AAPL: The IPad And The IPhone Lead In U.S. Mobile Shopping

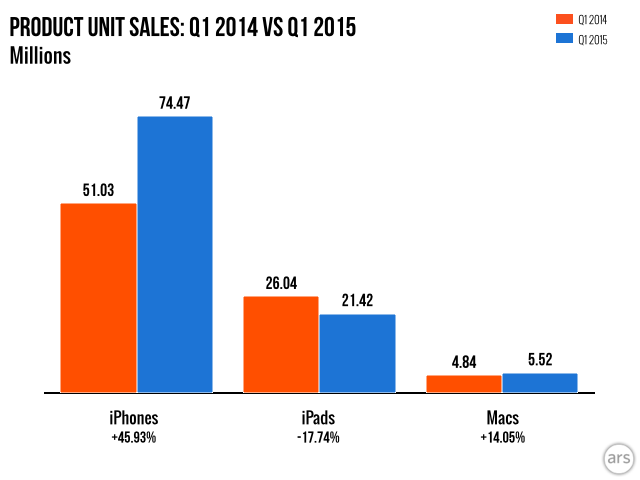

As per the latest earnings report of Apple (NASDAQ:AAPL), the company's tablet sales continue to decline. It is therefore worth noting that if it were not for the massive +45.93% year-over-year (Q1 2015 vs. Q1 2014) jump in iPhone sales, the big -17.74% drop in iPad sales would have worried many AAPL investors.

Fortunately, Cook's decision to release two big-display phablet-like iPhone 6 models last year was well received.

Source: Andrew Cunningham/ Ars Technica

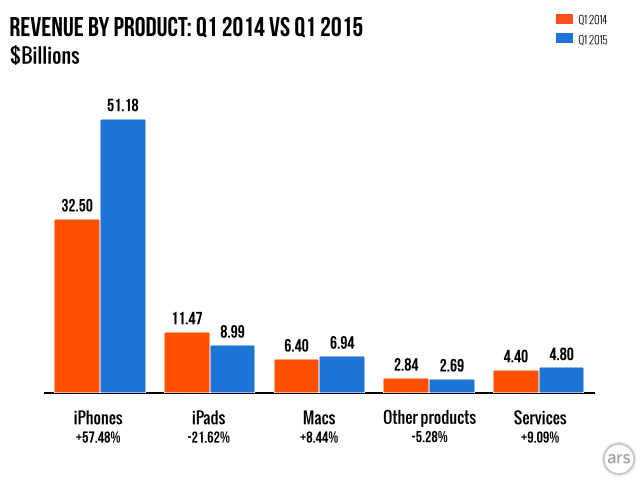

Revenue from the iPad also fell by almost 22% year-over-year. The competition posed by cheaper premium Android tablets definitely affected Apple's average selling prices for the iPad.

Source: Andrew Cunningham/Ars Technica

The bigger display of the iPhone 6 and the iPhone 6 Plus helped Apple post an impressive +57.48% year-over-year increase in iPhone sales. This incredible market success of Apple's latest smartphone should be a long-term tailwind for Apple Pay. The more NFC-equipped iOS devices that are sold, the bigger chance there is that Apple Pay will steal more market share from eBay's (NASDAQ:EBAY) PayPal and Google (NASDAQ:GOOGL) Wallet.

I strongly insist that Apple Pay's biggest competitor will not be MCX s CurrentC. I firmly believe that without the support of credit card companies and banks, CurrentC (which uses QR Codes and not NFC for mobile payments) might find it difficult to gain mainstream adoption among mobile shoppers. CurrentC is just U.S. retailers' attempt to eliminate the 2-to-3% fees that credit card companies charge them for every transaction done.

It is not superior to or more attractive than Apple Pay or Google Wallet.

Google's recent aggressive moves to expand its digital wallet business foretell an arduous fight for Apple Pay. However, like I already mentioned earlier, the iPhone and the iPad remain favorite gadgets among U.S. consumers, which should help Apple Pay gain more active users this year.

