A Tale Of Two Cities - Nasdaq Leads, But Russell 2000 In Trouble

Two very different things going on in the market at the moment.

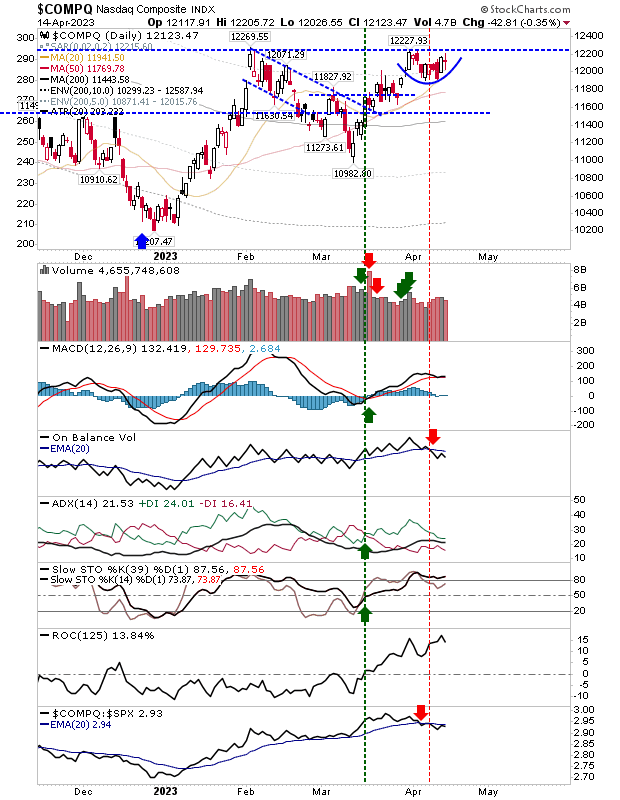

We have a Nasdaq that continues to prepare for a breakout. This time forming a mini-handle just below resistance. Aside from On-Balance-Volume, we have bullish technicals - although I would like to see a relative outperformance against the S&P, which is not the case at the moment.

On the other side, we have the Russell 2000 (IWM), which is struggling to build off its March swing low. This is a major concern, as the 200-day MA is now proving to be significant resistance. Cyclical and secular bull markets depend on growth stock leadership, and we are not seeing this here. Technicals are okay, in so far as only stochastics are bearish, but relative performance against the Nasdaq is shocking.

The S&P is siding more with the Nasdaq. While it hasn't shaped a 'handle' below resistance, it has managed to hold above 4,060 support while working a challenge of 4,190 resistance. Technicals are net bullish and its significantly outperforming the Russell 2000.

Going forward, there is a long-side opportunity in the Nasdaq. However, if the Russell 2000 continues to weaken - even if the Nasdaq manages to breakout - I would err on the side of caution and tighten stops on any tech breakout traded; double so should $IWM break below $169.

More By This Author:

Nasdaq Primed For BreakoutBuyers Deliver Confirmed Accumulation In Indices

Indecisive Gains, If There Is Such A Thing...

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more