5 Great Micro Cap Stocks

Today I wanted to find some micro cap stocks that had good technical indicators and charts so I used Barchart to screen their database for stocks that had under $2 billion in market capitalization and a price under $10 that had technical buy signals of 80% or higher. I then sorted the results for the ones with the highest number of new highs in the last month and used the Flipchart feature to review the charts.

Today's list includes:

GSE Systems (NYSEMKT:GVP),

Naugatuck Valley Financial (NASDAQ:NVSL),

Central Garden and Pet (NASDAQ:CENT),

Prophase Labs (NASDAQ:PRPH) and

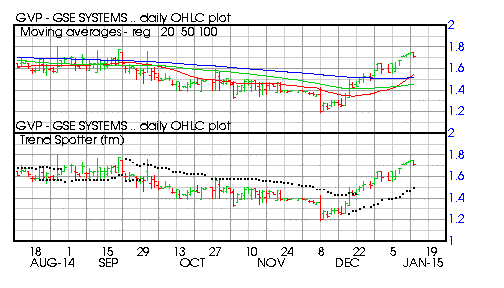

GSE Systems (GVP) Market Cap $31 million

Barchart technical indicators:

- 80% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 32.56% in the last month

- Relative Strength Index 66.33%

- Barchart computes a technical support level at 1.72

- Recently traded at 1.71 with a 50 day moving average of 1.46

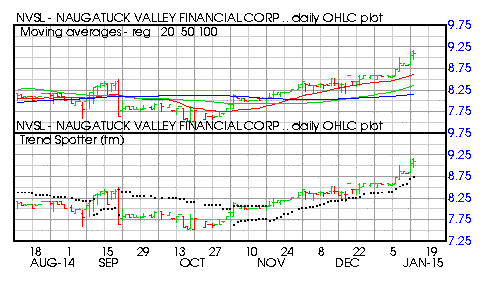

Naugatuck Valley Financial (NVSL) Market Cap $61 million

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 16 new highs and up 8.33% in the last month

- Relative Strength Index 78.23%

- Barchart computes a technical support level at 8.71

- Recently traded at 9.10 with a 50 day moving average of 8.36

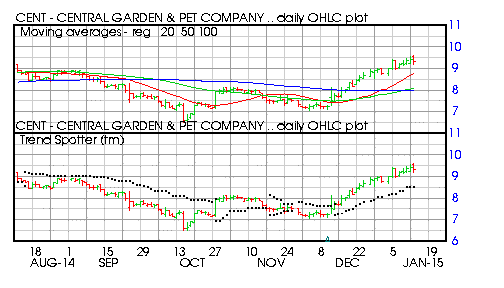

Central Garden and Pet (CENT) Market Cap $478 million

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 20.28% in the last month

- Relative Strength Index 67.72%

- Barchart computes a technical support level at 9.06

- Recently traded at 9.29 with a 50 day moving average of 8.07

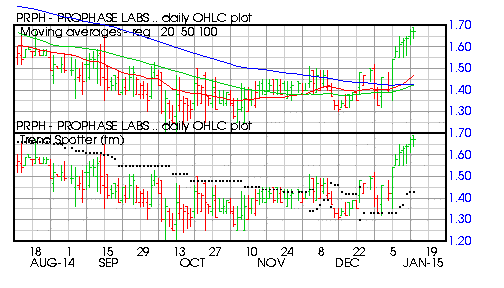

Prophase Labs (PRPH) Market Cap $25 million

Barchart technical indicators:

- 88% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 25.56% in the last month

- Relative Strength Index 67.10%

- Barchart computes a technical support level at 1.58

- Recently traded at 1.67 with a 50 day moving average of 1.42

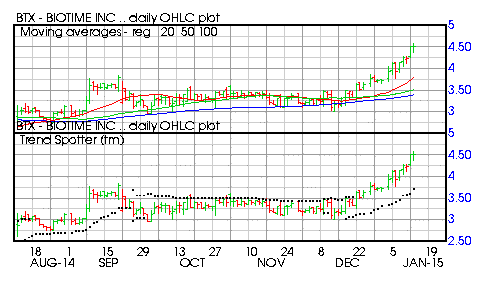

Biotime (BTX) Market Cap $352 million

Barchart technical indicators:

- 96% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 41.96% in the last month

- Relative Strength Index 73.03%

- Barchart computes a technical support level at 4.17

- Recently traded at 4.49 with a 50 day moving average of 3.51

Disclosure: None.