A Closer Look At The Current Earnings Picture

Image Source: Pixabay

- The overall picture that has emerged out of the Q2 earnings season is one of stability and an improving earnings outlook, with management teams generally providing a reassuring view of the economic ground reality. That said, estimates for the current period have started to weaken faster than we saw in the last two periods.

- For the 431 S&P 500 companies that have reported Q2 results, or 86.2% of the index’s total membership, total earnings are up +10.6% from the same period last year on +5.2% higher revenues, with 79.8% beating EPS estimates and 59.2% beating revenue estimates.

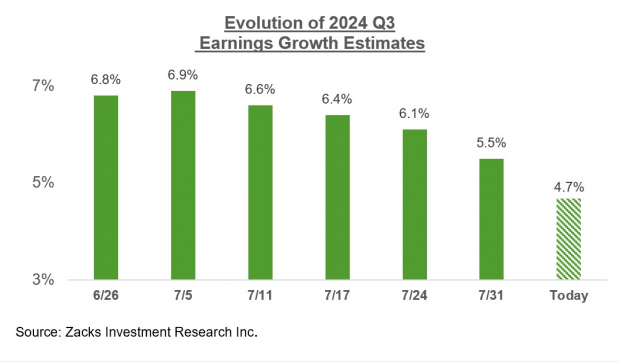

- For 2024 Q3, total S&P 500 earnings are currently expected to be up +4.7% from the same period last year on +4.7% higher revenues. Estimates for the period have been coming down since the quarter got underway, with the current +4.7% earnings growth pace down from +6.9% in early July.

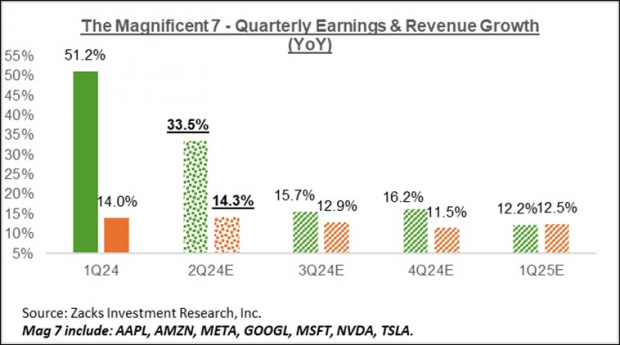

- Q2 earnings for the ‘Magnificent 7’ companies are expected to be up +33.5% from the same period last year on +14.3% higher revenues. Excluding the ‘Mag 7’, Q2 earnings growth for the rest of the index drops to +6.2% (from +11.0%).

The ‘Magnificent 7’ stocks - Microsoft (MSFT - Free Report), Alphabet (GOOGL - Free Report), Amazon (AMZN - Free Report), Apple (AAPL - Free Report), Meta Platforms (META - Free Report), Tesla (TSLA - Free Report) and Nvidia (NVDA - Free Report) – have been in the spotlight in the ongoing market turmoil. This followed these companies’ Q2 quarterly releases that mostly failed to impress market participants, particularly the reports from Alphabet, Microsoft, Amazon, and Tesla.

As we noted in this space recently, the market’s issue with the Mag 7 companies’ quarterly reports wasn’t so much their current earnings or outlooks for the coming periods but rather with their ever-rising capex levels that are going towards AI projects. Market participants would like to see a clearer monetization path for these AI investments, but management teams have generally been unable to provide that level of visibility.

We don’t see elevated capex by Alphabet, Microsoft, Amazon, or any other Tech operator as an issue. After all, these investments will ensure that these companies remain at the cutting edge of this evolving new business opportunity.

For the Mag 7 group as a whole, we now have Q2 earnings from all but Nvidia, which is scheduled to report on August 28th. For the group as a whole, combining the actual results from the six companies that have reported already with estimates for Nvidia, total Q2 earnings are on track to be up +33.5% on +14.3% higher revenues, as the chart below shows.

