After Poor GDP Data In China, We Await The Next Batch Of Corporate Results

During yesterday's session, Chinese GDP data for the third quarter was released. From this data, we can once again ascertain that the global economy is suffering a slowdown - caused by, amongst other factors, the pandemic and further enhanced by the energy crisis.

-1.jpg)

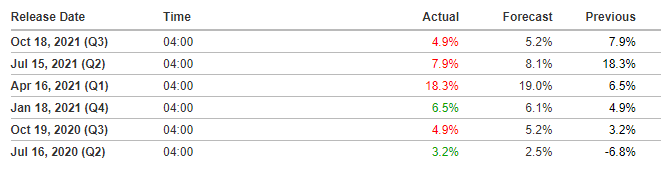

As with the latest PMI data in China, GDP was worse than expected and below the previous figure for the third time in a row. Specifically, GDP for Q3 came in at only 0.2%, bringing year-on-year GDP growth to 4.9%, compared to the 7.9% growth recorded at the end of the first half of the year.

Source: Investing.com

Therefore, we will have to keep a close eye on the evolution of macroeconomic data and, above all else, on energy prices. If this current trend continues, the problems could also continue to increase, leading to more temporary factory closures and thus impacting the economy even more so.

In other news, the steady stream of quarterly results continue to be released. Last week, we commented on the positive results coming from the banking sector; today, it is the turn of giants such as J&J (JNJ), Procter & Gamble (PG) and Netflix (NFLX), the latter being the company which is most highly anticipated, as the competition in this sector becomes stronger and stronger. It is expected that the recent success with South Korean series "Squid Game" could bring in up to 900 million dollars.

Another key player in yesterday's session was undoubtedly Apple (AAPL), after the company announced a second global event just a month after its much-anticipated annual event in September.

This time, Apple unveiled two new versions of its popular MacBook, a revamped version of the AirPods and a new streaming music service priced at around $5 a month.

Despite the positive results presented in recent months, after reaching record highs on 7 July 2021 at around 157.17 dollars per share, Apple’s share price began a sharp correction that led it to make a double bottom near the 50% Fibonacci retracement level of the last upward momentum.

These declines can be explained by the uncertainty generated by the microchip crisis and high energy costs that have caused problems in the manufacturing processes of its products. However, it is expected that as this situation improves, the share price could be restored. Nevertheless, we will have to pay close attention to their quarterly results, which are due to be presented on 28 October.

We will also have to be very attentive to the evolution of the price over the coming weeks. If it continues with the rebound and goes above 150 dollars per share again, we could witness an upwards momentum in search of historical highs. As long as the price maintains its current support level at the red band, sentiment will remain bullish.

(Click on image to enlarge)

Depicted: Admirals MetaTrader 5 – Apple Daily Chart. Date Range: 28 August 2020 – 19 October 2021. Date Captured: 19 October 2021. Past performance is not a reliable indicator of future results.

Evolution of the last five years:

- 2020: 80.75%

- 2019: 86.13%

- 2018: -6.78%

- 2017: 46.15%

- 2016: 9.99%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more