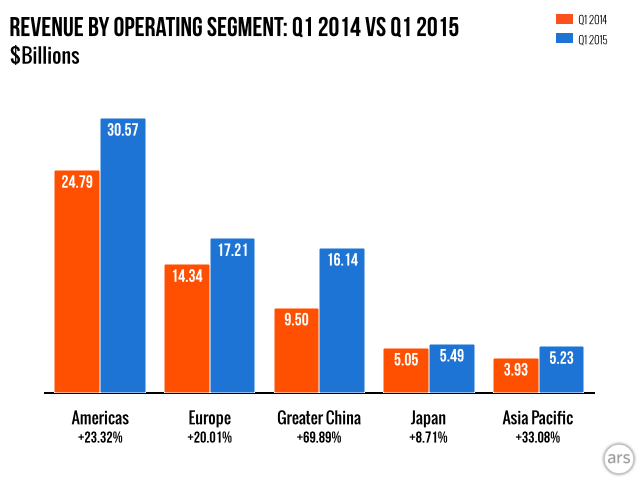

In spite of the big surge of sales (+69.89%) in China, the North American markets remain Apple's biggest moneymaker.

Source: Andrew Cunningham/ Ars Technica

The iPad remains a Favorite Tool for Mobile Shopping

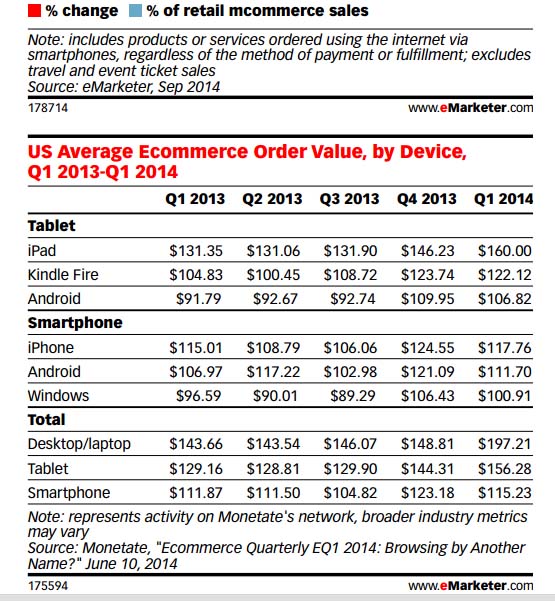

The iPad remains a favorite mobile shopping tool among U.S. consumers. As per eMarketer's latest report, the iPad helped iOS devices dominate the U.S. holiday shopping in 2014. Adobe Digital Index said Apple devices accounted for three-quarters of mobile commerce during the U.S. holiday season. The iPad was responsible for 48% of sales made through mobile devices.

Please study the eMarketer chart below. The iPad beats Amazon's (NASDAQ:AMZN) Kindle and other Android tablets when it comes to average spending done. The much cheaper Kindle was supposedly designed to inspire more Americans to shop at Amazon. However, the iPad posted a higher purchase average ($160) than the Kindle's $122.12.

The iPhone also delivered a higher purchase average than its Android and Windows phone counterparts. If we combine Apple's surging sales in iPhone handsets and eMarketer's data that iOS devices accounted for three quarters of U.S. mobile commerce during last year's holiday season, we could hypothesize that Apple Pay has a strong future.

There were 74.7 million iPhones sold last quarter - many of them were Apple Pay-compatible iPhone 6 units. The fast-growing U.S. mobile commerce business is a decent opportunity for Apple Pay. The bonanza from iPhone hardware sales will not last forever. Cook's release of Apple Pay is a new revenue stream that can help offset any future decline in phone sales.

