A Rough Year So Far For U.S. Bonds With No Relief In Sight

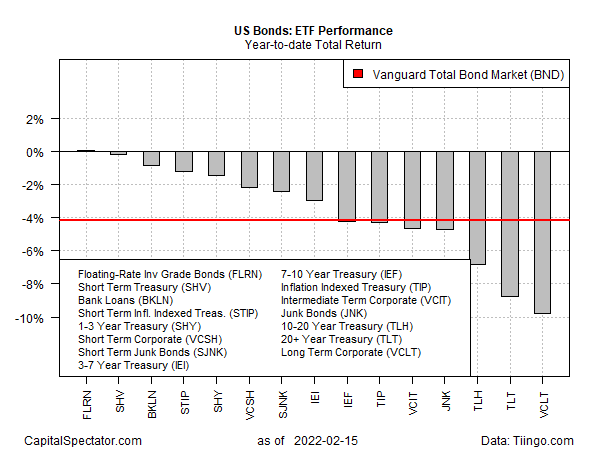

After a run of rising interest rates in recent months, the usual suspects in the US bond market have taken a hit this year. With one exception, all the major slices of fixed income are posting losses in 2022, based on a set of ETFs through Tuesday’s close (Jan. 15).

The upside outlier, just barely: SPDR Bloomberg Barclays Investment Grade Floating Rate ETF (FLRN), which has scored a trivial gain of 6 basis points so far in 2022.

FLRN, a mix of floating-rate investment-grade corporates and US governments, has found a bit of traction this year as yields have increased. The fund’s portfolio has a short-maturity bias, roughly 1.8, according to Morningstar.com. The trailing 12-month yield is 0.39%, which means that the fund is effectively a money market alternative. Overall, a relatively conservative player in the fixed-income space with a mild kicker via floating rates that will, in the current environment, periodically reset with higher payouts.

FLRN won’t get hearts racing, but compared with the rest of the field so far this year it stands out. Indeed, every other ETF in this space is currently posting varying degrees of loss.

The deepest shade of red at the moment: Vanguard Long-Term Corporate Bond (VCLT), which is down 9.8% year to date. For context, the broad investment-grade US bond benchmark’s loss so far in 2022 is 4.2%, based on Vanguard Total Bond Market (BND).

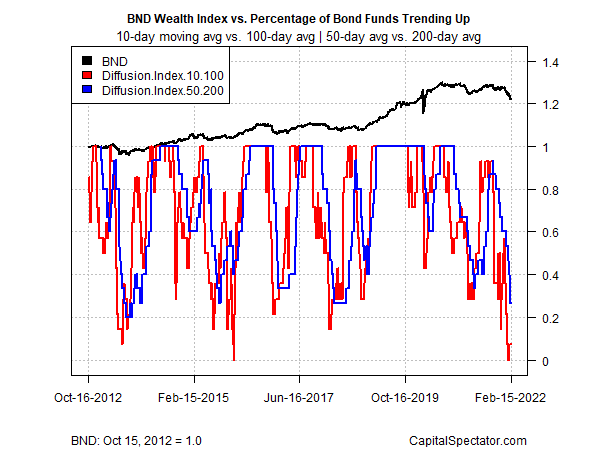

Tracking the overall short-term cycle of the bond ETFs listed above via a set of moving averages shows that the current downdraft is one of the steepest in the past decade. The depth of the slide suggests that a bit of relief may be near, if only temporarily.

Even if the current selling wave is approaching a lull, staying cautious on bonds still looks prudent until there are convincing signs that inflation has peaked. Meantime, the Federal Reserve is on the cusp of raising interest rates at next month’s policy meeting (March 16).

Most forecasters are currently looking for a series of rate hikes in the months ahead. The outlook aligns with the market forecast via Fed funds futures, which are pricing in high odds of ongoing policy tightening for the near-term future.

“I do think we need to front-load more of our planned removal of accommodation than we would have previously,” St. Louis Fed President James Bullard said on Monday. “We’ve been surprised to the upside on inflation. This is a lot of inflation.”

What might stay the Fed’s hand and delay rate hikes? A sharp deterioration in economic conditions tops the list. But while US growth appears to be slowing in the kick-off to 2022, it’s not a deep enough slowdown to put the expected monetary policy changes on hold.

But at a time of heightened geopolitical risk linked to the Ukraine-Russia crisis, it’s not inconceivable that macro conditions could deteriorate quickly if a war starts and unleashes blowback for economic activity, such as a spike in energy prices from already elevated levels.

Bond manager Jeffrey Gundlach is considering the possibility of a US recession later this year as a non-trivial risk, citing the Treasury yield curve as an early warning indicator. “The yield curve has us on watch already,” he said last week. “Once you get the yield between the 10-year Treasury and 2-year Treasury inside of 50 basis points, you’re on recession watch. And that’s where we are.”

The rate spread between the 10-year and 2-year yield was 47 basis points yesterday (Feb. 15), or just below Gundlach’s tipping point.

The counterpoint is that the 10-year/3-month spread — arguably a more reliable measure of recession risk via yield-curve analytics — is still firmly positive and much higher at 165 basis points, which suggests that the recession risk is lower than implied via the 10-year/2-year gap.

Nonetheless, macro conditions may be unusually fluid in the weeks and months ahead, due to the confluence of elevated inflation and geopolitical risk. In the current environment, what looks reasonable on the forecasting front today could turn to dust tomorrow.

Disclosures: None.

Looks better than the stock market.