ADRs Best & Worst Report - July 11, 2016

- The best sector across ADRs is basic materials.

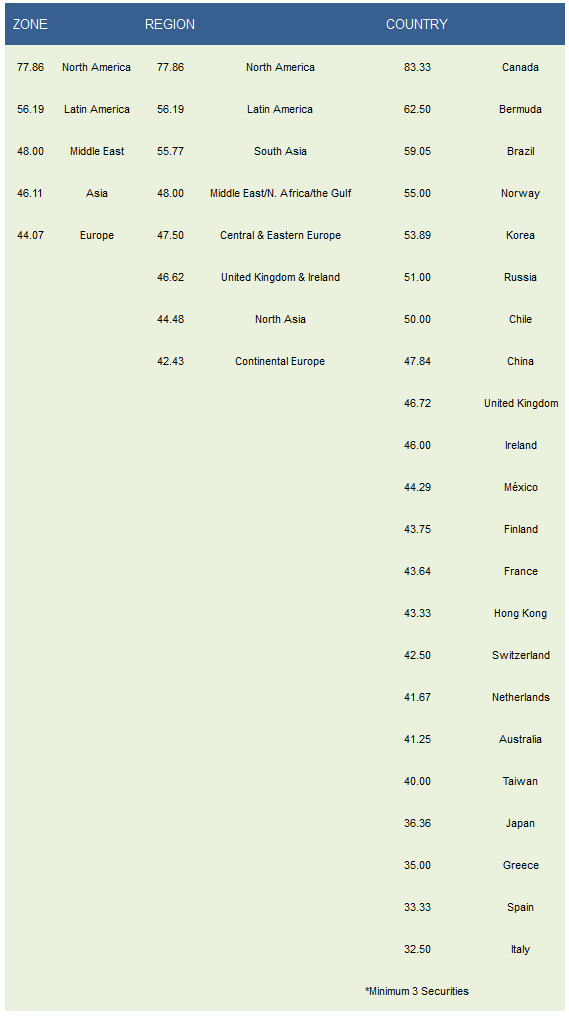

- The top countries are Canada, Bermuda, and Brazil.

The average score across our universe of ADRs is 48.69. The average ADR is trading -23.76% below its 52 week high, 2.83% above its 200 dma, has 3.72 days to cover held short, and is expected to grow its EPS by 17.58% next year.

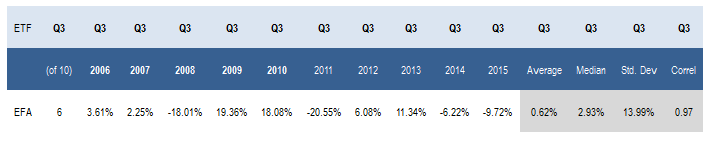

Over the past 10 years, the MSCI EAFE has gained ground six times, returning a median 2.93%. That essentially coin-flip seasonality should be taken in context to the fact that the EFA has dropped in 2 of the past 3 Q3's and that it's standard deviation over the past decade is significantly higher than U.S. index ETFs.

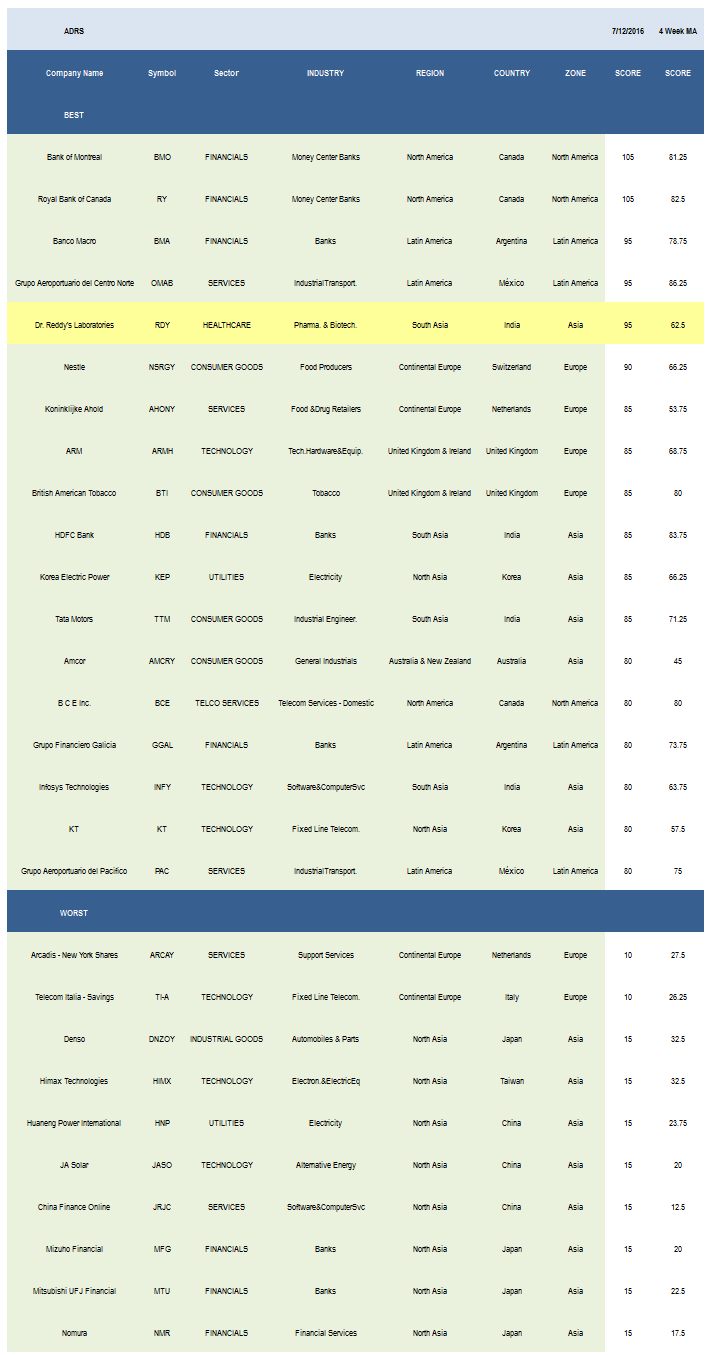

The following stocks score best and worst in our ADR universe.

(Click on image to enlarge)

The best scoring sectors across ADRs are basic materials (SNP, SID, HMY, YZC, YPF, SUBCY, SHI, GOLD, GFI, ECA, DRD, CNQ, CEO), utilities (KEP, SBS, ELP), and healthcare (RDY, GWPH, AMRN, AZN, NVO, GSK, GLPG). Financials, consumer goods, and technology score in line with the average universe score. Services and industrial goods score poorly.

The strongest regions are North America (RY, BMO, BCE, TU, ECA, CNQ) and Latin America (OMAB, BMA, PAC, GGAL, UGP, CIB, BBD, SID). North America, Latin America, and South Asia (RDY, HDB, TTM, INFY, TLK) are the best regions. Canada (RY, BMO, BCE, TU, ECA, CNQ), Bermuda (AXS, GSOL), Brazil (UGP, BBD, SID, BRFS), Norway (SUBCY, STO), and Korea (KEP, KT) are the top scoring countries that should be overweight in portfolios.

Disclosure: None.