30Y Auction Tails Despite Solid Foreign Demand, Record Low Dealers

Image Source: Pixabay

After two decidedly subpar coupon auctions earlier this week - a soggy 3Y and a disappointing 10Y - moments ago we got the week's final sale, this time of 30Y paper and this one too could have been stronger (although it also could have been worse).

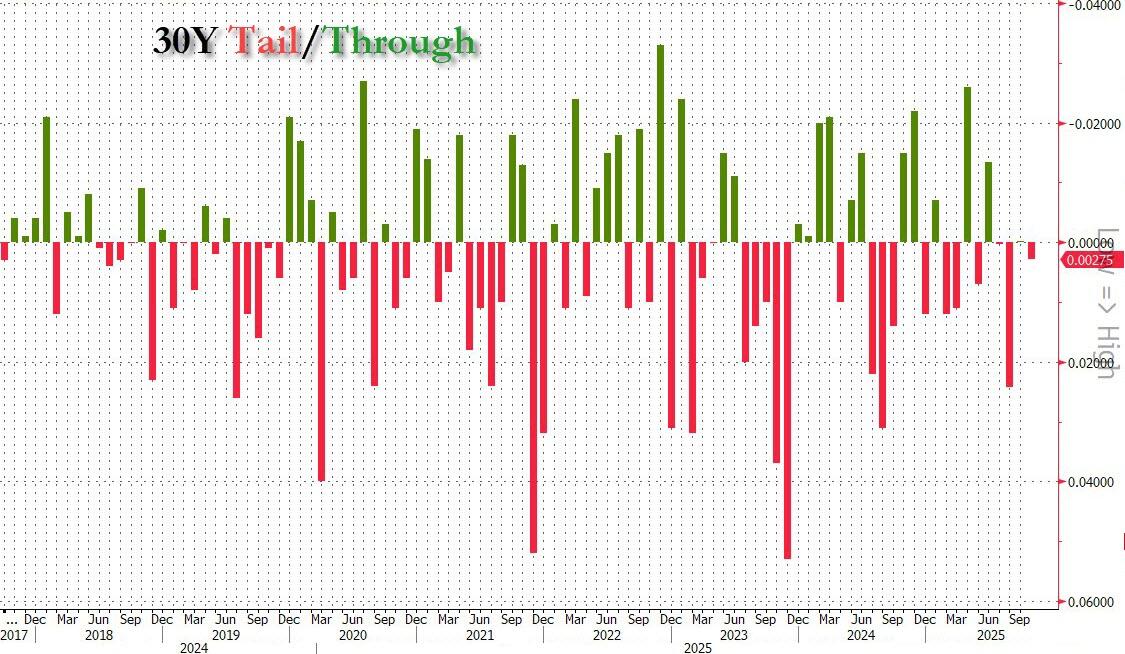

The reopening of 29Y-10M cusip UM8 priced at a high yield of 4.734%, which while up from 4.651% last month, was still the second lowest since March. It also tailed the When Issued 4.730% by a modest 0.4bps, the 3rd tail in the last 4 auctions.

(Click on image to enlarge)

