Airline And Cruise Stocks Star As Wall Street Surges

What a difference a day makes.

Following Monday’s Omicron driven sell-off, which marked three consecutive days of declines on Wall Street, the main US indices all moved higher on Tuesday, as investors appeared to shrug off concerns surrounding the latest variant of Covid-19.

The S&P 500, which had fallen more than 2.8% over the previous three sessions, ended the day up by 1.78% - almost reversing the previous day's losses.

Tuesday’s gains were largely driven by technology and travel stocks – with both airlines and cruise lines having particularly strong days.

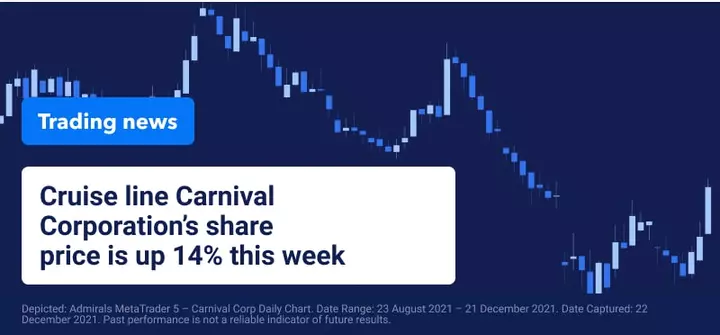

Out of those travel stocks which performed well, cruise line Carnival Corporation led the way, rising 8.7% during the session and taking its total gains for the week so far to 14%, following the release of their Q4 results on Monday.

But why are investors so bullish on a company which posted a net loss of $2.6 billion for the quarter and which is burning cash at an average monthly rate of $510 million?

Well, if we look beyond these not so encouraging numbers, there is certainly cause for optimism to be found.

According to the results, during the quarter ending 30 November, revenue per passenger cruise day rose by around 4% when compared to the same quarter in a “strong 2019”. Furthermore, this was achieved with the cruise line’s fleet operating at 61% capacity. Looking forward, Carnival anticipates that their full fleet will be back in operation by spring 2022.

Q4 marked the third consecutive quarter in which the company saw an increase in customer deposits, which totalled $3.5 billion, an increase of around 13% from the previous quarter. Advanced bookings for the second half of 2022 and first half of 2023 are also at “the higher end of historical ranges and at higher prices”.

And what about the amount of cash they are burning each month? Well, that looks slightly less scary when you consider that Carnival has more than $9 billion cash on the books. Even at their current burn rate, they have more than enough to sustain themselves until their “seasonally strong summer period” arrives.

All these positives help explain why investors have been piling into this cruise line stock this week. However, with the threat of Omicron and future variants still lingering, further volatility in travel stocks over the coming months cannot be ruled out.

(Click on image to enlarge)

Depicted: Admirals MetaTrader 5 – Carnival Corp Daily Chart. Date Range: 23 August 2021 – 21 December 2021. Date Captured: 22 December 2021. Past performance is not a reliable indicator of future results.

Carnival Corporation’s Share Price Five-Year Evolution

(Click on image to enlarge)

Depicted: Admirals MetaTrader 5 – Carnival Corp Weekly Chart. Date Range: 7 June 2015 – 21 December 2021. Date Captured: 22 December 2021. Past performance is not a reliable indicator of future results.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more