLD MATLS INC |

29.84 |

-21.18% |

85.51% |

1.21% |

14.62% |

21.47 |

Computer and Technology |

AMAT |

|

|

NETEASE INC |

211.97 |

2.93% |

90.65% |

1.03% |

12.32% |

18.72 |

Computer and Technology |

LRCX |

|

|

LAM RESEARCH |

93.32 |

2.70% |

28.24% |

0.86% |

10.25% |

14.67 |

Computer and Technology |

AVGO |

|

|

INTEL CORP |

35.89 |

8.64% |

25.75% |

0.67% |

8.06% |

14.26 |

Computer and Technology |

INTC |

|

|

BROADCOM LTD |

176.42 |

4.89% |

40.05% |

0.67% |

8.05% |

19.67 |

Computer and Technology |

NTES |

|

|

CISCO SYSTEMS |

31.44 |

4.16% |

21.48% |

0.66% |

7.91% |

14.62 |

Computer and Technology |

FB |

|

|

FACEBOOK INC-A |

126.12 |

-12.28% |

41.03% |

0.61% |

7.37% |

52.26 |

Computer and Technology |

MCHP |

|

|

AMGEN INC |

170.06 |

-8.56% |

12.04% |

0.55% |

6.56% |

15.33 |

Medical |

CSCO |

|

|

eBAY INC |

32.16 |

-8.18% |

18.63% |

0.51% |

6.08% |

20.31 |

Retail-Wholesale |

CA |

|

|

CA INC |

33.91 |

17.49% |

24.26% |

0.47% |

5.63% |

14.89 |

Computer and Technology |

TXN |

NOTE: New stocks are in BOLD

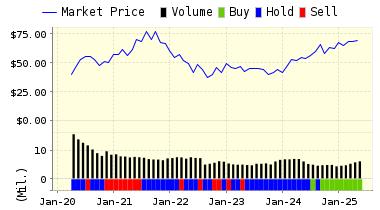

Below is today's data on eBAY (EBAY):

eBay is one of the world's largest online trading communities. eBay creates a powerful marketplace for the sale of goods and services by a passionate community of individuals and small businesses. eBay enables trade on a local, national and international basis with local sites in numerous markets in the United States and country-specific sites in the United Kingdom, Canada, Germany, Austria, France, Italy, Japan, Korea and Australia.

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on EBAY INC for 2016-08-31. Based on the information we have gathered and our resulting research, we feel that EBAY INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

32.32 | 0.51% |

|

3-Month |

32.33 | 0.54% |

|

6-Month |

32.30 | 0.43% |

|

1-Year |

34.12 | 6.08% |

|

2-Year |

30.07 | -6.51% |

|

3-Year |

28.32 | -11.94% |

|

Valuation & Rankings |

|||

|

Valuation |

8.18% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

0.51% |

1-M Forecast Return Rank |

|

|

12-M Return |

18.63% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

-0.02 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

-1.00% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

42.43% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

6.32% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

39.95 |

Size Rank |

|

|

Trailing P/E Ratio |

20.31 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

19.10 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

3.22 |

PEG Ratio Rank |

|

|

Price/Sales |

4.55 |

Price/Sales Rank(?) |

|

|

Market/Book |

21.12 |

Market/Book Rank(?) |

|

|

Beta |

0.99 |

Beta Rank |

|

|

Alpha |

0.07 |

Alpha Rank |

|

ValuEngine Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

52.55% |

|

Stocks Overvalued |

47.45% |

|

Stocks Undervalued by 20% |

22.16% |

|

Stocks Overvalued by 20% |

15.32% |

ValuEngine Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

0.03% |

2.04% |

9.54% |

12.82% overvalued |

5.08% |

20.67 |

|

|

-0.52% |

1.23% |

10.41% |

9.36% overvalued |

14.05% |

23.92 |

|

|

-0.31% |

3.08% |

16.36% |

6.74% overvalued |

9.20% |

23.09 |

|

|

-0.99% |

-0.91% |

45.22% |

3.81% overvalued |

52.53% |

31.58 |

|

|

0.04% |

3.50% |

15.39% |

2.06% overvalued |

8.51% |

29.13 |

|

|

-0.22% |

1.23% |

0.60% |

1.94% overvalued |

-0.02% |

21.20 |

|

|

-0.41% |

-2.67% |

10.90% |

1.19% overvalued |

13.85% |

21.95 |

|

|

0.38% |

2.82% |

7.32% |

0.88% overvalued |

5.29% |

16.32 |

|

|

-0.26% |

2.76% |

16.31% |

0.67% undervalued |

-11.00% |

25.18 |

|

|

0.43% |

1.31% |

30.61% |

1.41% undervalued |

12.27% |

21.15 |

|

|

0.49% |

0.23% |

11.20% |

2.01% undervalued |

-14.57% |

14.58 |

|

|

0.01% |

1.58% |

9.05% |

2.20% undervalued |

0.01% |

24.04 |

|

|

0.35% |

1.54% |

9.35% |

5.40% undervalued |

1.10% |

24.74 |

|

|

0.34% |

2.17% |

4.84% |

8.10% undervalued |

4.10% |

16.48 |

|

|

-0.32% |

1.64% |

2.11% |

9.70% undervalued |

-3.43% |

23.23 |

|

|

0.04% |

-0.59% |

0.66% |

10.81% undervalued |

-13.90% |

27.65 |

VALUATION WATCH: Overvalued stocks now make up 47.45% of our stocks assigned a valuation and 15.32% of those equities are calculated to be overvalued by 20% or more. Eight sectors are calculated to be overvalued.

Disclaimer: ValuEngine.com is an independent research ...

more

Thanks for sharing