A Historical Lesson About Debt, Bearish Conviction, And The Need For Flexibility

These Passages Send A Powerful Message

If we take the time to read the passages below, they can serve as a powerful reminder about the need to keep an open mind about all outcomes (bullish and bearish).

Historical Passage Number One

To assist in this exercise, we have removed the names and dates from the quotes below.

“I think the financial community, particularly Wall Street, was dealt a life-threatening blow, but they are in shock and don’t realize it.

Everything gets destroyed a hundred times faster than it is built up. It takes one day to tear down something that might have taken ten years to build.

I know from studying history that credit eventually kills all great societies. We have essentially taken out our American Express card and said we are going to have a great time. We have borrowed against the future, and soon we will have to pay.

Do you see any way in which we can solve our current problems before we go into a deep recession, or even depression? That is what scares me so much. I don’t see any blueprint out of our current dilemma.”

Historical Passage Number Two

The second excerpt (below) also references legitimate concerns about the sustainability of the growth of debt and the reliance on credit:

“[This successful hedge fund manager’s] bearish analysis is centered on the U.S. Specifically, he thinks that given the fact that U.S. credit market debt as a percentage of GDP is near historical highs… markets should be trading at a discount to historical valuations rather than the current premium. He also notes that extreme debt levels, high percentages of non-performing loans, and slowing growth… means that the previous engine of global investment growth is now out of commission.”

Historical Example Passage One Comes From 1988

The first example takes on a different meaning when we are told it is an excerpt from an interview that occurred in 1988; not far removed from a very difficult and volatile 1987. The text comes from the Market Wizards book that was published in 1989; the 1988 interview was with Paul Tudor Jones, a hedge fund manager that has compiled a very impressive long-term track record:

“I think the financial community, particularly Wall Street, was dealt a life-threatening blow on October 19, 1987, but they are in shock and don’t realize it.

Everything gets destroyed a hundred times faster than it is built up. It takes one day to tear down something that might have taken ten years to build.

I know from studying history that credit eventually kills all great societies. We have essentially taken out our American Express card and said we are going to have a great time. We have borrowed against the future, and soon we will have to pay.

Do you see any way in which we can solve our current problems before we go into a deep recession, or even depression? That is what scares me so much. I don’t see any blueprint out of our current dilemma.”

Paul Tudor Jones

1988

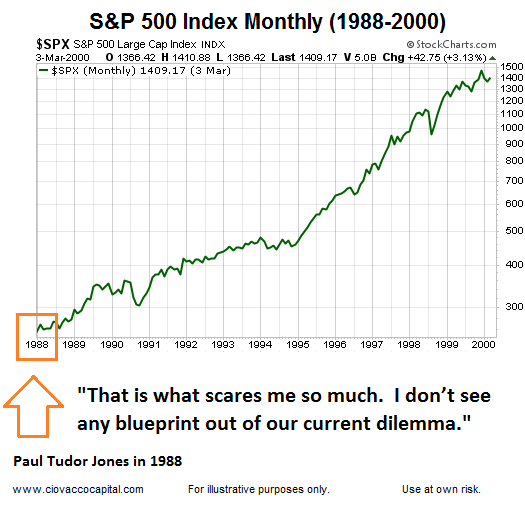

1988: What Happened Next?

What happened after Paul Tudor Jones was concerned about excessive debt in the financial system? Two things: (1) when price action did not confirm his bearish stance, he quickly reversed to a bullish stance, and (2) instead of 1988 being the end of the line for debt and the markets, the S&P 500 moved from under 280 to over 1,400 between the end of 1988 and March 2000.

Historical Passage Number Two From 2016

Our second historical example citing legitimate and well-founded concerns about global debt occurred in June 2016 and was covered by The Motley Fool. Similar to the 1988 case which was preceded by difficult and rare market events, the 2016 example came after the worst ten-day start to a year in U.S. stock market history. The 2016 text below is based on the views of another very successful hedge fund manager, Stanley Druckenmiller.

“Druckenmiller’s bearish analysis is centered on the U.S. Specifically, he thinks that given the fact that U.S. credit market debt as a percentage of GDP is near historical highs… markets should be trading at a discount to historical valuations rather than the current premium. Druckenmiller also notes that extreme debt levels, high percentages of non-performing loans, and slowing growth… means that the previous engine of global investment growth is now out of commission.”

Exercise Has One Only One Purpose

Before you begin composing tweets and emails with “but 1988 was a much different period from an economic perspective”, our purpose here is not in any shape, form, or fashion to compare anything in 1988 to 2016 other than the key points below:

- In the markets, even the smartest of the smart can be wrong sometimes.

- A key trait of many successful money managers is the ability to remain flexible when price does not confirm their bearish stance.

- Three things are extremely dangerous in the markets: (a) arguing with price, (b) ignoring a market that is not aligning with your hypothesis, and (c) deciding in advance what is going to happen.

The Purpose Is Not To Support The Bullish Case

Are there serious and bearish issues facing the 2016 markets? Yes, we have recently outlined numerous reasons to be concerned. Stanley Druckenmiller also makes a sound case for concern.

Flexibility is needed 100% of the time; a statement that applies to monitoring the recent bullish breakouts in the major U.S. stock indexes. If the breakouts fail, it will be time to pay attention to the new message from price.

At the time of this writing, the S&P 500 is holding above the key 2,100 to 2,135 range. As long as that is the case, we will give our growth oriented positions and the case for better than expected outcomes the benefit of the doubt.

For the record, our current allocations are based on the facts in hand. The facts support stocks, but they also support more conservative-oriented bonds and gold, meaning price is calling for a measured and rational allocation at the present time.

The key takeaway is if one of the brightest money managers in history felt there was no blueprint in 1988 to avoid a recession or economic depression, then it becomes much easier to ask ourselves in 2016:

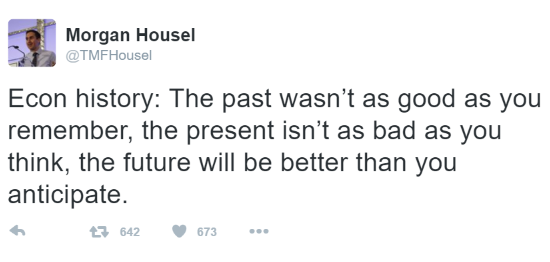

Is it within the realm of possibility the future will turn out to be better than expected?

Disclosure: This post contains the current opinions of the author but not necessarily those of Ciovacco Capital Management. The opinions are subject to change ...

more

Well said. Thanks for sharing