A Different Look Behind The Retail Apocalypse

Even the apocalypse is a process that takes time. Like a financial crash that isn’t really a condensed all-at-once occurrence, the retail industry’s long-described reset has for another year reached even greater proportions in 2018. It’s not clear when the term first showed up, but by now it is a mainstream staple. No article on the state of retailers is complete without the term Retail Apocalypse.

Many if not most attribute the sad state of affairs to Amazon. Consumer preferences have finally changed. Warnings issued all the way back in the dot-com era about the death of “brick and mortar” operations are finally coming true. Crashes don’t happen all at once, most of the time they take an immense amount of time.

There is no doubt that online and virtual shopping is a key factor in the ongoing transformation. But I don’t believe it can account for the proportions that are being described. In all of 2017, according to CoreSight Research, there were 6,995 store closings announced (an imprecise and heterogeneous measure of distress, but an aggregate one nonetheless). That number surpassed even 2008’s previous record.

Through the week of June 8, 2018, CoreSight notes 4,123 planned closings. This year is on pace to surpass last year’s record, assuming things hold up as they are now.

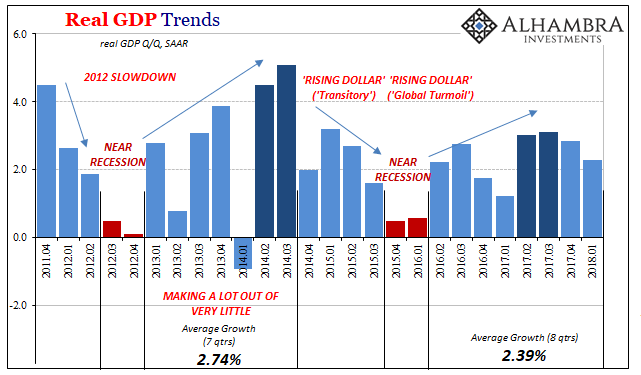

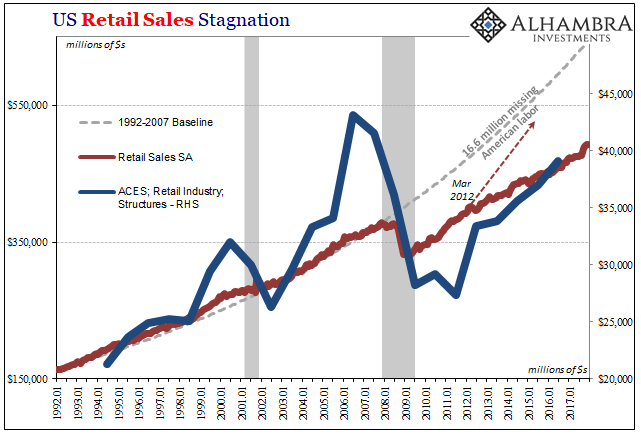

This is surprising to most people because in conventional terms the economy is supposedly doing quite well. Unemployment is at a multi-decade low, consumer confidence is sky-high, and there isn’t a day that goes by where the words “strong”, “robust”, and “booming” aren’t used in mass proportions.

Thus, it must be Amazon.

The US Census Bureau is the part of the Commerce Department charged with, obviously, conducting the US Census. Article 1, Section 2 of the US Constitution mandates government counting. Additional demographic data has been added over the centuries, but in the 20th century this piece of the bureaucracy really came into its own.

The Bureau has become an indispensable part of the economic landscape. One reason for that is the agency has the power to compel participation in its various activities. On matters that have nothing to do with the official Census, the Census Bureau can mandate a business respond to its several possible requests for information, each with the force of government, and possible penalty, behind them.

In truth, the Census Bureau should be renamed the Survey Bureau for these reasons. Its compulsion means that it gathers more data than any private source (except for Big Data places like Google and Facebook).

Among the many surveys in its arsenal is a little-known supplement to the Economic Census. Every year, the agency conducts the Annual Capital Expenditures Survey, or ACES. As with most others, participation is mandatory under US Code, Title 13.

