A Sobering Insider Buy

Image source: Pixabay

Insiders are loading up on a $9 million stock with new government mandates around preventing drunk driving. But read this before you start chasing illiquid stocks.

Market Update

The VIX reached over the 17 mark, oil prices appeared to be coming down, and the market headed into the weekend on a rebound high. It might not feel like it, but the S&P 500 has been under a lot of pressure, and I expect to see a further decline in Occidental (OXY), which may set us up with an insider opportunity in the next week.

Adventures Through Baltimore

I’d like more people to “take a car.” What does that mean?

I was driving back up Interstate 83 on Thursday from downtown Baltimore. Around 3 p.m., a driver was weaving between the center lane and halfway into the right lane. It was a small car—a Honda Civic—and I laid down on my horn for what seemed like the first time in forever to get the driver back into the center lane.

I thought momentarily as I looked over that the driver was looking at their phone. But they weren’t. When we made brief eye contact, the driver had that long stare -- the lost one, the one that only a person who’d started drinking hours ago could have. And they broke eye contact and went back to casually looking at the road. I sped up, and it was only a minute before the car was out of my rear-view mirror.

I bring this up because there is a market story here. In two years, all new vehicles will have passive alcohol monitoring systems. The 2021 Infrastructure Investment and Jobs Act requires that every new car sold in America after 2026 must passively monitor a driver's performance for signs of drunk driving.

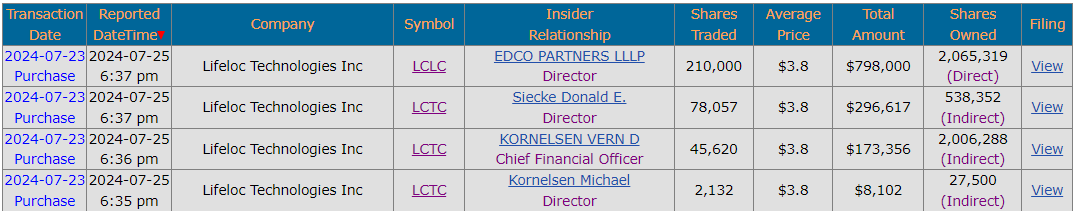

This is why I wasn’t shocked to see the developers of these systems experience dramatic levels of insider buying over the last few days.

This is a lot of insider buying. Because LifeLoc Technologies (LCTC) is just a $9 million company—and it jumped as much as $32% on the news—it could benefit from new laws. LifeLoc manufactures breathalyzers and other alcohol/drug monitors.

That said, it is still losing money. Insiders bought about 1/9th of the company with more than $1 million. The stock hit a new 52-week high.

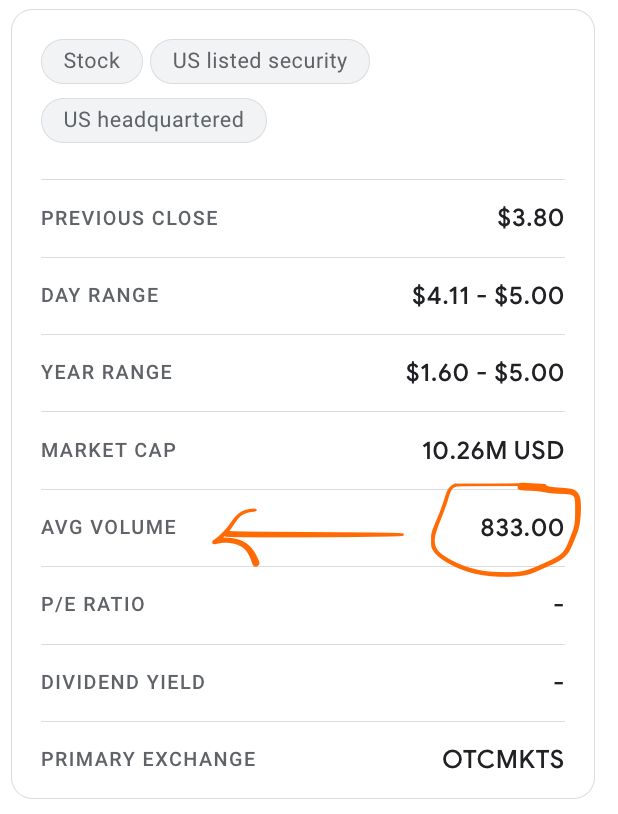

Now, do not run out and start buying this over-the-counter stock. Investors (and traders) must be careful here, as this is a highly illiquid stock. The average volume of this stock is a whopping 833 shares per day. Anyone trading it or trying to buy and sell this company and others like it may quickly lose money when you’re trading the news of illiquid, nano-cap stocks.

Let me explain.

What’s An Illiquid Stock?

In the equity market, an illiquid stock refers to a security that is not easily traded due to a lack of buyers or sellers. This low trading volume means transactions can significantly impact the stock's price, leading to high volatility and unpredictable price movements.

Investors must be careful with illiquid stocks because they may face difficulty selling their shares quickly at a desirable price. If you sell the stock at market price, it will go to whatever the bid price is.

The bid-ask spread (the difference between the buying and selling price) is often wider, increasing transaction costs. So if the bid is $3.50 and the ask is $4.50, it’ll sell at the bid price (the lower price) if you unload shares at “market price.”

Additionally, illiquid stocks may be more susceptible to manipulation, as it takes fewer shares to influence their price. Combined, these factors can lead to potential losses and higher risks, making understanding a stock's liquidity important before investing.

Using Limit Orders

When investors want to buy illiquid stocks, they should use limit orders instead of market orders. A limit order specifies the maximum price an investor will pay for a stock, ensuring they do not overpay due to sudden fluctuations.

This strategy is crucial for illiquid stocks, where market orders can lead to significant price impacts and unfavorable trades due to low trading volumes. Additionally, investors should be patient and prepared for longer execution times, as finding a matching seller at the desired price may take time. Please also conduct thorough research on the stock and understand the reasons behind its low liquidity.

Lifeloc is a tiny company, and I’m not going to buy and hold it without much knowledge of its operations. But there are many other over-the-counter stocks with large market capitalizations that still have very wide spreads and low volumes.

Finally, government mandates are a source of revenue for many companies. After all, the U.S. government is the largest activist investor on the planet.

But we’d prefer to focus on longer-term trends in companies with wider moats and larger sources of revenue and profits. We’ve written about Geo Group (GEO) as a beneficiary of the migration patterns on the U.S. Southern border -- consider that a starting point. There are no liquidity concerns around this name.

On Monday, we’ll discuss other companies with wide moats linked to government fiat and expected policy changes. We’ll discuss one of the most interesting companies that will benefit regardless of who wins this election.

More By This Author:

A Dip In LiquidityHow the American Stock Market Ends...

Don't Stop Driving ... Everything I Need To Know About Trading

Disclosure: None.