Tuesday, March 12, 2024 1:05 PM EST

Every month I publish the annualized inflation chart following the CPI release, and every month I get enormous pushback.

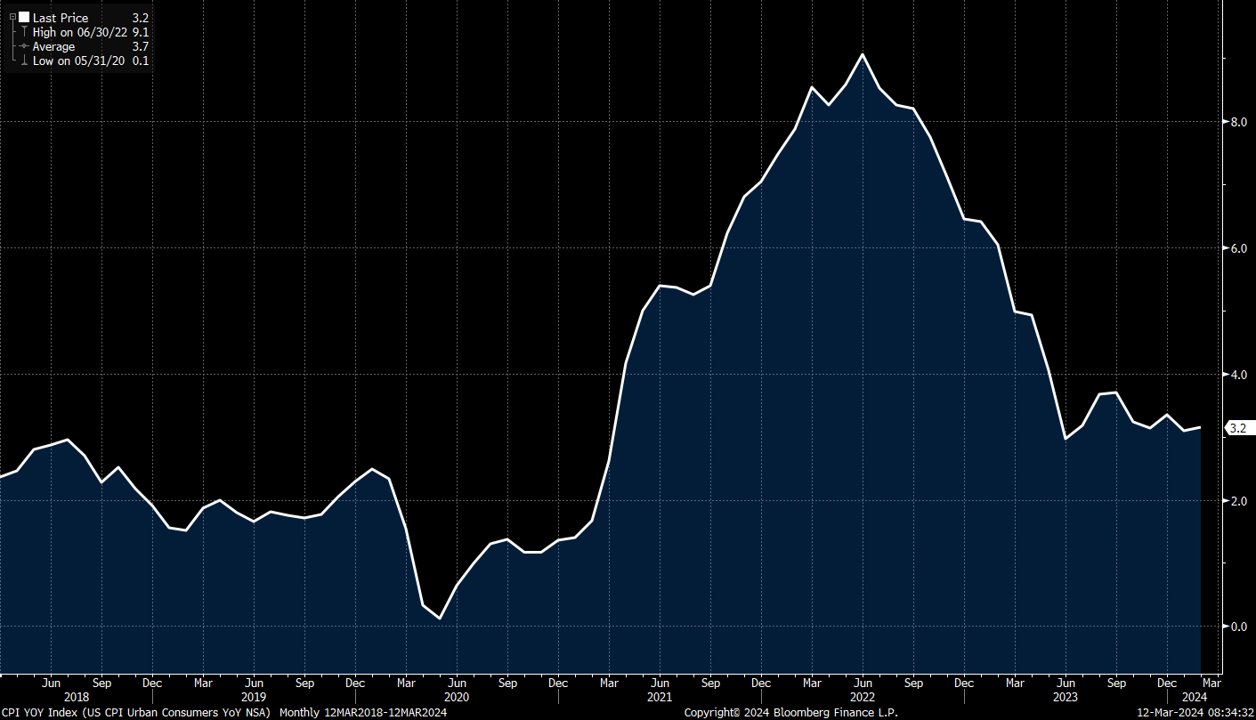

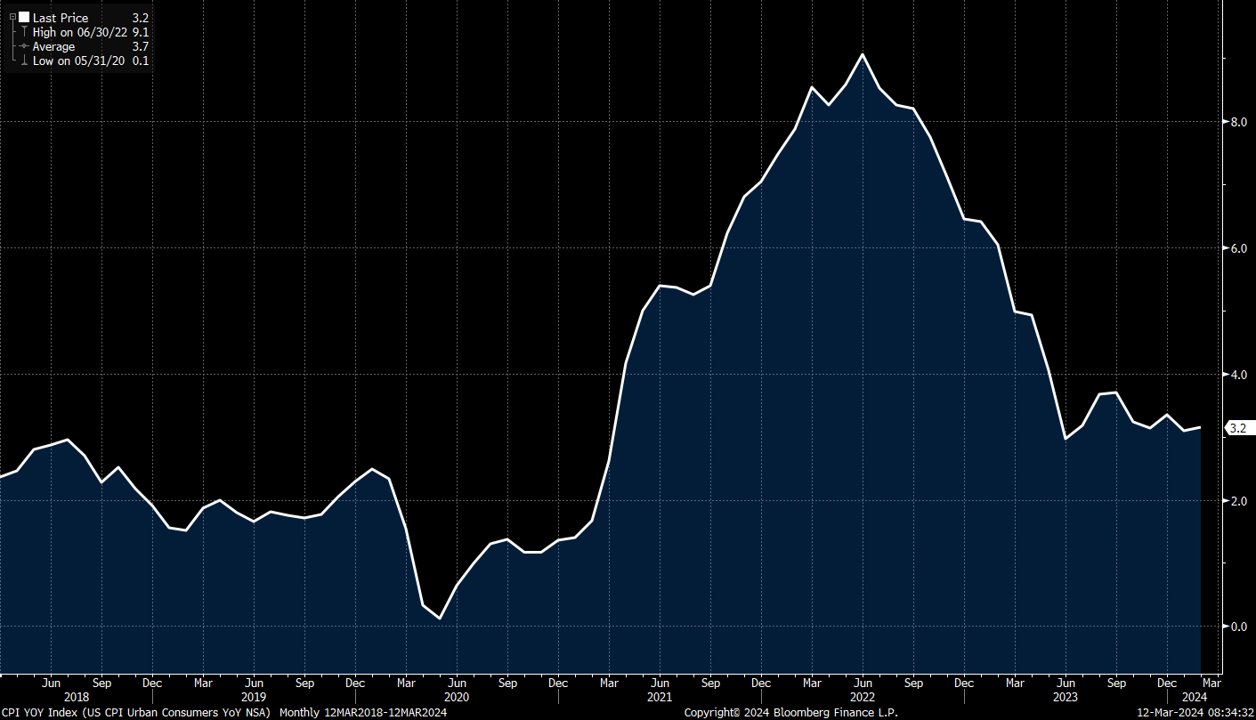

(Click on image to enlarge)

CPI Index YOY (source: Bloomberg LP)

Corporations are passing through price increases at will, keeping margins and earnings growth strong. Wages are increasing at 4%+. We’re adding 250k+ jobs per month, even after revisions. Rents are now climbing again, +2% month-over-month. There is *massive* fiscal spending flowing through the real economy via use-it-or-lose-it ARPA billions, Bipartisan Infrastructure Bill programs, and the initial Inflation Reduction Act programs.

Inflation stopped going down 8 months ago and we’re about to take off again. I don’t know why this is so hard to understand. Or rather, I do know why this is so hard to understand, because a lot of jobs on Wall Street and in Washington depend on not understanding it.

Including jobs at the Fed. Which I suppose explains their ‘reaction function’ these days.

And you wonder why Bitcoin and gold – insurance policies against central bank error – are at record highs.

The bottom line is this: the Fed’s inflation-fighting credibility is shot and everyone in Washington and on Wall Street is in the bag for massive nominal economic growth going into November.

What is ‘nominal economic growth’? It’s a ten-dollar phrase that means Number Go Up.

What numbers? ALL NUMBERS.

After that … well, as Louis XV so aptly put it: après moi, le déluge.

Wheeee!

More By This Author:

One Less VulnerabilityThe Drumbeat Of Inflation The Story Arc Of SBF And FTX

Disclosure: This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views ...

more

Disclosure: This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results. Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

less

How did you like this article? Let us know so we can better customize your reading experience.