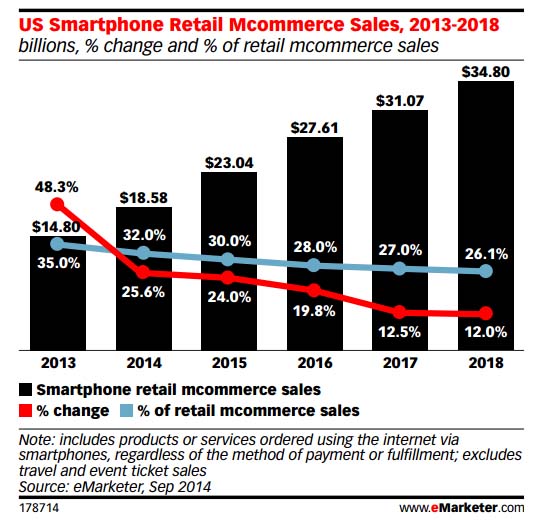

The experts at eMarketer estimates that the smartphone mobile retail commerce market in the U.S. will be worth $23.04 billion this year. It will grow to $34.80 billion by 2018.

As per Apple Insider's article last year, Apple will allegedly earn 15 cents for every $100 transaction (a very low fee of 0.15%). This is miniscule compared to the margins on iPhone sales. If we calculate that Apple Pay will grow to process 30% of all U.S. mobile ecommerce this year, the potential revenue is only

$23.04 billion x .30 x .0015 = $10.37 million.

However, any non-iPhone revenue is always welcome. Apple has not made any official announcement as to how much it actually earns from every Apple Pay transaction. The 15 basis points report of Apple Insider is in line with Digital Transactions' claim. Apple is allegedly charging this small fee as a "token assurance provider." Banks and credit card companies used by Apple Pay customers will still handle the majority of fees.

It should be noted that the $23.04 billion estimate (for 2015) of eMarketer only covers smartphone mobile shopping done through the internet. It does not include purchases done at brick and mortar stores using the phone as a digital wallet. The Apple Pay's total addressable market is therefore greater than $23.04 billion.

Final Thoughts

It is not important that Apple Pay seems to be a negligible revenue stream right now. The key is that a majority of U.S. mobile shoppers are using iPhone and iPad units to buy things online. I opine that Apple Pay is just another compelling reason for U.S. customers to continue using and buying new Apple-made phones and tablets. Apple Pay offers a very secure and user-friendly digital wallet alternative to PayPal and Google Wallet.

The potential of Apple Pay will come into full bloom once MCX CurrentC fails to gain traction. The iPhone crowd is definitely not in love with CurrentC. The iOS app version of CurrentC has received a very disparaging 1 star rating on iTunes. The comments also declared CurrentC to be not user friendly and it poses serious privacy problems.

CurrentC also received an abysmal 1-star rating from Android device users. I already discussed last year just how superior Apple Pay is when it comes to security and privacy issues. Apple Pay does not store customer data. Apple Pay does not store bank info.

The fact that many Americans continue to use their iPhones and iPad tablets to shop online is a strong hint that Apple Pay might gradually become more successful than CurrentC. AAPL is a Strong Buy. Apple is a high-quality company that is producing high-margin, high-quality products. The current Apple management is also high-quality.

Look at the quality indicators of Apple. Tim Cook's team is delivering better-than-everybody-else ROI, ROA, and ROE ratios.

Source: getaom.com

The weekly technical indicators of AAPL are also endorsing a Strong Buy.

Source: investing.com

Disclosure: The author is long AAPL

As much as I admired Steve Jobs, it is worth noting that sometimes, you need to give the market what they want. Jobs was against larger iPhones, and smaller iPads and swore he'd never allow them. Now that he's gone, Cook went ahead and listen to the company's customers and the sales numbers above show this was the right move.

I had been certain that Apple's best days were behind them once Jobs passed. I'm happy to say that clearly I was wrong.

I would believe you Apple fanboys more if you didn't give yourselves away by getting so carried away with the wonderfulness of everything Apple.

Ah, I always love hearing your angry 'ol rants. But just as some people will never admit Apple's faults, you Apple haters will never give credit where credit is due. Apple smashed expectations and broke sales records. So clearly they are doing something right. Alcaraz's article states facts, not undeserving lavish love.