An Urgent Update On China’s Black Swan

The markets have rallied hard on news of a potential Evergrande (EGRNF) debt payment.

In case you’ve missed this story, Evergrande is a massive property developer in China. The company is effectively insolvent, and with $300 billion worth of debt many analysts were predicting this would lead to China’s “Lehman moment.”

We had some fireworks on Monday, but the markets have since rallied hard on news that Evergrande would make a payment on one of its Yuan-denominated bonds.

That payment is expected to be made today.

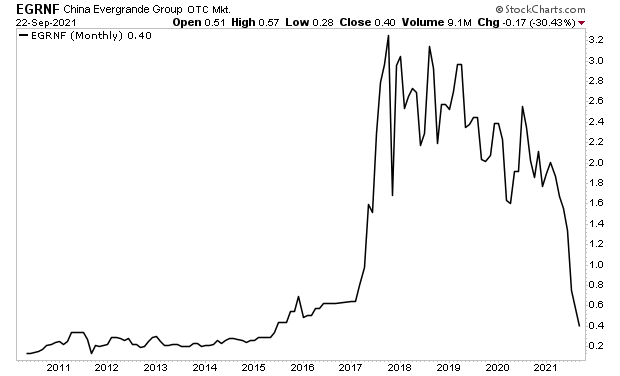

Regardless of what happens with this specific payment, the fact remains that Evergrande is effectively insolvent. The chart says it all.

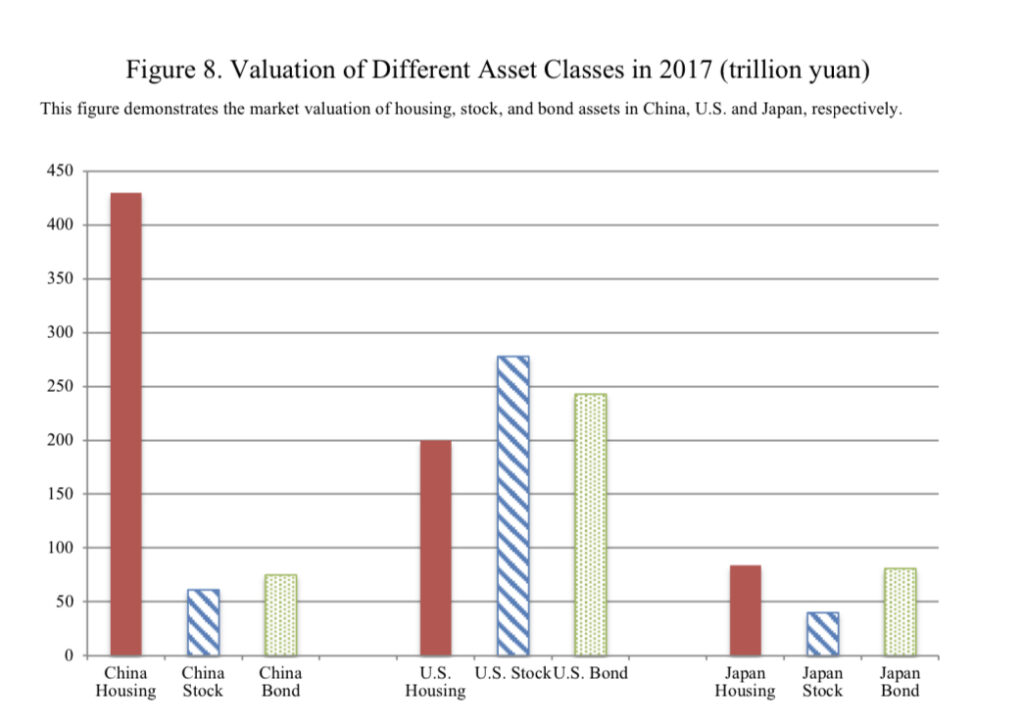

Moreover, this company is not an isolated situation. China’s government has made it clear it wants the real estate sector to deleverage, which means many of the over-indebted property developers are at risk of similar issues. Real estate and construction account for 16% of China’s ~$15 trillion economy… so this is not a small problem.

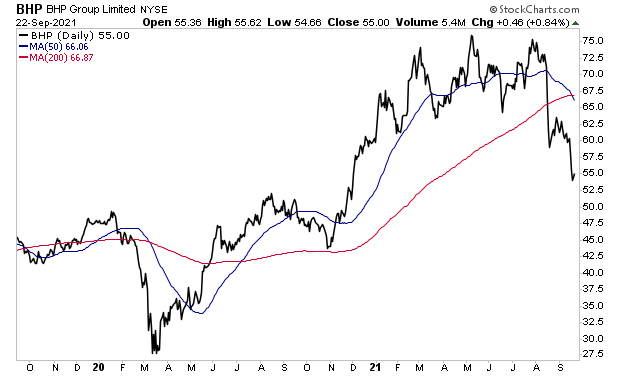

Keep an eye on BHP Group limited (BHP). As one of the largest Australian mining companies responsible for supplying China’s construction/real estate sectors, it’s a decent litmus test for whether or not this issue is really resolved or not.

As I write this, BHP is staging a VERY small bounce. The chart is profoundly ugly.

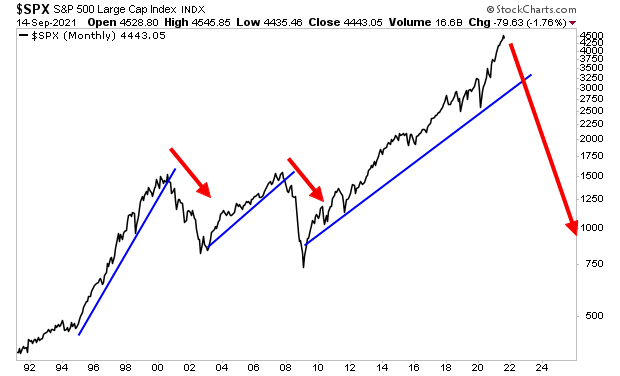

At the end of the day, whether Evergrande pays its bond or not today is just one paragraph in the book of bad debts that are floating around the financial system. The fact the Fed has spent over $4 trillion propping things up since 2020 doesn’t mean this whole mess won’t come crashing down.

In chart terms, it’s only a matter of time before this happens.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.