'Apolitical' Fed Slashes Rates By 50bps With Stocks & Home-Prices At Record Highs

Image Source: Pexels

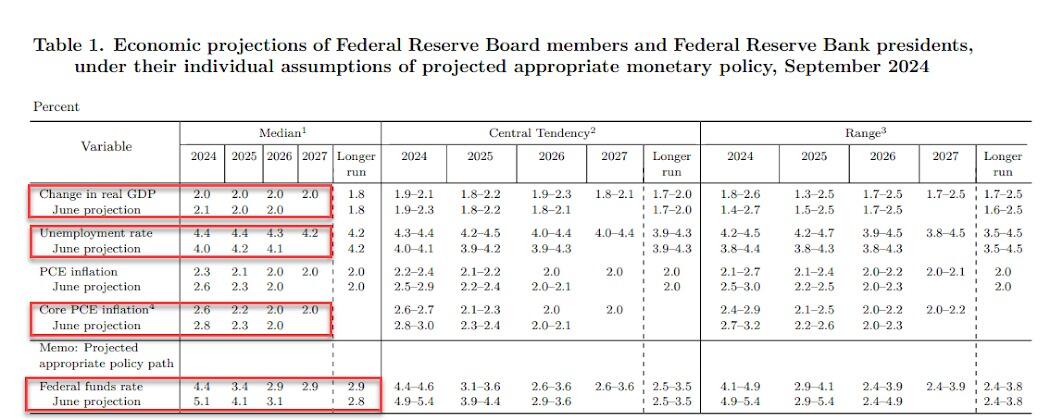

Tl; dr: Despite only 9 of 113 economists surveyed expecting a 50bps rate-cut, Powell and his pals did it. At the same time they slashed their 'DOTS' expectations for rates, despite not adjust growth expectations, barely adjust unemployment, and hoping for lower inflation.

And all this two months before the election... amazing!

Amazing what an 818K downward jobs revision that "nobody could have seen coming because the Biden economy was so strong" will do... pic.twitter.com/xvTwmE4eUJ

— zerohedge (@zerohedge) September 18, 2024

Paging Arthur Burns...

...and of course, if this occurs, guess who will get the blame when he wins in November!

***

Since the last FOMC meeting on July 31st, a lot has happened - growth scares, Jackson Hole, weak data, strong data, and endless FedSpeak - but most notably, the market has practically convinced itself that it needs 50bps of cuts but a recession is not imminent. Bonds and Gold have dramatically outperformed while oil has been a big loser (along with the dollar)...

Source: Bloomberg

Stocks and bonds are in worlds of their own since the last FOMC meeting with the former unchanged (no recession) while the latter has seen yields puke 40-50bps (recession)...

Source: Bloomberg

US Macro data has surprised to the upside dramatically since the last FOMC (perfect time to cut rates?)

Source: Bloomberg

And both growth and inflation data has surprised to the upside (screw the inflation data, we're cutting!!)

Source: Bloomberg

Overall rate-cut expectations have soared since the last FOMC meeting (adding 60bps of cuts to expectations to the end of 2025), with a heavy waiting to 2024 cuts...

Source: Bloomberg

Finally, before we get to the actual decision, we note that the odds of a 50bps cut today had drifted lower intraday (to 57% from 75%)...

Source: Bloomberg

Today will be not just about the size of the cut, but most focus will be on the messaging for what happens next, especially given the new DOTS, which will likely adjust dramatically more dovish (to catch down to the market's expectation)....

Source: Bloomberg

At the last refresh of the SEP (dot-plot), 4 FOMC members expected no rate-cuts in 2024, 7 members expected 1 rate-cut in 2024, 8 members expected 2 rate-cuts.

So what did The Fed do?

Wow! The economy is so great, it needs an crisis-level rate cut 2 months before the election

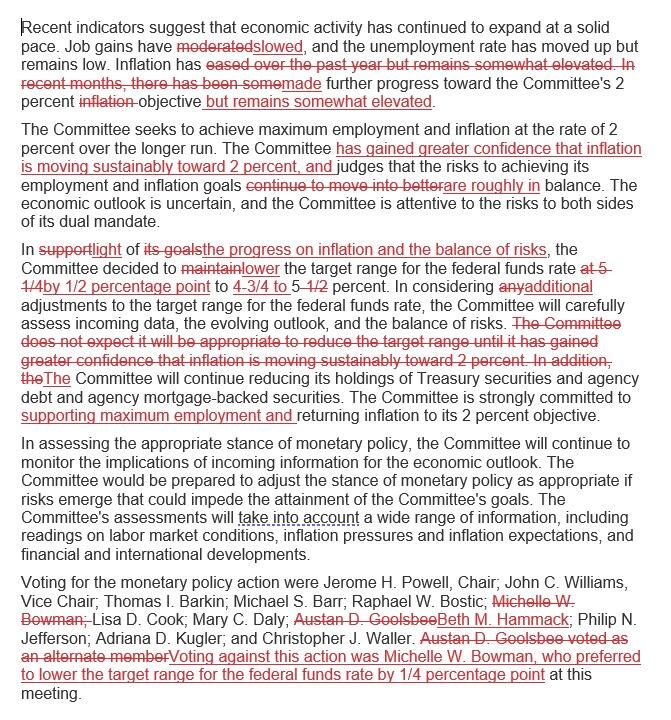

- Federal Open Market Committee votes 11 to 1 to lower benchmark rate by 50 basis points to target range of 4.75%-5.0%, the first rate cut in more than four years

- Fed governor Miki Bowman dissented in favor of a smaller 25 bps cut. It's the first dissent by a governor since 2005.

- Statement adds language to say the committee is “strongly committed to supporting maximum employment” in addition to returning inflation to its 2% goal

- Statement says that “in considering additional adjustments” to rates, officials will assess incoming data, evolving outlook and balance of risks

- Fed tweaks language to note job gains “have slowed;” says inflation “has made further progress toward the committee’s 2% objective but remains somewhat elevated”

The Fed Dots tumbled to meet market expectations, with 2024's median dot slashed from 5.125% to 4.375%, 2025 cut from 4.125% to 3.375%, and 2026 from 3.125% to 2.875%...

Nine of 19 officials penciled in 75 basis points of cuts or less...

Close up on 2024 and 2025 - The Fed members literally abandoned all of June's expectations...

But amid that massive easing adjustment in the dots, The Fed did not change its 2025 GDP forecast at all, it sees 2025 unemployment up just a fraction, from 4.2% to 4.4% and 2025 core PCE dip from 2.3% to 2.2%...

... and that justifies the FOMC predicting an additional 3 rates cuts from June to September...

Read the full FOMC Statement red-line below:

More By This Author:

Bitcoin & Big-Tech Battered, Bonds & Black Gold Bid As Rate-Cut Expectations SoarMoney-Market Fund Assets Hit Another New Record High As Domestic Bank Depos Surge To Pre-SVB Levels

Nvidia & WSJ Spark Surge In Stocks, Gold, & Crypto This Week

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more