Apple Is Still A Buy In My Book

I have been investing for over 45 years. During that time I have studied Fundamental, Technical, Quantitative and Momentum investing analysis, techniques and strategies and have found that none of them work all the time and all of them work some of the time. I've learned from mistakes and have come to realize that if you embrace all of them at the same time you very much improve your chances of staying on the right side of the market.

Apple (NASDAQ:AAPL) has been a very widely popular stock that has been very good to long term shareholders and punished a lot of traders and short interest investors. Today I'd like to step back and give you my opinion but at the same time give you the information you need to decided if this is the right time for you to be buying, holding or selling this security.

Apple (AAPL) is more than just a computer company, it's more like a communications products company providing devices to supply you with both visual and audio data and information in formats that the consumers seem to appreciate. They are able to sell products at a premium price and most of the time consumers are willing to buy new versions, sight unseen, even before the critics have a chance to evaluate the device and distribute their opinions. But here we are looking at Apple as an investor not as a consumer.

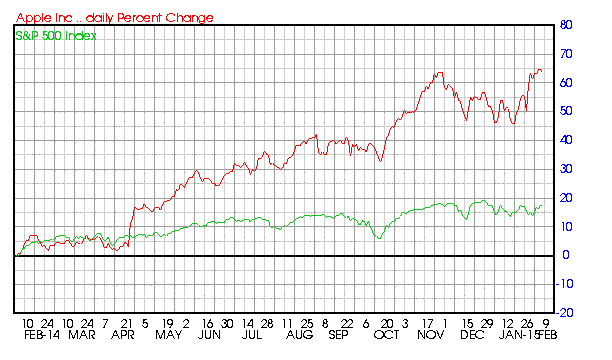

One of the first things I look at whether buying, selling or holding is has the stock been beating the Market over the past year. This is a deal breaker so if it hasn't, I usually don't look any further. Why would I want a stock in my portfolio that is under performing the market? In the last year while the Market as measured by the S&P 500 Large Cap Index was up 15.90%, Apple soared 62.44%:

Apple clearly made the cut. Next I'd like to see if the gains are warranted with the projections that are available:

- Market Cap $692.74 billion

- P/E 16.16 ( lower than the 19.00 P/E of the average stock)

- Dividend yield 1.57%

- Revenue predicted to grow 23.10% this year and another 3.10% next year

- Earnings estimated to increase 32.90% this year, an additional 6.70% next year and continue to compound at an annual rate of 12.76% for the next 5 years.

- Financial Strength A++

The overall sentiment of the investing community is important but I want to make clear that you should never buy a stock because it's trendy but also you should be aware if segments of investors are being advised to dump the issue. Negative sentiment is a red flag the the Market may be missing something and you should be cautious.

- 41 Wall Street brokerages follow the stock and issue opinions

- Their analysts issued 16 strong buy, 25 buy, 9 hold and 1 under perform recommendations on the stock

- Institutional investors own about 60.68% of the outstanding share but recently have sold a net of 114 million shares

- The individual investor on Motley Fool has voted 28,940 to 2,306 that the stock will beat the market

- I discount insider sales while interesting, they are often done for non-financial reasons

- There were 2 insider buys and 45 sells for a net decrease of 4 million shares

- I view the short sellers as some of the most savvy investors in the Market and since July when their short sales were 103 million shares they have closed their positions to a lower 62 million shares short recently

- On the Street.com, Jim Cramer and his staff still give the stock an A+ rating

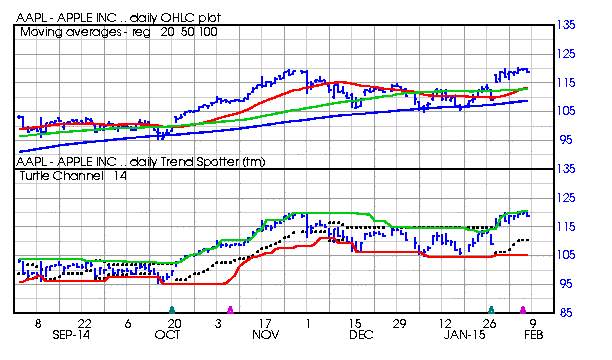

I want to make sure the stock has current momentum and use Barchart to provide me with the technical momentum indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 11.92% in the last month

- Relative Strength Index 61.35%

- Barchart computes a technical support level at 117.41

- Recently traded at 118.93 which is above its 50 day moving average of 112.74

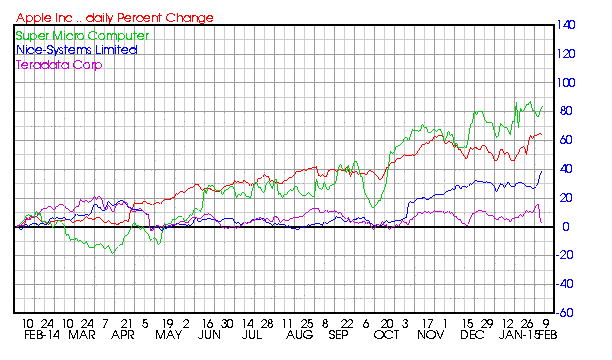

How does the stock hold up against its peers? Apple is a member of the Electronic Computer sector and is by far bigger that its next 3 peers combined. In the last year while Apple (AAPL) gained 62.44%, Super Micro Computer (NASDAQ:SMCI) gained 78.94%, Nice-System Ltd (NASDAQ:NICE) gained 41.95% and Teradata (NYSE:TDC) gained only 1.54%:

Additional Comparisons:

Super Micro Computer (SMCI)

- Market Cap $1.13 billion

- P/E 21.30

- Revenue expected to grow 33.50% this year and another 16.50% next year

- Earnings estimated to increase 63.40% this year, an additional 12.30% next year and continue to increase at an annual rate of 15.00% for the next 5 years

- Wall Street analysts issued 2 strong buy and 2 buy recommendations

- Financial Strength B-

Nice-Systems (NICE)

- Market Cap $3.22 billion

- P/E 21.63

- Dividend yield 1.01%

- Revenue expected to grow 6.20% this year and another 7.40% next year

- Earnings estimated to increase 7.00% this year, an additional 11.70% next year and continue to compound at an annual rate of 9.03% for the next 5 years

- Wall Street analysts issued 4 strong buy, 3 buy, 2 hold and 1 under perform recommendations

- Financial Strength N/R

Teradata (TDC)

- Market Cap $6.45 billion

- P/E 15.92

- Revenue expected to shrink 1.20% this year but grow again by 3.60% next year

- Earnings estimated to decrease 9.40% this year but increase again by 12.40% next year and continue to increase at an annual rate of 7.50% for the next 5 years

- Wall Street analysts issued 2 strong buy, 5 buy, 14 hold, 4 under perform and 1 sell recommendation on the issue

SUMMARY: Although all these stocks seem to have good prospects Apple (AAPL) appears to me to be the superior choice. The P/E is lower than the average P/E of the Market as a whole and the 5 year projections for earnings growth of 12.00%+ is very attractive and could bring even new investors a 10% -13% total return over the next 5 years. I'm giving it a buy rating and advice you to use the chart below to monitor the price vs its moving averages and 14 day turtle channel to see if it keeps making new highs:

I have evaluated several technical trading strategies for this stock and although a few of these were effective they caused too much churning in the portfolio. My advice would be to use a moving stop loss about 10% below its recent high and keep this as along term core position in your portfolio.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in AAPL over the next 72 hours.