84 Million Option Contracts Traded In Complete Silence

Image Source: Unsplash

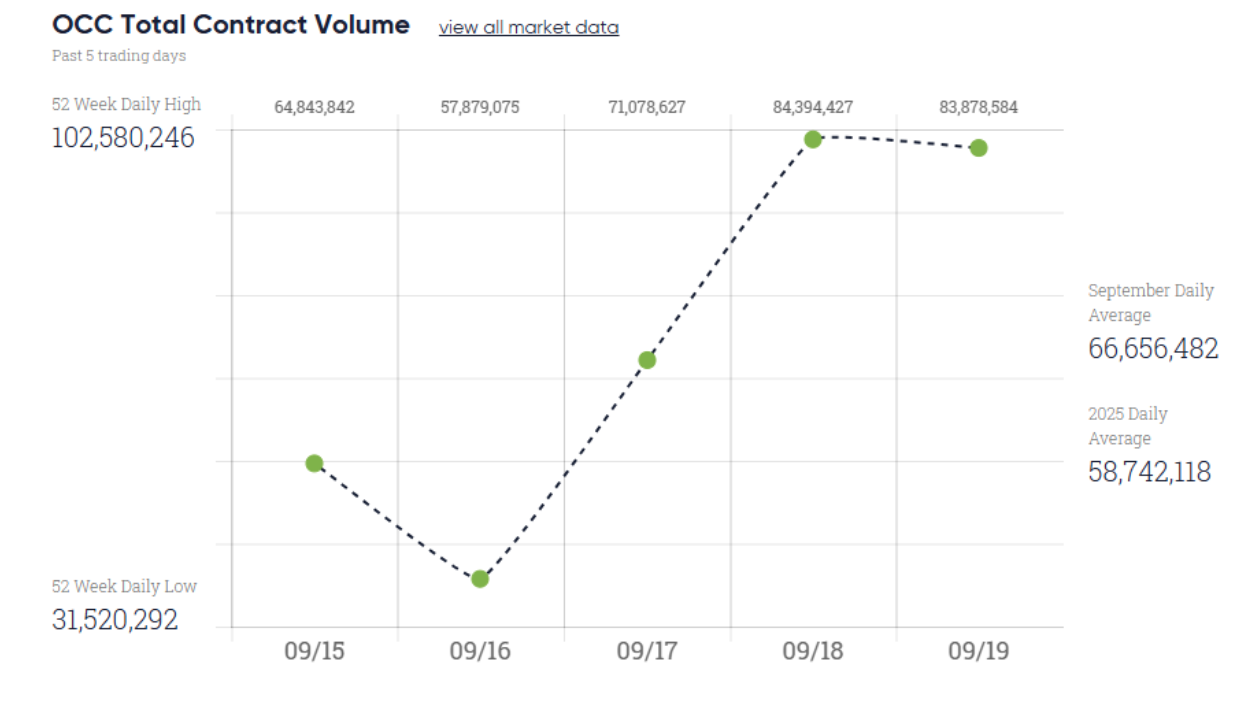

Last Thursday, we traded over 84 million option contracts. The average is 58 million. Nothing happened in the market that day. Nobody in the industry can explain why.

Let me paint the picture: Wednesday, Thursday, and Friday of last week were some of the quietest trading sessions I've seen.

If the market's heartbeat was this flat, you'd be dead. One sign of life on Wednesday around the Fed announcement, then back to meandering like a drunk in the woods.

The Volume That Doesn't Make Sense

84 million option contracts on Thursday.

To put that in perspective, the only times we see numbers this big are during market panic - like the selloffs back in April.

But April was pandemonium. Last week was a snoozefest.

I've been asking buddies across the industry the same question: "Have you ever seen volume this significant without heavy volatility?"

Everyone's saying the same thing - "Holy crap, didn't see that one coming."

(Click on image to enlarge)

What Actually Happened

The market rolled huge amounts of risk forward under an extraordinarily docile marketplace.

