Algorithms Correlating Oil To S&P More Than In Past

“Davidson” submits:

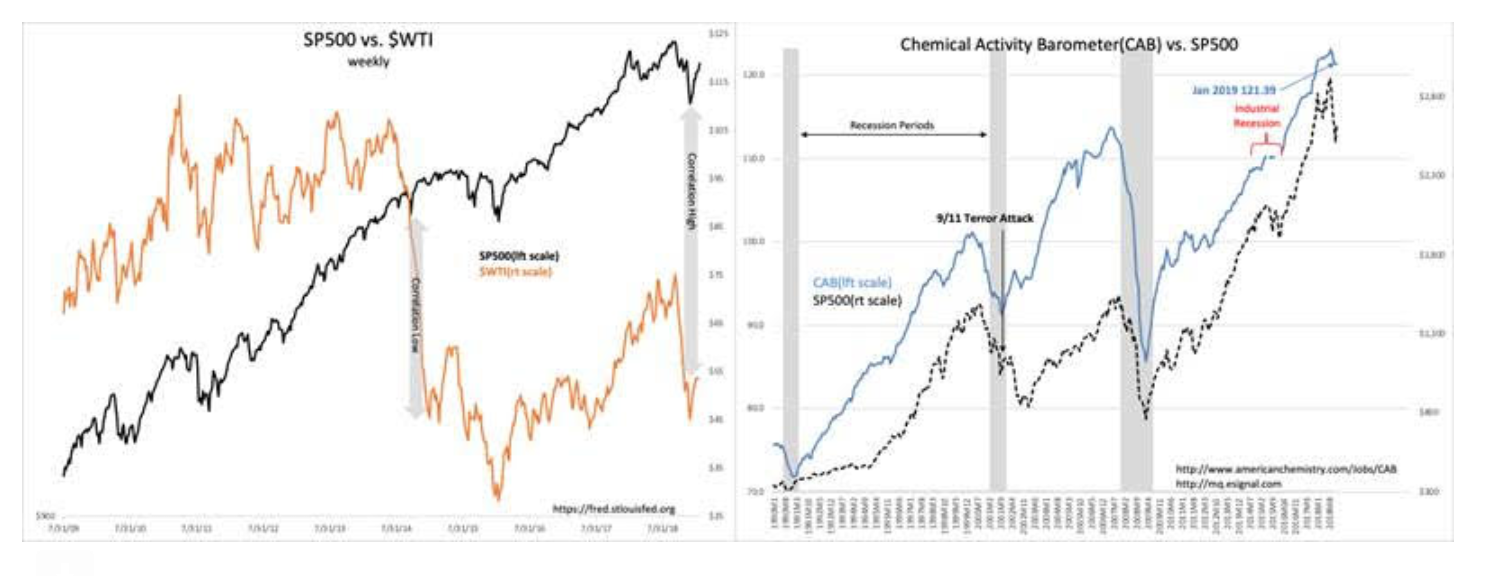

Momentum Investor algorithms connect oil prices to SP500 much more today than in past. The weekly SP500 vs. WTI (West Texas Intermediate Oil Price) from July 2009 reflects some correlation 10yrs ago having evolved into an exaggerated correlation today. The media is awash in chatter about oil prices being a guide to future economic activity, oil being in excess or short supply and the connection to equity prices. Most of what is discussed in the media is in one form or another that ‘market prices forecast economic outcomes’. Very little commentary discusses economic fundamentals as drivers of market prices. The fact remains that prices reflect market psychology after data is reported. Prices do not anticipate, they follow!

Since the teachings of Harry Markowitz’s Modern Portfolio Theory, ‘risk’ is defined as volatility and the goal of every manager is to minimize volatility through the use of mathematical models (algorithms) letting computers run hyper-speed trading programs to react before one’s competitors. The recent market decline showed a much high correlation between the SP500 and WTI pricing than that which occurred with 2014-2016’s almost non-existent correlation. The primary difference, in my opinion, was that 2014-2016 WTI decline had fewer algorithms making the connection in pricing. Unfortunately, there is no means to measure how much capital is subject to algorithms as this data is not available. The best we can do is to infer Momentum Investor thinking in comparison to economic fundamentals. The Oct 2018-Dec 2018 panic occurred with high levels of insiders buying their shares, rising employment, rising retail sales, rising personal income, rising new job openings, rising temporary help levels and strong trends in the Jan 1990-Present monthly Chemical Activity Barometer(CAB)(shown). The other indicators are not shown because it would make this note too cluttered.

A major feature of the Oct 2018-Dec 2018 decline was that the ‘market was too long in the tooth’ and simply due for an economic correction. The media helped drive prices lower with the discussion that conditions were similar to the Great Depression. Fundamentally, financial conditions are very sound and not by any means comparable to Great Depression conditions, but to those only dependent on price trends and algorithmic correlations a full-on panic occurred.

Since the Dec 2018 lows, the employment data and corporate earnings have begun to ease this panic. As the data continues to roll in the next few months, we should expect to see signs that economic activity continues to expand. The algorithms remain intact. WTI prices are likely to rise with the SP500 as economic fundamentals shift market psychology to being more optimistic.

Investors much always keep in mind that changes in price trends can be detected weekly, but changes in the trends of economic fundamentals can only be determined within a minimum of 12mo of data. This is why Momentum Investors suffer short-term bouts of euphoria and panic as Value Investors ride the long-term fundamentals. The media is always dominated by Momentum Investors who periodically work themselves into trading frenzies to which Value Investors do not respond.

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more