Another Perspective On Today's Strong Housing Numbers

Following today's better than expected housing numbers (See Housing Starts and Permits Surge Most in Seven Years) Doug Short at Advisor Perspectives pinged me with these comments.

Mish – I started tracking these for the first time today – complete historical data. These are two of the noisiest series of all time.

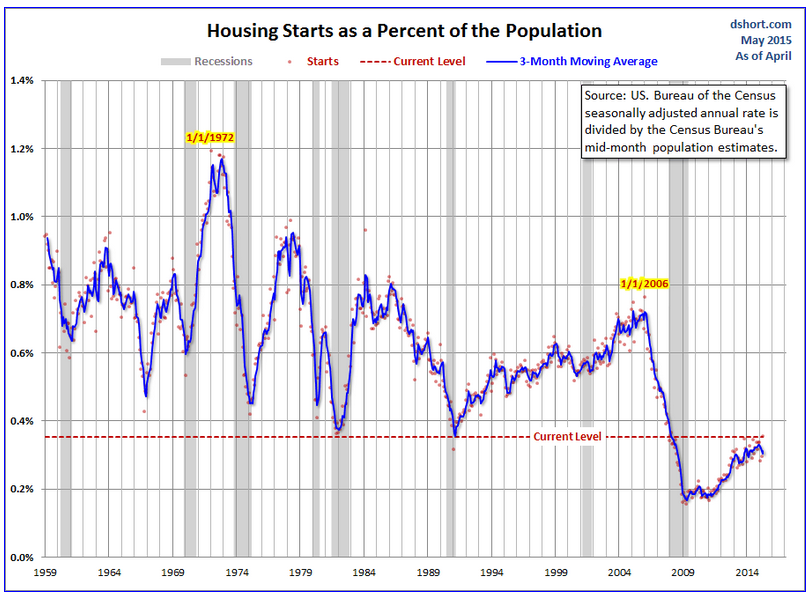

Take a look at the charts, especially the population-adjusted versions. You’ll see why you need at least a 3-month moving average to get an idea of the real trend direction and slope. And check out where the latest data points put us relative to the total series.

Starts: New Residential Housing Starts Surge in April

Permits: New Residential Building Permits Rise 10.1% in April

Bottom line: take the April data with a grain of salt … maybe a tablespoon full.

Privately Owned Housing Starts

Housing Starts as Percent of Population

The above from Doug Short

Here is a chart and comment I posted yesterday in Home Builders Optimistic Despite Decline in Traffic; Housing Market Index Declines.

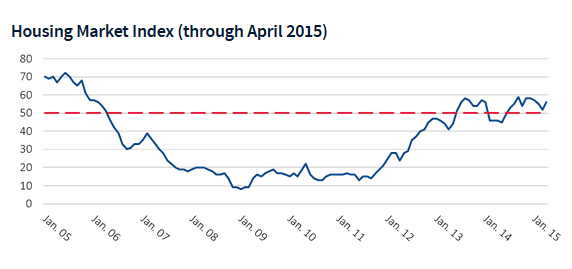

NAHB Housing Market Index

If you ask the builders, sales conditions are very good with a score of 59. Sales expectations rose to an excellent score of 64. Meanwhile, actual lookers score a very poor 39.

Average it all together and you get the totally useless chart above.

Housing Market Index Components

Yesterday afternoon I asked the NAHB for the subcomponent data. Here is a chart I put together from that data.

Note the actual traffic of prospective buyers vs. sales expectations six months out.

Mike "Mish" Shedlock

Disclaimer: The content on the Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All ...

more

April's numbers may appear like good news, but might only reflect the seasonal fluctuations in the housing market where the hibernating buyers are waking up from a long cold snowy winter. The U.S housing market is generally ok for now, BUT if there's an increase in interest rates, this will push up the cost of borrowing money for mortgages and may ultimately affect sales' numbers. The affect of interest rates on mortgage rates is one the leading influences on supply and demand in the real estate market, along with regional demographics, and the state of the economy both regionally and nationally.