Making up the survey are 50,000 businesses with paid employees pulled from the Business Register, including all who employ more than 500 workers. An additional 20,000 strong sample is generated from among nonemployer firms.

As the name proposes, the purpose is to obtain information about capital expenditures. Dating back to 1994, these estimates are further broken down according to business size as well as by industry (noting some classification changes over the years).

That means we have pretty comprehensive figures about how the retail industry in particular has been investing in its productive, or unproductive, capacities through almost a quarter century.

(Click on image to enlarge)

(Click on image to enlarge)

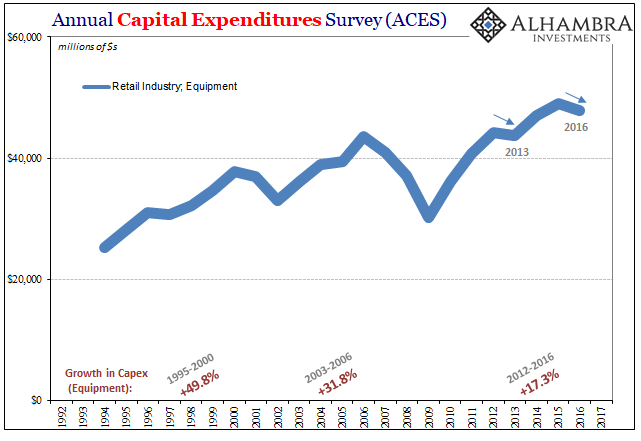

Capital expenditures according to ACES are classified as either relating to equipment or relating to structures (including the refurbishment of existing buildings). What stands out in the first segment, equipment, is that the retail industry appears to have spent less in 2016 (the latest data) than in 2015.

That wasn’t Amazon, that was all “dollar.” Retail sales were throughout 2015 and early 2016 among the lowest in the data series apart from 2008 and 2009. It makes sense in macro terms that retail businesses would be cautious and reluctant to invest during 2016 given the “unexpected” (and still unconfirmed, in a mainstream sense) economic downturn they experienced.

It was a repeat of the stumble in 2013, which also followed an “unexpected” (and still unconfirmed) downturn in 2012.

The overall trend here matches the overall economic slowdown that has been largely uninterrupted since 2011 (broken only by limited upswings in 2013, 2014, and 2017). Capex spending is noticeably lower since that broader weakening took hold. From the end of 2011, equipment investment has risen only 17% total, compared to a 32% increase in the “boom” years in the middle 2000’s and a nearly 50% gain during the late nineties.

(Click on image to enlarge)

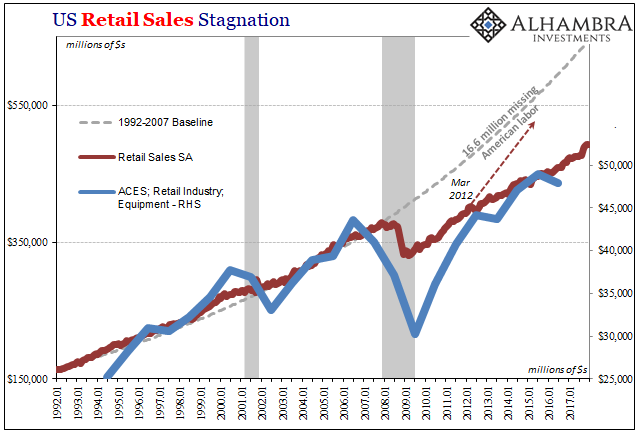

These figures suggest that retailers are, in fact, paying attention to the state of the economy as it is rather than the one we all keep hearing about, and have heard about since 2011.

