84% Of CEOs Expect A Recession In 2024 (& 0% Of Fed Staff)

Image Source: Pixabay

For much of the last year, recession fears have been building against a sharp rise in interest rates and market uncertainty.

Only recently has there been a shift in sentiment. Given the resilience of the U.S. economy, a growing amount of investors are seeing an increasing likelihood of a soft landing - where the Federal Reserve raises interest rates to combat inflation without triggering a recession. However, many still remain cautious.

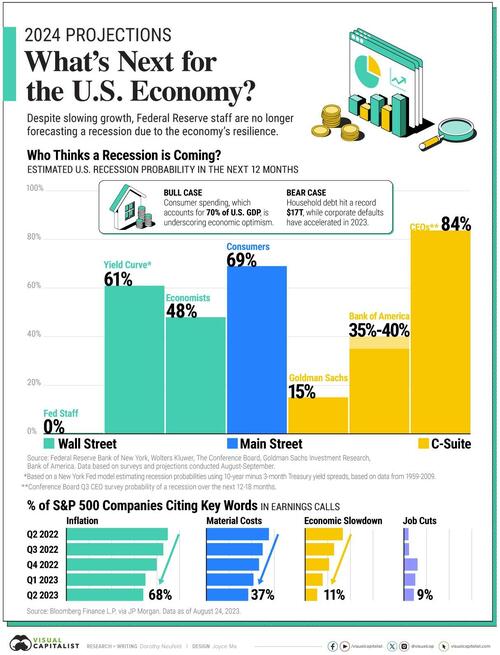

In the graphic below, Visual Capitalist's Dorothy Nuefeld shows U.S. economic forecasts across Wall Street, Main Street, and C-Suite for 2024.

U.S. Economic Forecast: Is a Recession Coming?

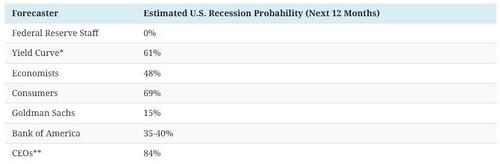

Here’s what key players are projecting for the economy:

Source: Federal Reserve Bank of New York, Wolters Kluwer, The Conference Board, Goldman Sachs Investment Research, Bank of America. Data based on surveys and projections conducted August-September.

*Based on a New York Fed model estimating recession probabilities using 10-year minus 3-month Treasury yield spreads, based on data from 1959-2009.

**Conference Board Q3 CEO survey probability of a recession over the next 12-18 months.

In July, the Federal Reserve staff announced that they were no longer forecasting a recession in 2024, marking a sharp departure from earlier projections.

While the Fed staff continue to share a brighter outlook, the yield curve spread between 10-year and 3-month Treasury rates suggests there is a 61% chance of a recession in the 12 months ahead. Historically, the yield curve has been a reliable predictor of recessions, based on a New York Fed model that uses data from 1959-2009.

Meanwhile, a survey of economists by Wolters Kluwer shows that they’re split, with 48% calling for a recession over the next 12 months.

Across Main Street, consumers share a more cautious sentiment, with over 69% saying that a recession is likely in the next year, based on a Conference Board survey.

Yet corners of America’s C-suite have grown more positive. Goldman Sachs recently dropped its recession forecast to a 15% likelihood while Bank of America gives it a 35-40% odds. On the other hand, 84% of CEOs are preparing for a recession in the next 12-18 months, a drop from 92% seen in the second quarter of 2023.

Bull Case vs. Bear Case Signals

Among the key factors, investors are closely watching center around the impact of higher interest rates on the economy.

For the bull case, higher rates appear as though they haven’t significantly impacted consumer spending yet, although spending has slowed on non-essential items. Retail sales continue to be solid, and earnings across Home Depot (HD), Walmart (WMT), Lowe’s (LOW), and other major retailers show resilience. The main changes are occurring with consumers purchasing more affordable options.

However, consumers are relying increasingly on borrowing for spending.

For the bear case scenario, household debt hit record highs of $17 trillion in March, rising 19% year-over-year. Higher rates have led these borrowing costs to jump, likely affecting household budgets. Meanwhile, corporate defaults have accelerated in 2023, and are projected to keep rising.

Overall, there are mixed signals across the wider economy. Quantifying the full effects of higher interest rates on consumers and businesses remains an open question.

More By This Author:

Exploding Mortgage Rates, Approaching 8%, Send Mortgage Demand To Lowest Since 1996Global Stock Rout Reverses As Yields Dip After 30Y Treasury Tags 5%

Judge Denies SEC's Plan For Quick Appeal Against Ripple Ruling

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more