AI Spending: No, This Is Not The Dot-Com Bubble All Over Again

Photo by Steve Johnson on Unsplash

Does Artificial Intelligence Capex present a threat to the AI story? The market has cited three main concerns regarding it: the sheer size, the use of leverage, and the so-called circular financing. But this is not the 1990s from a Capex standpoint, writes Nancy Tengler, CIO of Laffer Tengler Investments.

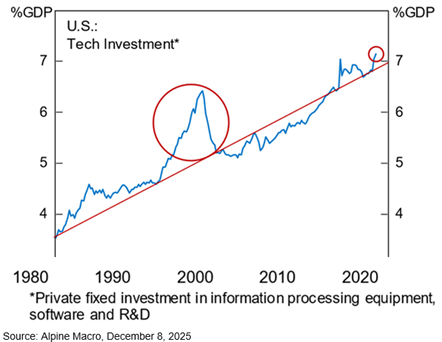

It is true that tech spend is at a historical high, but it mostly reflects the structural rise in tech’s share of total investment. An economy in transition, as my partner, Arthur Laffer, Jr., calls it.

The chart below shows that the current cycle spend is only slightly above trend. Compare that to the 1990s. Spend was way above trend then; it is not now.

When you back out Oracle Corp. (ORCL), the hyperscalers are funding Capex from cash flow. Oracle has always used a great deal of debt. One year ago, the company sported a 780% debt-to-equity ratio with earnings growing at half the rate currently. At the end of Q3, the debt-to-equity ratio was down to 500% (but likely rising).

Interestingly, while technology accounts for over 40% of the equity index, it only accounts for about 6% of the debt market. Debt levels are rising, but they are not yet in the danger zone.

About the Author

Nancy Tengler is the chief executive officer and chief investment officer of Laffer Tengler Investments. She is responsible for active equity management research and portfolio management, as well as leading the firm. Ms. Tengler is a committed advocate of financial literacy for women as the leader of Laffer Tengler’s Women & Wealth initiative, which encourages and informs women on how to take charge of their own financial and investment planning. The second edition of her book, The Women’s Guide to Successful Investing, was published in September 2023.

As one of the most dynamic women in the investment management industry today, she is a sought-after TV and print financial commentator on local and national media outlets. Prior to joining Laffer Tengler, Ms. Tengler had a distinguished investment management career in several senior leadership roles. Most recently, she served as chief investment officer at Heartland Financial where she was also a director of Arizona Bank & Trust.

Ms. Tengler has also served as president, chief executive officer, and chief investment officer of Fremont Investment Advisors in San Francisco. Before that, she founded Global Alliance Value Investors. She also worked for UBS Asset Management as head of the Value Equities Group and with Spare, Tengler, Kaplan, and Bischel, Ltd., as president and senior portfolio manager.

More By This Author:

CBTJ: A "Protected" Bitcoin ETF That Helps Limit Downside RiskSeven Themes Investors Should Focus On In 2026

DATCos: Why You Should Stay Away From These Stocks

MoneyShow Editor’s Note: Nancy will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. more