Think about that for a second. Massive risk transfers happening while the S&P barely twitched.

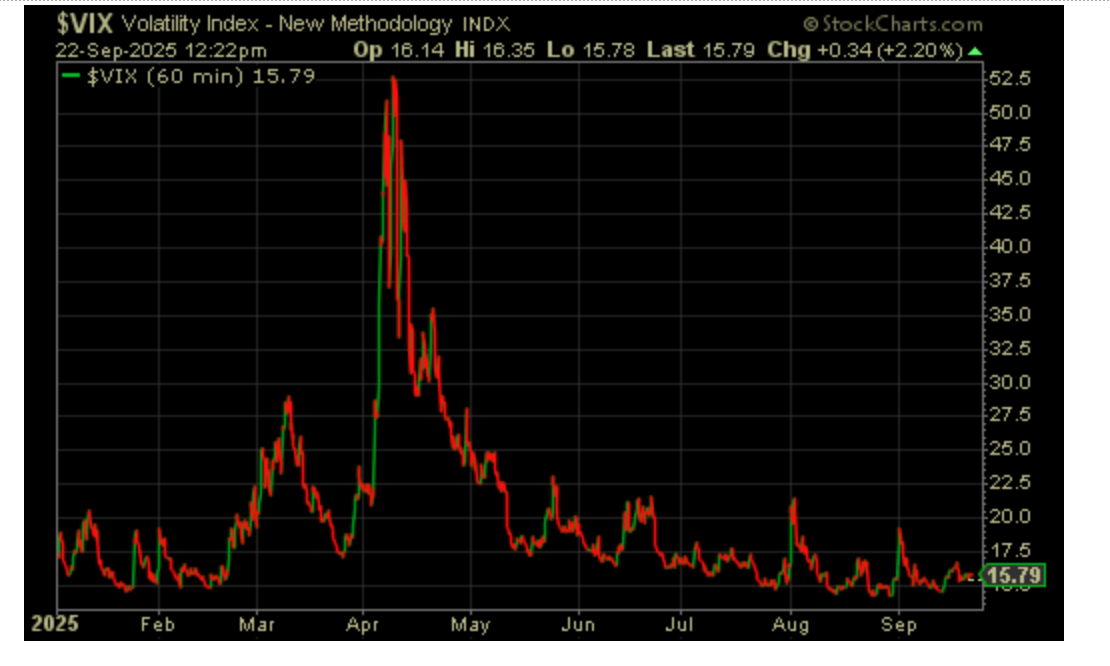

It's like watching the VIX keep climbing while the market goes down 12 points. The two don't jive.

(Click on image to enlarge)

The SPY Volume Story

Even the SPDR S&P 500 ETF (SPY) was trading over 100 million shares. The only comparable volume we've seen was during major selloffs. But this wasn't a selloff - it was just... quiet.

Triple witching was supposed to explain some of it, but this was the most docile triple witching I can remember.

Yet the contract volume was catastrophically large.

Here's the bottom line: There's never been more money and more risk in the marketplace. Ever.

Sure, we're sitting at all-time highs, but that doesn't quantify anything. The risk has to be at all-time highs to generate the kind of volume we saw Thursday.

The Bigger Picture

When trading firms move 84 million contracts with nothing happening on screen, they're positioning for something. What that something is, nobody knows for sure.

Does it mean volatility is coming? I'm not sure. But I know this: When the market moves that much money that quietly, pay attention.

Action Item: Don't chase the quiet.

Start thinking about hedges.

And if you’re going to get long, make sure you’re using spreads.

When volume explodes without volatility, volatility usually follows. Consider adding some VIX exposure or protective puts to portfolios that have gotten too comfortable with this low-vol environment.

More By This Author:

We're Living Through The Next Dot Com BubbleThe Fly Trap Can Catch More Than Flies

The Win Rate Question That Makes Me See Red