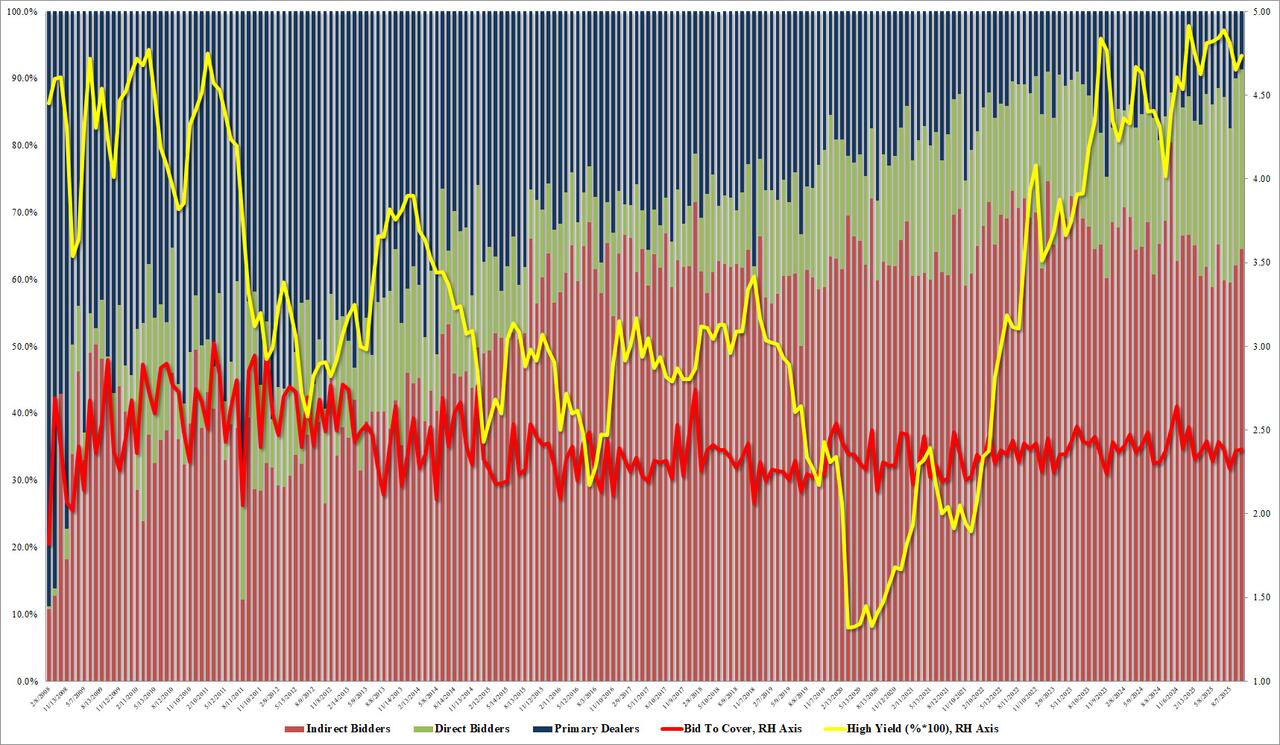

The bid to cover was 2.382, virtually unchanged fractionally higher than 2.376 last month, and above the six-auction average of 2.367%.

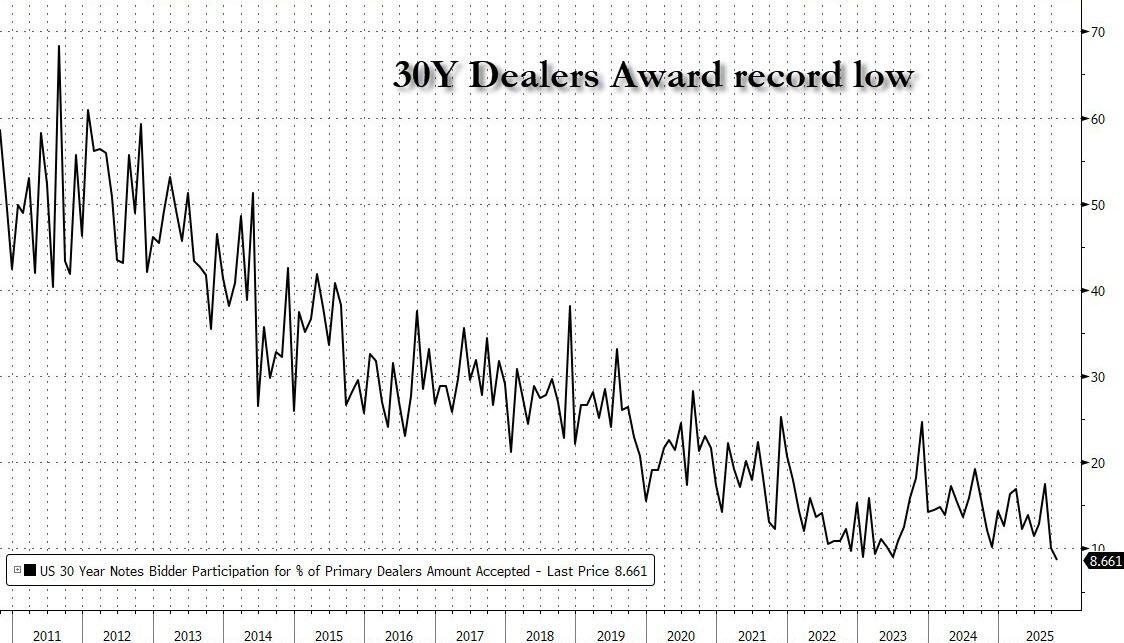

The internals were better with Indirects awarded 64.5%, up from 62.0% in Sept and the highest since June. And with Directs also taking down a solid 26.9%, Dealers were left with just 8.7%, the lowest on record, a solid results all else equal.

(Click on image to enlarge)

Overall, aside from the modest tail, this was a good auction...

(Click on image to enlarge)

... and the market agrees, with the price of the 30Y flat on news of the solid (if not stellar) auction.

More By This Author:

US Stock Ownership Is High But Unequally DistributedConsumer Sentiment Cracking Amid Gov't Shutdown; 17% Of Americans Delay Major Purchases, Survey

FOMC Minutes Signal Dovish Policy Tilt, But 'Majority' Fear Inflation Upside Risks

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more