ADRs Best & Worst Report - October 20, 2014

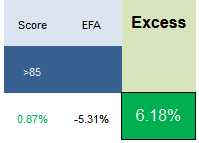

The best scoring ADRs from one year ago (10/21/2013) returned an average 0.87%, 6.18% better than the MSCI EAFE index (EFA). The best performing from our list one year ago have been SHPG up 48%, SIG up 44%, and YPF up 38%.

The average score across our ADR universe is 44.91, up from 43.67 last week, but below the four week moving average score of 45.84. The average ADR is trading -24.92% below its 52 week high, -8.87% below its 200 dma, has 3.95 days to cover held short, and is expected to post EPS growth of 19.09% next year.

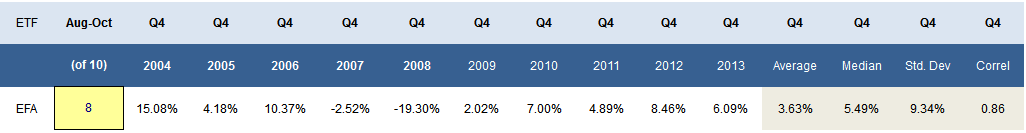

In last Monday's ADR report I noted that ADR average scores and the number of ADRs trading more than 5% below their 200 dma were both suggesting we were getting close to actionable levels. Both measures improved this week and while one week doesn't equal a trend, it remains an encouraging sign given the historical seasonal strength for the EFA.

