Analysts Weigh In On Biogen Inc. As It Partners Up With Applied Genetic Technologies Corp

On July 2 before market open, Biogen Inc. (NASDAQ:BIIB) and Applied Genetic Technologies Corp (NASDAQ:AGTC) announced a broad collaboration and license agreement to develop gene-based therapies for multiple ophthalmic diseases. The primary focus of the partnership will be on developing therapeutic programs for orphan diseases of the retina that can lead to blindness in children and adults. This news has spurred interest among investors as analysts shed light on Biogen’s future.

Senior Vice President of Biogen, Oliver Danos, commented on the partnership, noting,"With this collaboration, we hope to advance gene therapies to open possibilities for patients who suffer from diseases that are well understood, but have no adequate treatment." Essentially, the biotech firms know what is wrong, but has not yet developed a cure. Danos goes on to explain how "AGTC is an exceptional partner to help us advance our gene therapy capabilities by targeting diseases of the eye – an organ that provides an ideal setting for the localized, selective delivery of gene-based therapies."

AGTC’s proprietary manufacturing technology and extensive gene therapy experience coupled with Biogen’s history of success with developing complex disease treatments,makes for an ideal partnership to conquer this problem and find a solution.

At the forefront of the developmental programs are X-linked Retinoschisis (XLRS) and X-Linked Retinitis Pigmentosa (XLRP). XLRS is a disease affecting young males that can eventually lead to vitreous hemorrhage or retinal detachment during adulthood. On the other hand, XLRP is not gender specific and most of the time causes night blindness by the age of ten. Eventually, XLRP will progress to legal blindness in individuals by the age of 40. Both of these diseases perfectly demonstrate the unmet needs that may be fixed by replacing the single, faulty gene causing each disease.

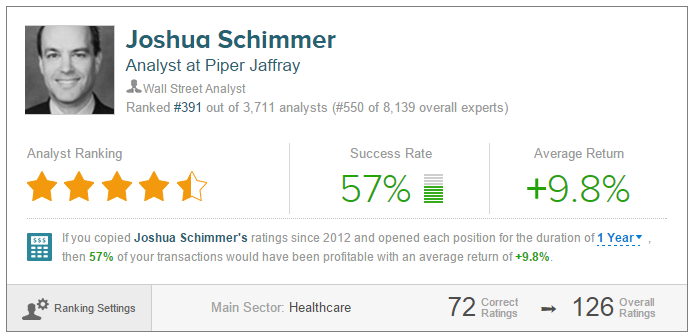

Piper Jaffray’s analyst Joshua Schimmer weighed in on Biogen on July 2, reiterating a Buy rating on the stock with a $485 price target. The analyst observed, "BIIB has secured rights to the lead XLRS program, which is already in Phase 1, as well as the XLRP program, which is expected to enter the clinic next year." Furthermore, the analyst "continues to see this as a validation of gene therapy’s science as well as transformative potential, as [he] believe[s] the gene therapy field will become an important driver of the biotech industry in the coming years." He concludes that he, "struggle[s] with BIIB’s overall strategy and still sees a significant need to improve its pipeline and growth outlook."

Joshua Schimmer has a 57% success rate recommending stocks, earning a +9.8% average return per recommendation.

J.P. Morgan’s analyst Cory Kasimov also weighed in on Biogen on July 2, reiterating a Buy rating on the stock with a $407 price target. This is up from his previous target of $400 to compensate for more upside potential.

Kasimov commented, "We’re providing updated thoughts on BIIB following a series of calls, a buy side survey, and a complete re-build of the model." He continues to explain that "BIIB’s pipeline is one of the most compelling in large biotech." The analyst concluded that the "combination of meaningful earnings growth plus significant pipeline optionality [will] generate investor interest in 2015."

Cory Kasimov has a 63% success rate recommending stocks, earning a +13.3% average return recommending stocks.

In terms of the deal, Biogen will initially pay AGTC $124 million. Included in that amount is a $30 million equity investment in AGTC for a price equal to $20.63 per share; a $27% premium to the July 1 closing price. In return, Biogen will be granted a license to the XLRS and XLRP programs.

In reaction to the news, AGTC stock jumped as much as 24% in early morning trading on July 2. However, Biogen stock was down a fraction the same morning.

Out of the 10 analysts polled by TipRanks, seven analysts are bullish on Biogen and three are neutral. The average 12-month price target for Biogen is $484.50, marking a 19.84% potential upside from where the stock is currently trading. On average, the all-analyst consensus for Biogen is a Moderate Buy.

Disclosure: To see more, visit more