AAPL's Worst Dump In 7 Months Sparks Nasdaq Slump

Treasuries closed practically unchanged today after yields spiked higher on 'ceasefire' news then rallied lower all day long (30Y -2bps 2Y unch). Credit markets surged tighter on the news then collapsed wider to the lows of the week by the close (diverging from stocks). The USDollar slipped lower on the day, led by EUR strength. Gold ($1,270) and silver limped higher all day but WTI crude took off, gaining back all the flush losses from yesterday (above $95). In stock-land, the cease-fire sparked exuberance to new record-highs. That strength began to fade as soon as the US opened with notable selling in the holiest-of-holies - AAPL. This wesighed on Nasdaq heavily (to red on the week) and Russell high-beta stocks tumbled. Despite the standard late-day VWAP ramp, stocks were unable to recover as USDJPY was no help after breaking back below 105.00 and ended with the worst day in 5 weeks. And finally, of course, the S&P 500 closed with a 2,000 handle - so crucial to maintain the dream.

S&P 2,000 remains all that matters...The last 7 days => 1997.92, 2000.02, 2000.12, 1996.74, 2003.37, 2002.28... and today...2000.75

USDJPY was in charge of stocks (as AUDJPY correlation broke down)...

From the ceasefire headlines, stocks juimped but gave it all back once the US opened...

On the week the USD is up 0.15%, and the broad US equity market is down 0.15%...

With homebuilders and Energy underperforming...

High-beta momo had a very volatile day...

Treasury yields rallied back from 'ceasefire' spike high yields...

Credit remains unamused by the exuberance in stocks...

FX markets had a change of trend today as recent USD strength faded with EUR strength and some JPY buying...

PMs traded flat to very slightly higher, copper faded, but WTI crude took off...

Brent tracked WTI pretty tightly all day...

It's all AAPL's fault!!! Worst day in 7 months on heavy volume...

AAPL up close...the machines were extremely active

Charts: Bloomberg

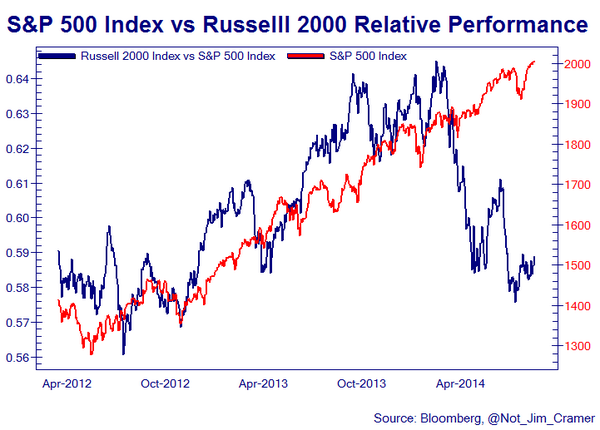

Bonus Chart: Small Caps continue to underperform...

Copyright ©2009-2014 ZeroHedge.com/ABC Media, LTD; All Rights Reserved.