A Return Of Inflation Fear Drags The Stock Indices

During yesterday's session, we observed how the fear of inflation took over the market again, causing a generalized negative closure in the North American indices, among which the declines of technology companies stood out. The Nasdaq index experienced a 2.55% decline, while the SP500 and DJI30 fell by 1.04% and 0.10% respectively.

These significant decreases were accompanied by strong growth of the so-called fear index since the VIX recorded a rise of 17.80% to 19.66 points during the day yesterday. Meanwhile, today the index continues to rise above 10% and is already trading at levels close to 22 points.

This strong fear of an upturn in inflation has infected the rest of the world stock markets, which today are trading in the red with declines of more than 2%. This includes the Euro Stoxx 50, CAC40, and DAX30 indices, although such declines may increase during the course of the session, depending on the behavior of the American stock markets.

For its part, the main Japanese index closed with decreases of 2.75% on a day in which the Nikkei opened negatively, increasing these losses successively throughout the session.

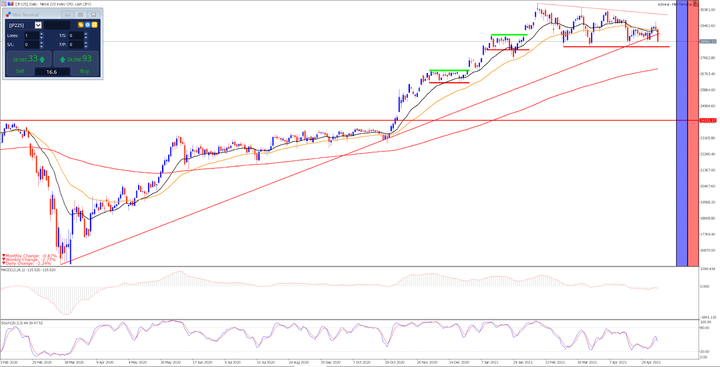

Technically speaking, if we look at the daily chart, we can see how these declines have led to a close below its uptrend line, which can cause a further decline in price to the lower band in red of the triangular formation it is currently in.

The break of this important support level could confirm the change in trend, increasing the declines to its 200-session moving average in red. As long as the price recovers its long-term uptrend line and surpasses the highs of the April level, we cannot expect a big trip to the upside.

Source: Admiral Markets MetaTrader 5. JP225 daily chart. Data range: February 3, 2020 to May 11, 2021. Prepared on May 11, 2021 at 12:30 p.m. CEST. Keep in mind that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 16.01%

- 2019: 18.20%

- 2018: -12.08%

- 2017: 19.10%

- 2016: 0.42%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more