Americans’ Net Worth Plunges In 2022

Before I get into today’s discussion, let me briefly comment on the Fed Open Market Committee’s (FOMC) latest decision regarding short-term interest rates. As was widely expected, the FOMC voted yesterday to raise its Fed Funds rate by 0.5% to a range of 4.25-4.50%. This increase followed four consecutive rate increases of 0.75% earlier this year.

In his post-meeting press conference Fed Chairman Jerome Powell indicated there will be more interest rate hikes going forward as the Fed tries to get inflation down to its target rate of 2%. The Consumer Price Index rose 0.1% in November and increased 7.1% over the 12 months ended November. The core CPI (excluding food and energy) rose 6.0% over the last 12 months. So, the Fed still has a long way to go to get inflation down to its goal of 2%.

The Fed also released its latest economic projections yesterday, and they show interest rates peaking in 2023 and then trending lower in 2024. The FOMC now expects the Fed Funds rate to peak at just over 5% next year. In his press conference, Mr. Powell warned that the Fed Funds rate might have to stay at 5% for an extended period.

In perhaps the biggest surprise in the FOMC’s latest economic projections, the Fed now projects the economy will grow by only 0.5% in GDP over the next two years. This was down significantly from the Fed’s last GDP projections of 1.2% and 1.7% for 2023 and 2024 in September. So, this is a big change! Not surprisingly, stocks traded sharply lower after the Fed’s announcement and projections yesterday and again today.

Now let’s get to today’s topic.

Americans’ net worth has taken a hit in 2022 primarily due to weakness in the economy earlier this year and a bear market in stocks. Data released by the Fed last week showed that the net worth of households and nonprofit organizations dropped by $400 billion to $143.3 trillion in the third quarter. The value of households’ stocks declined by $1.9 trillion.

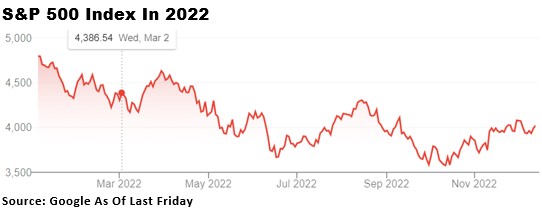

The decline comes after their wealth plummeted more than $6 trillion in the second quarter, which was also driven primarily by a drop in stock prices. The S&P 500 Index has declined by over 16% this year, while the Nasdaq Composite Index has lost over 29% this year, so it’s no surprise Americans have seen a hit to their net worths.

The current slide in wealth is a notable turnaround from the robust gains that began in mid-2020, fueled by skyrocketing prices of homes and equities. Net worth hit a high of $150.1 trillion in the final quarter of last year before declining for the past three consecutive quarters.

Yet despite the drop in wealth this year, the latest Fed report shows that many middle-class and upper-income Americans are still in pretty good shape financially, compared to pre-pandemic times. The net worth of households and nonprofit organizations is 7.7 times their disposable personal income, compared to 7 times in the final quarter of 2019.

While Americans’ net worth has declined for the last three consecutive quarters, most consumers are still better off than they were several years ago, thanks primarily to the increases in real estate prices in recent years. This is allowing them to keep spending even though inflation has pushed up prices.

And if the United States falls into a recession next year, the still relatively strong balance sheets of consumers should help prevent it from being a very deep downturn.

Even with the turbulent times on Wall Street and the minor slowdown in the real estate market this year, households and nonprofit groups have only lost about $7 trillion. That’s still far above the $110.8 trillion in the first quarter of 2020 when the start of the Covid-19 pandemic roiled equities and the economy.

Understandably, most Americans are not happy about their financial situation. A recent CNN poll found that about half of those surveyed said their financial situation was worse than a year ago, while only a third said it was the same and only 16% said it was better.

Slightly over half said they believe the economy is continuing to worsen, while 30% said it has stabilized. Only 16% said economic conditions are getting better.

Some 63% of respondents said they are “very concerned” about rising prices, while 93% of those responding to the recent survey said they are at least somewhat concerned by the current cost of living.

The question remains, of course, whether we will have a recession next year or not. As noted above, the Fed does not think so and believes GDP growth will stay modestly positive (+0.5%) over the next two years. Yet many other forecasters remain convinced we will have a recession next year. Time will tell.

More By This Author:

3Q GDP Rises Again, Fed’s Jerome Powell Remains Hawkish, But…

More Americans Starting New Businesses, Despite Slow Economy

Why Inflation Is Not Going Away Anytime Soon