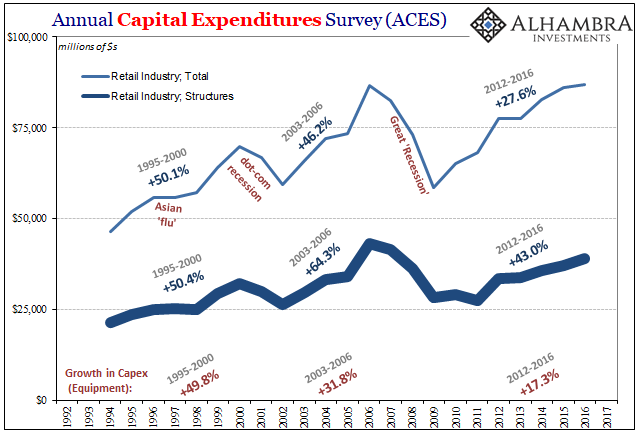

But it’s in sharp contrast to the other side of the ACES report. In terms of structures, the vast majority of which relates to new building rather than upgrades to existing facilities, retailers have behaved with far more profligacy.

(Click on image to enlarge)

In those same slowdown years, 2012 to 2016 (inclusive), capex in structures increased 43% including continued growth in 2016. That’s about the same annual pace as during the late nineties. In the middle 2000’s, retailers had simply lost their minds, producing a great deal of the overhang that the apocalypse speaks of today. In just those four years, 2003 to 2006 (inclusive), capex in structures surged by an insane 64%.

These numbers are consistent with the idea that the retail industry over-expanded and are suffering for it. The real question is why, particularly since this is in sharp contrast to the industry’s behavior in equipment.

(Click on image to enlarge)

I think the answer is Economists and Economics, not Amazon. If capex on the equipment side is more closely related to actual, current conditions, an increase in store count and the building of additional square footage relates more to expectations about the future.

There has been, especially since 2011, a massive chasm between the proposed sets of circumstances in those two timeframes unlike any other we have ever seen (or anything I’ve ever read about in economic history). No matter how prolonged the current malaise, how much time it goes on and on when it’s not supposed to, Economists are always, forever certain it will end next year; and then, they repeatedly claim, things will really take off.

In short, it appears as if retailers have invested in equipment based on the pitiful state of the economy today, but then have contributed even more overbuilding in new structures based on the economy Economists always claim “will be.” Because that economy never actually shows up, the retail apocalypse is now at hand (for another year).

And it isn’t just limited to the past six years, either. This goes back to the middle 2000’s, too. I don’t think it mere coincidence that the ACES data peaks for structures in 2006 – the peak of the housing bubble. The interruption that became the Great “Recession” was equally “unexpected” as was the middling (at best) labor market of that era forward.

Even though retailers have been building less now than they did in the middle 2000’s, the fact that they are building at such a steep pace anyway despite the scale of that prior imbalance can only contribute that much more to the imbalance. A far more reasoned approach to the aftermath of the Great “Recession”, in my view, would have been to refrain from most new structures until that overhang had been fully absorbed, no matter how long it might have taken (given the actual record, that might have been a very long time). To be so prudent would have required, of course, a more realistic assessment of the future – which is now our lengthy, undesirable past.

This survey, while quite compelling in my mind, certainly isn’t conclusive. But I think it an important piece of the story for not just the retail apocalypse, applicable for more than just analysis of the state of Commercial Real Estate. It is this wide disconnect between what’s happening today and what is supposed to happen tomorrow (but never does) that we find in all things macro. Related factors like consumer confidence would apply in this fashion, where consumers are sky high, according to surveys, yet they are spending like it has been a depression (as shown on the charts above).

I guess the real question, then, is why does anyone still listen to Economists? You can understand why they receive attention in the media, since that is according to acceptable mainstream practice and the editorial standards that place more emphasis on credentials than anything legitimate. But why in a business setting where everything is eventually on the line do things like the useless Blue Chip Economic Survey still get passed around so readily when it comes time set future projections?

Corporate bonds and leveraged loans might be one answer, but there’s no way to really tell. It might just be the lack of alternative. I can’t help but think of Milton Friedman right before he passed away:

The difficulty of having people understand monetary theory is very simple—the central banks are good at press relations. The central banks hire people and the central banks employ a large fraction of all economists so there is a bias to tell the case—the story—in a way that is favorable to the central banks.

It sure hasn’t been favorable to the retail industry, meaning the whole economy.

Disclosure: None.

While certainly many retail stores are suffering (#ToysRus immediately comes to mind), I do recall reading that many stores like #Macys were benefiting from a rebound and increased sales. $M