Image Source: Zacks Investment Research

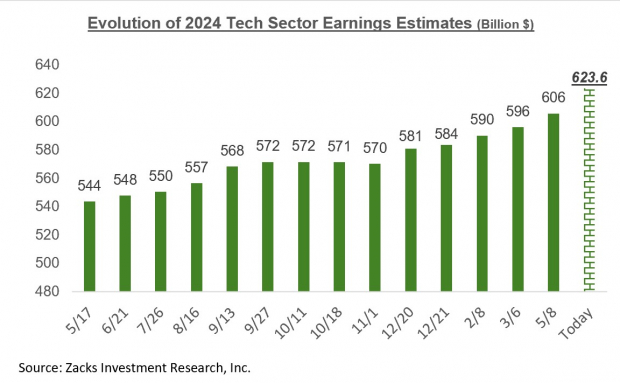

Beyond the Mag 7, Q2 earnings for the Tech sector as a whole are expected to be up +20.6% from the same period last year. The revisions trend for the Tech sector has been positive for a while now, which is important since the sector alone is on track to bring in almost 30% of all S&P 500 earnings over the coming four-quarter period.

For the full year 2024, Tech sector earnings are expected to be up +17.5%, followed by another strong showing expected next year. The chart below shows how the aggregate earnings total for the Tech sector has evolved over the past year.

Image Source: Zacks Investment Research

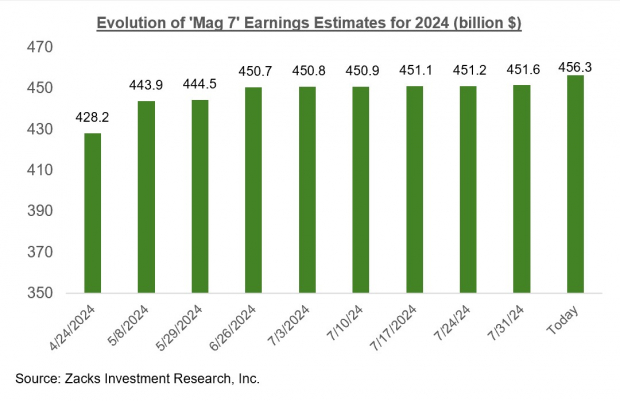

The chart below shows how estimates for the Mag 7 group have evolved lately.

Image Source: Zacks Investment Research

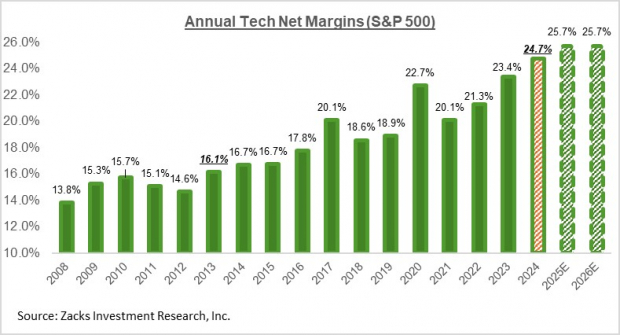

A big contributing factor to the Tech sector’s positive earnings outlook is the sector’s margins outlook, as the chart below shows.

Image Source: Zacks Investment Research

We are already in record territory with Tech sector margins, with 2024 margins expected to exceed last year’s record level. The expectation is for some more gains next year and the year after, with the ever-growing share of higher-margin software and services in the overall Tech earnings pie explaining the favorable trend. Part of this likely also reflects optimism about the impact of AI on the sector’s productivity.

The Earnings Big Picture

For the current period (2024 Q3), total S&P 500 earnings are expected to be up +4.7% from the same period last year on +4.7% higher revenues. Estimates have come down since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

This is a bigger decline to estimates relative to the comparable periods for the two preceding quarters. The negative revisions trend is widespread and not concentrated in one or two sectors, with estimates for 14 of the 16 Zacks sectors getting cut over this period. The Tech and Finance sectors are the only ones enjoying positive estimate revisions over this period.

The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

Please note that this year’s +8.4% earnings growth on only +1.8% top-line gains reflects revenue weakness in the Finance sector. Excluding the Finance sector, the earnings growth pace changes to +8.1%, and the revenue growth rate improves to +4.2%. In other words, about half of this year’s earnings growth comes from revenue growth, with margin gains accounting for the rest.

On the margins front, 11 of the 16 Zacks sectors are expected to have higher margins in 2024 relative to last year, with Tech, Finance, and Consumer Discretionary as the big gainers.

More By This Author:

Top Analyst Reports For AstraZeneca, TotalEnergies & ConocoPhillips

The Market's Excessive Recession Fears

Magnificent 7 Earnings: Good Or Bad?