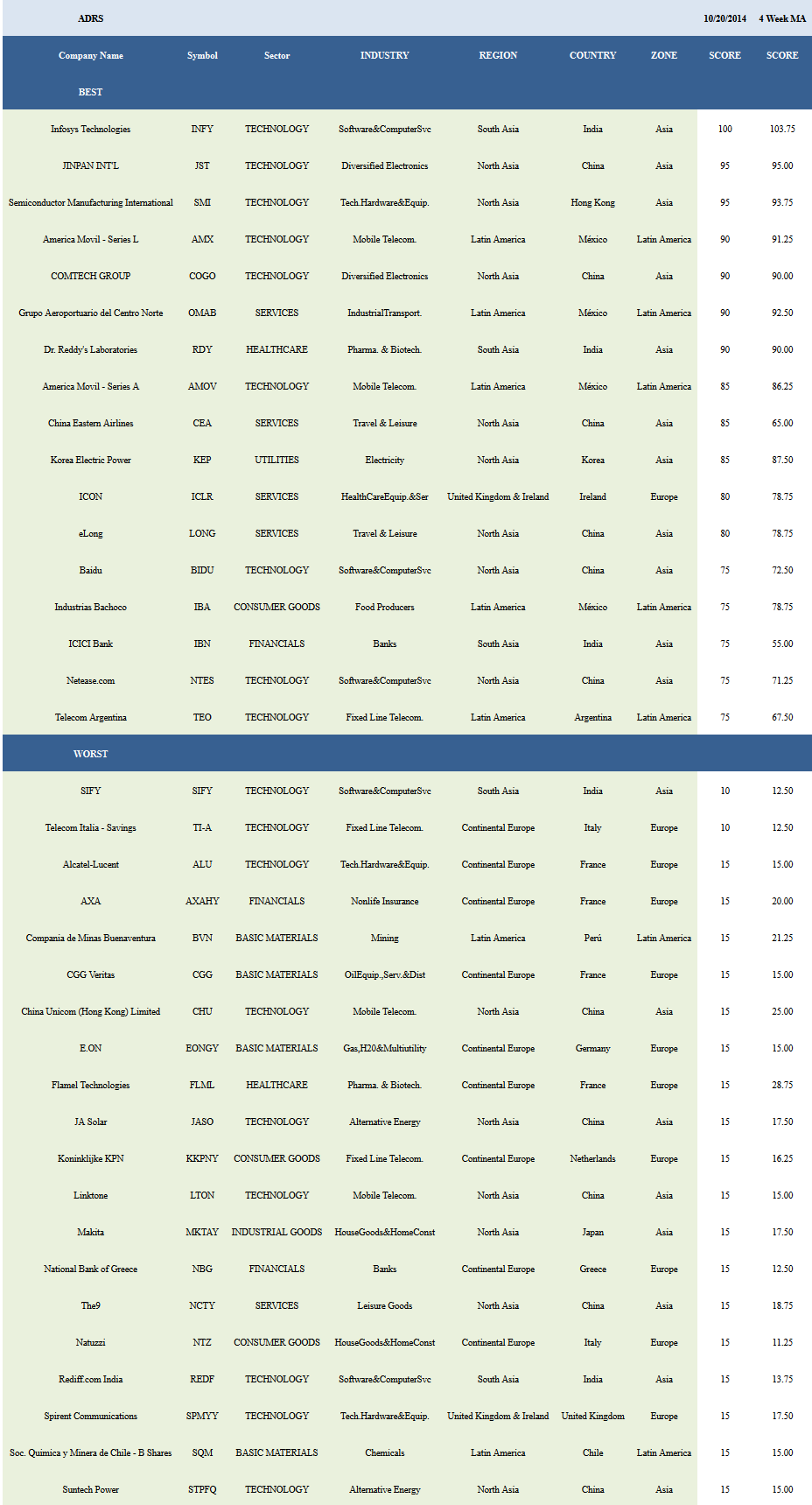

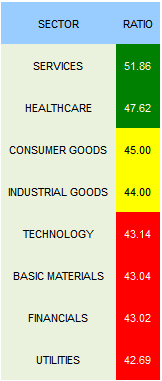

Services (OMAB, CEA, LONG, ICLR, SFL, RUK, MPEL, HMIN, GSH, ASR) and healthcare (RDY, RHHBY, NVO, NVS, BAYRY) score above average across ADR's this week. Consumer goods and industrial goods score in line with the ADR universe average score. Technology, basics, financials, and utilities score below average.

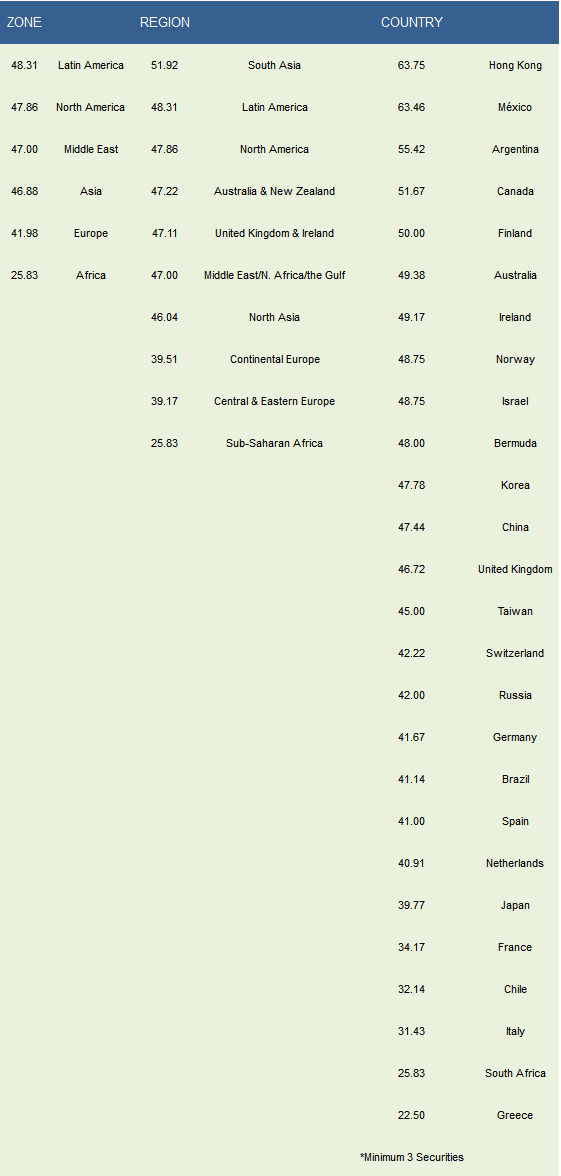

The top scoring zone's are Latin America (AMX, OMAB, BBD, AMOV, IBA) and North America (RY, BMO, BCE). South Asia (INFY, RDY, IBN, WIT, HDB), Latin America, and North America are the best regions. Hong Kong (SMI, HKTV, MPEL), Mexico (AMX, OMAB, AMOV, IBA), Argentina (TEO, BMA, GGAL, YPF), Canada (RY, BMO, BCE), and Finland (MXCYY, NOK) are the highest scoring countries.

Disclosure: None.