Actuant: 3 Different Insiders Have Purchased Shares This Month

Actuant Corporation (ATU) designs, manufactures, and distributes a range of industrial products and systems worldwide.

(Click on image to enlarge)

Insider buying during the last 30 days

Here is a table of Actuant's insider activity during the last 30 days.

| Name | Title | Trade Date | Shares Purchased | Current Ownership | Increase In Shares |

| Gene Skogg | EVP | Dec 22 | 5,000 | 50,415 shares | +11.0% |

| Andy Lampereur | CFO | Dec 22 | 20,000 | 357,939 shares | +5.9% |

| Bob Arzbaecher | CEO | Dec 22-23 | 210,000 | 448,540 shares | +88.0% |

There have been 235,000 shares purchased by insiders during the last 30 days.

Insider buying by calendar month

Here is a table of Actuant's insider activity by calendar month.

| Month | Insider buying / shares | Insider selling / shares |

| December 2015 | 235,000 | 0 |

| November 2015 | 0 | 0 |

| October 2015 | 87,914 | 0 |

| September 2015 | 0 | 0 |

| August 2015 | 0 | 0 |

| July 2015 | 0 | 0 |

| June 2015 | 0 | 0 |

| May 2015 | 0 | 0 |

| April 2015 | 0 | 5,117 |

| March 2015 | 0 | 0 |

| February 2015 | 0 | 0 |

| January 2015 | 0 | 0 |

| December 2014 | 5,000 | 0 |

There have been 327,914 shares purchased and there have been 5,117 shares sold by insiders since December 2014. The month of December 2015 has seen the most insider buying.

Financials

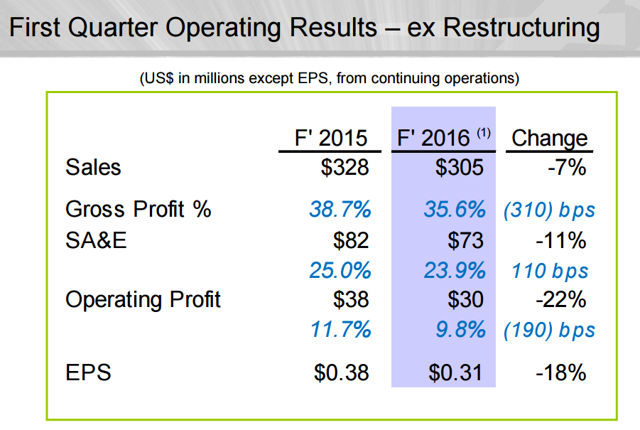

Actuant reported the fiscal 2016 first-quarter, which ended November 30, financial results on December 17 with the following highlights:

| Revenue | $305.0 million |

| Net income | $15.4 million |

| Cash | $171.9 million |

| Debt | $588.1 million |

The three insiders purchased their shares after these results.

(Source: Investor presentation)

Outlook

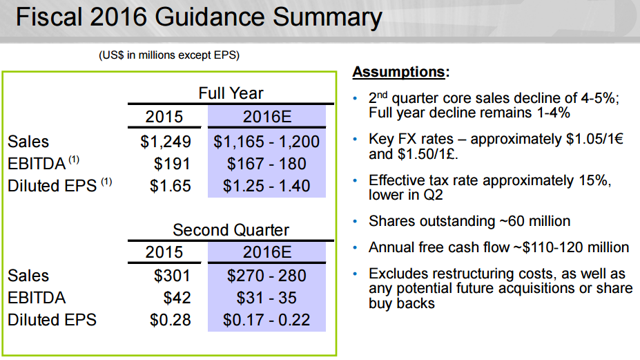

Actuant's guidance is as follows:

| Q2/16 | FY2016 | |

| Revenue | $270-$280 million | $1.165-$1.200 billion |

| EPS | $0.17-$0.22 | $1.25-$1.40 |

(Source: Investor presentation)

Competition

Actuant's competitors include Kennametal (NYSE:KMT) and Parker-Hannifin (NYSE:PH). Here is a table comparing these companies.

|

Actuant has the highest gross margin among these three companies.

Here is a table of these competitors' insider activities this year.

| Company | Insider buying / shares | Insider selling / shares |

| PH | 2,000 | 41,839 |

| KMT | 10,600 | 18,077 |

Actuant has seen the most insider buying this year.

Conclusion

There have been three different insiders buying Actuant and there have not been any insiders selling Actuant during the last 30 days. Two of these three insiders increased their holdings by more than 10%.

The three insiders purchased their shares at prices ranging from $22.79 to $24.44. I believe Actuant could be a good pick below $24.44 based on the intensive insider buying.

Disclosure: I/We have no positions in any stocks mentioned, but may initiate a long position in ATU over the next 72 hours.

As interesting as these insider trading numbers are, obviously insider buying should never be relied on alone for investing decisions. Actuant is down around 10% year to date but can 2016 be a positive one for the stock? In terms of analyst opinions: 1 is a strong buy, 3 are buys, and 5 are holds. Major competitors for this industrial machinery manufacturer include: Parker-Hannifin Corporation and Kennametal Inc. With global industrial production especially in China slowing down, it's questionable whether we will so continued growth in this sector and in this stock in particlualr.

Very impressive @@[Markus Aarnio](user:5781), I've added you to my follow list!