Alts Are Really Alternatives To…

With the market continuing to trade sideways in a very tight range, this looks to be as good a time as any to finish up our review of alternative investing strategies and how they should be employed in one’s portfolios.

So far, we’ve established that there are two categories of “alts.” First there are what I call the traditional alternatives, which include Gold, REITs, and Commodities. And then there is the new-age stuff, which includes alternative approaches to the traditional asset classes of stocks and bonds. To review, the new-age strategies include long/short equities, managed futures, arbitrage, global macro, option strategies etc.

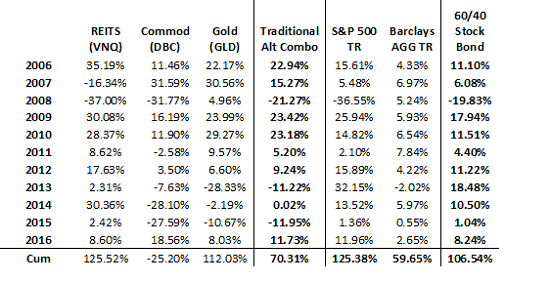

Next, we have concluded that the traditional alts can actually be viewed as an alternative to stocks. As the table below illustrates, both REITs (I’ve used the VNQ as a proxy) and Gold (GLD) did actually keep pace with the S&P 500 for the 11-year period ending 12/31/2016.

Traditional Alternatives

Source: Morningstar

We’ve also opined that the devastation that occurred in the commodities markets in both 2008 and since 2011 (the DBC fell more than -51% from 2011 through the end of 2015) caused investors to look elsewhere in their quest for non-correlated assets and has led to the rise of what we call the new-age alt category.

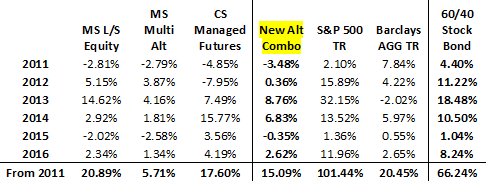

However, as a class, the sophisticated new-age alts have not lived up to expectations. As the table below illustrates, the S&P 500 has delivered returns that are nearly five times the Morningstar Long/Short Category from 2011, nearly six times the Credit Suisse Managed Futures benchmark, and more than seventeen times the Morningstar Multialternative Category.

New-Age Alternatives

Source: Morningstar

As such, we simply cannot agree with the idea that the new-age alts are an alternative to the U.S. stock market.

In addition, we looked at the alts as a way to protect against bear market declines in the stock market. And while most of our new-age benchmarks did lose less than the S&P 500, we concluded that tactical strategies designed to reduce exposure to market risk in negative environments actually make more sense.

But As An Alternative To…

The proponents for new-age alts contend that these non-correlated strategies should really be viewed as alternatives to bonds. So, let’s spend a moment exploring this idea.

Since 2011 (through the end of 2016):

- Barclays Aggregate Bond TR: 20.5%

- REITs (VNQ): 89.5%

- Morningstar Multialternative Category: 5.7%

- Morningstar Long/Short Equity Category: 20.9%

- Credit Suisse Managed Futures: 17.6%

- Gold (GLD): -21.0%

- Commodities: -42.5%

- New-Age Alt Combo: 15.1%

Source: Morningstar

On the surface of this rather rudimentary analysis, it would appear that Long/Short Equity and REITS have actually outperformed the bond market (as defined by the Barclays Aggregate Bond Total Return index) while Managed Futures have largely kept pace and the Multialternative Category once again did not.

As for the combo of the traditional alts since 2011, the word “ouch” comes to mind.

Atls vs. Bonds During the Recent Spike in Yields

Next, I decided to get more granular and analyze the returns when bonds actually performed poorly. After all, the intent of a non-correlated class would be to outperform when the targeted class is weak.

In 2013 (the year of the taper tantrum), a combination of the new-age alts DID beat the AGG by a wide margin: +8.76% vs. -2.02%. Well done.

In 2016 – when bonds got hit hard in second half of year, the AGG won the battle versus the Multialternative class: +2.62% vs. +1.34%. But, the L/S Equity kept pace with the AGG and the Managed Futures benchmark outperformed. So again, it looks like the argument has merit.

And then if we zoom in on the second half of 2016, we see strong returns for the Multialternatives: +1.95% vs. AGG -3.44%. Success.

In sum, it would appear that the argument of the new-age alts being an alternative to the bond market holds water – especially when bond prices decline.

So, if you believe that the bond market has entered a bear market, then using some combination of traditional and new-age alternatives would appear to make sense – perhaps even a LOT of sense.

But let me leave you with one caveat. If you are wrong on your macro bet and bonds do NOT fall hard… Bonds will likely win, alts will likely lose, and if you are the money manager making the bet, you run the risk of getting fired for underperforming in an already low-return environment.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the “Trump Trade”

2. The State of Global Central Bank Policies

3. The State of U.S. Economy

4. The State of Bond Yields

Thought For The Day:

Action is the foundational key to all success. – Pablo Picasso

Disclosures: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: GLD. Note that positions may change at ...

more

Thanks for sharing