A Low-Risk Alternative To Bitcoin

You probably know the story of bitcoin. For some, it’s the next great investment. To others, a decline appears imminent.

If you believe a decline is near, you might also think there’s no viable way to trade that belief.

Of course, you could short bitcoin. In a short trade, you sell something you don’t own. You profit if prices fall and lose if prices rise. But shorting a strong uptrend is dangerous.

To open a short position, you might use futures. However, a small price move against your position could hurt you, and even though bitcoin has dropped almost 50% from its peak, the decline includes a number of uptrends.

An Alternative to Bitcoin Futures

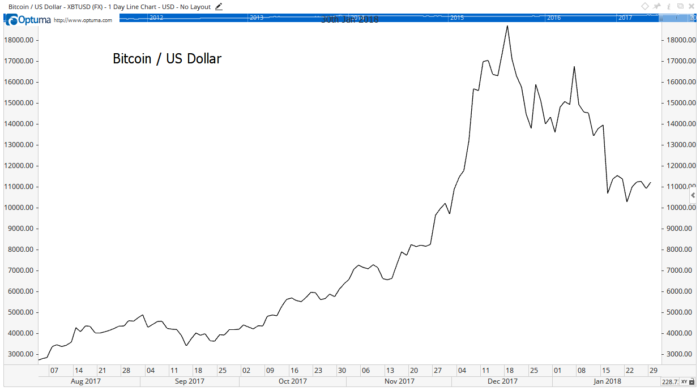

The chart below shows the downtrend and several short rallies.

(Click on image to enlarge)

While the trend in the chart is down, a short trade made at the top could still show a loss.

For example, your futures broker might require $11,000 in margin for this trade. A 20% price move then means a 100% gain or loss. Odds of a 20% move in bitcoin are high, so the risk of this trade is high.

But you don’t need futures to benefit from a decline in bitcoin.

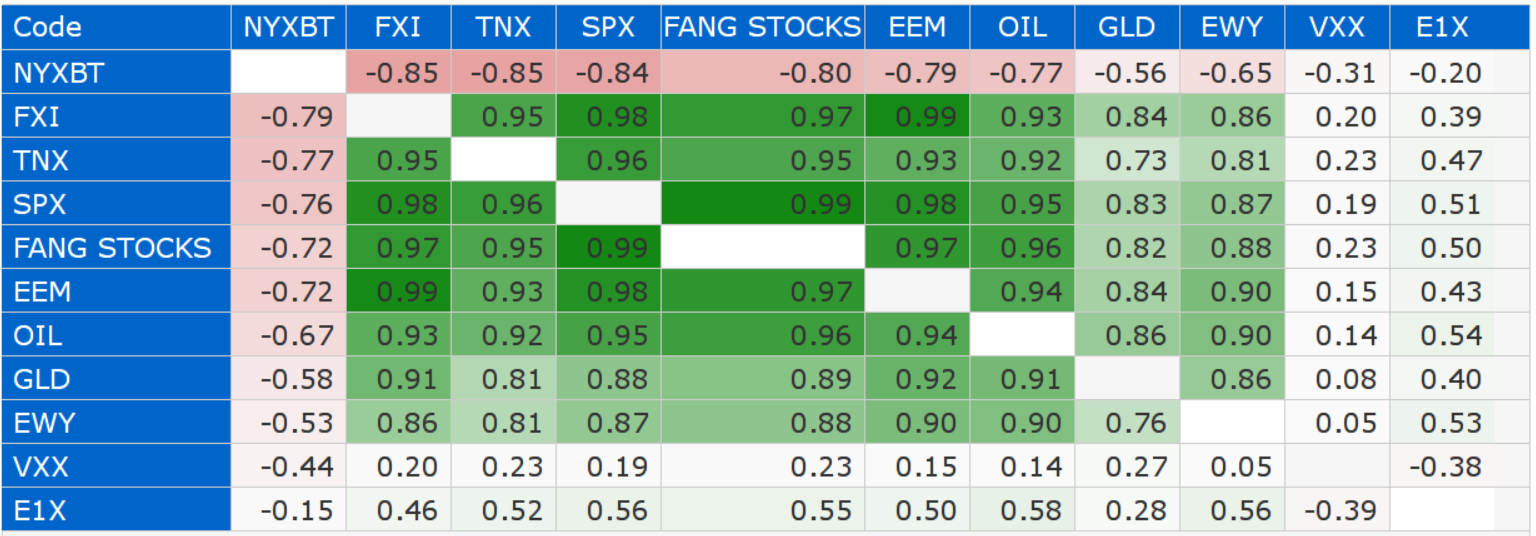

The next chart is a correlation matrix. The numbers in the table show the relationship between the price moves of different assets.

The numbers are correlation coefficients. A value of 1 shows perfect correlation, -1 shows perfect inverse correlation and 0 shows no relationship. Values above 0.70 or below -0.70 are generally tradable.

Bitcoin is NYXBT in the chart.

If the value is below -0.70, the asset tends to offset the risks of bitcoin. In broad terms, this means when money moves into bitcoin, it appears to be coming from the other asset.

This is true for the iShares China Large-Cap ETF (NYSE: FXI). With a coefficient of -0.79, FXI has the strongest negative correlation to bitcoin.

FXI is shown since regulations on cryptocurrencies are a frequent rumor in the Chinese market. The negative correlation shows that traders tend to buy stocks as they worry about that possibility.

But regulation is not always a problem for cryptos. The iShares MSCI South Korea Capped ETF (NYSE: EWY) is not highly correlated with bitcoin despite that country’s threat to regulate.

Ten-year Treasury yields and U.S. stocks are generally negatively correlated with bitcoin. This is also true for the FANG stocks (Facebook, Apple, Amazon, Netflix and Alphabet, the parent of Google) and the iShares MSCI Emerging Markets ETF (NYSE: EEM).

Gold, oil, the CBOE Volatility Index (shown as VXX in the table) and European stocks (E1X in the table) are not highly correlated with bitcoin.

What Does This Tell Us?

Investors seem to think of bitcoin as an alternative to stocks in China and the United States. This means a large drop in cryptocurrencies could help the stock market in the future.

But if cryptos go up, it doesn’t mean we should sell stocks. It just means that gains in cryptocurrencies are likely to be larger than gains in the stock market.