7Y Auction Stops Through Despite Muted Foreign Demand

After two consecutive stellar auctions, moments ago the Treasury concluded the week's schedule of coupon sale when it auctioned off $44BN in 7Y paper, and just like the week's previous auctions, this one too was very strong.

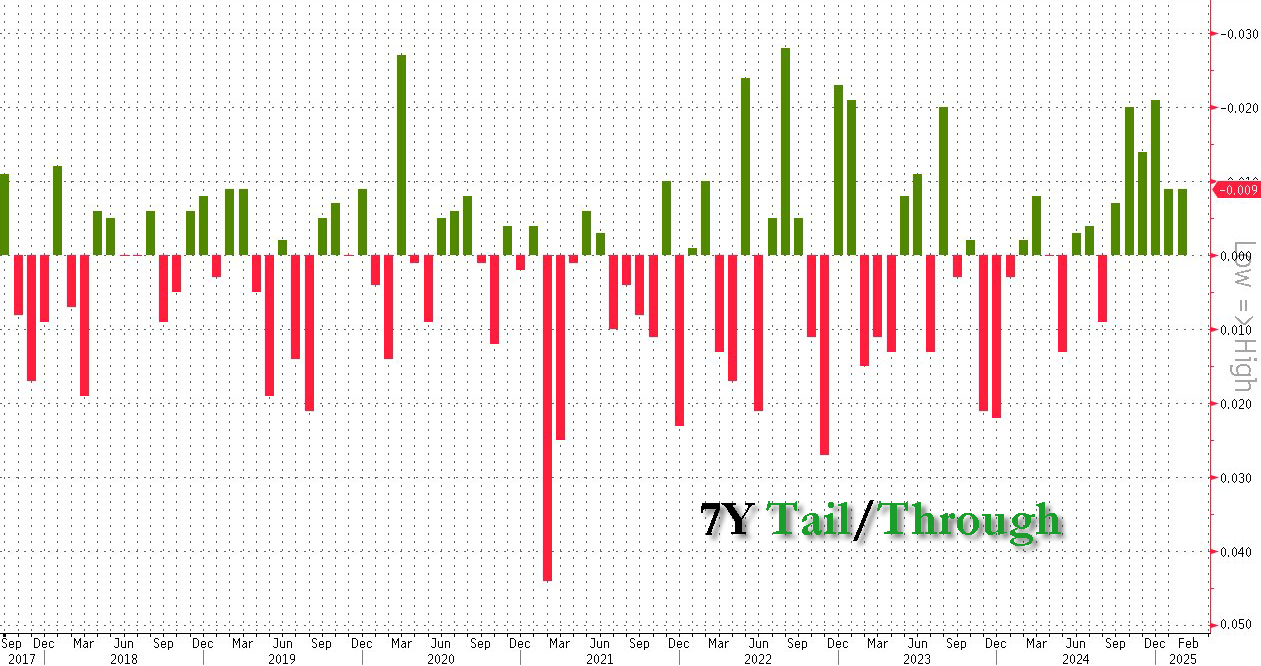

Pricing at a high yield of 4.194%, the yield was 26bps lower than last month's and was the lowest since September; and like the week's previous two coupon auctions, this one too stopped through the When Issued 4.203% by 0.9bps.

(Click on image to enlarge)

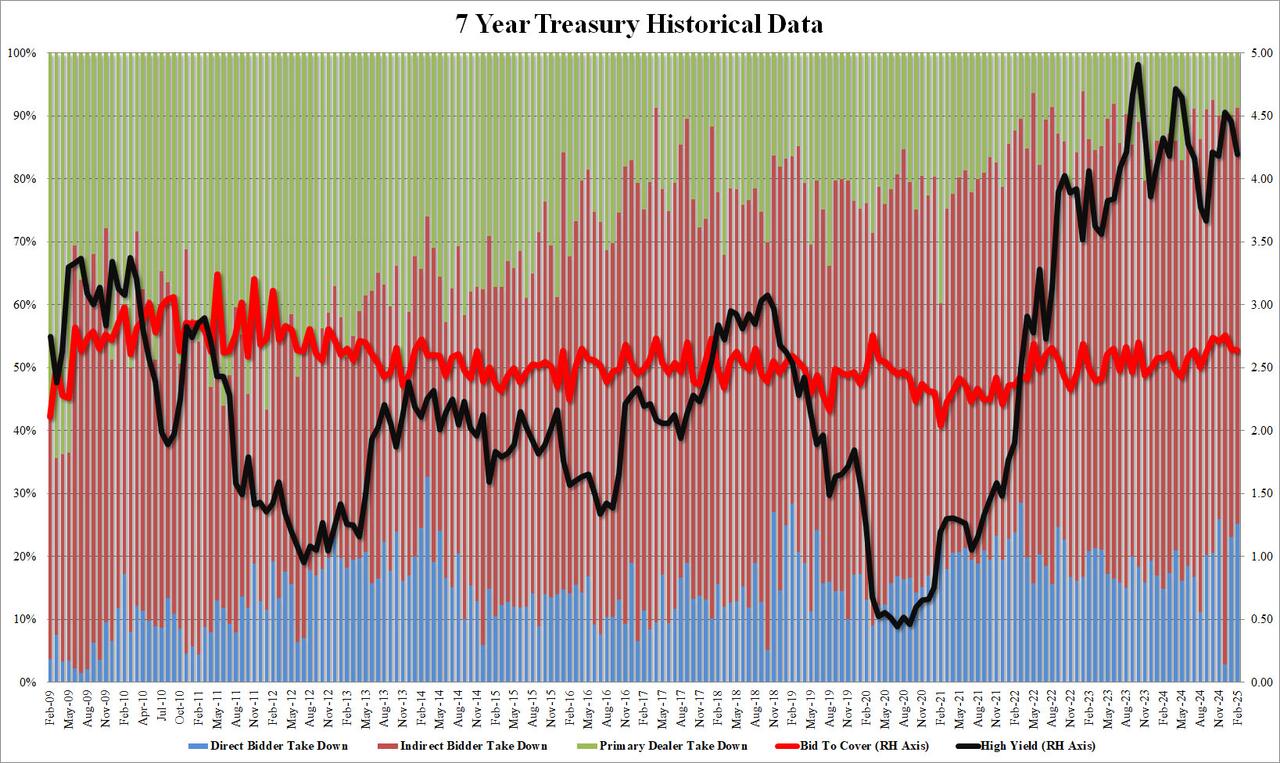

The bid to cover was 2.64, virtually unchanged from last month's 2.643 and just below the six-auction average of 2.66.

However, unlike the week's previous two coupon auctions which saw a surge in foreign demand, today's sale was in line with recent performance as indirect bidders took down 66.1%, down from 67.1% and the lowest since November; And with Directs awarded 25.2% or the highest since November, Dealers were left holding just 8.8%, the lowest since October.

(Click on image to enlarge)

Overall, this was yet another solid auction and one which comes as yields continue to tumble - thus without any concession - which shows just how much demand there suddenly is for US paper. Sure enough, yields dropped to another session low after the auction results hit the tape. Then again, once sentiment flips and yields blow out again, which they will, everyone who bought at today's yield will be underwater. Until then, however, let the party continue.

More By This Author:

New Home Sales Plunge In January As Mortgage Rates Spiked

US Futures Jump Ahead Of Nvidia Earnings, Europe Hits Another Record

U.S. Egg-Laying Hen Population Implodes, Wholesale Egg Prices Hit New Record

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more