3 Reasons This Rally Won’t Last

After a couple of rough weeks of sledding, the market rebounded this week. The S&P 500 posted a gain of 3.3% over the past five trading sessions, its best weekly gain since mid-December of 2014. Other indices followed suit. Investors were encouraged by Fed minutes Wednesday where policy makers emphasized that they would raise interest rates slowly and carefully.

I would love to say this is a start of a sustained “Santa Claus” rally, but I do not believe this to be the case. I continue to raise cash as we head into the New Year as I believe 2016’s risks outweigh its rewards at current levels in the market. There are myriad reasons I believe this to be the case.

Obviously increasing Islamist-based terrorism is a concern that could cause shocks to the market at any time. We have not had an interest rate hike since 2006, so how investors react to that event when it occurs bears watching. And, of course, global growth is currently at lowest levels since 2009; this is a trend I think will continue on into 2016. However, there are three current reasons I believe the rally this week will fizzle.

Narrow Breadth:

A fascinating stat was provided on Real Money Pro the other day. The average gain going into Friday’s trading for the top ten stocks by market capitalization in the S&P 500 was a positive 13.8%. For the other 490 stocks in the index, the average was a negative 5.8% for 2015. This is why most investors when they look at their brokerage and 401K statements are down for the year, even if the major indices are showing slight gains.

More importantly, this sort of narrow leadership almost always occurs at market tops and never at market bottoms. Whether it is the “Nifty-Fifty” of the late 60s/early 70s or the internet boom led by the likes of Cisco Systems (NASDAQ: CSCO) in late 1999/early 2000, this type of narrow breadth rarely leads to good things for investors.

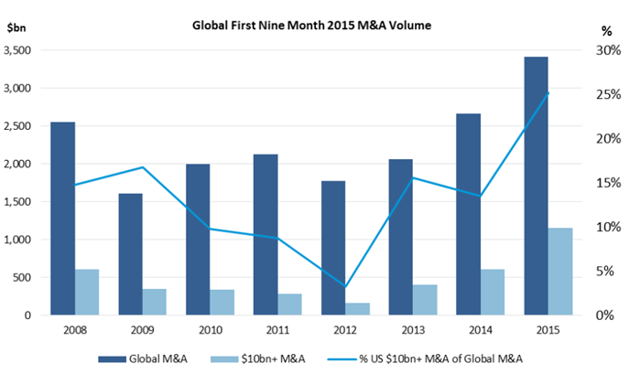

M&A Activity Booming:

It appears that 2015 will go down as a record year for M&A activity by dollar volume. It really has been amazing the size of the deals recently culminating with the possible combination of Pfizer (NYSE: PFE) and Allergan (NYSE: AGN) that could create a $300 billion behemoth. There are myriad reasons why merger activity is at record levels: lack of growth opportunities, the desire to take capacity out of a sector of the market and low financing rates are some of them. Trying to mitigate the United States’ complex tax code that has the highest corporate rates in the developed world is another one.

Again this type of activity almost always happens near the top of market cycles. The last two peaks were 2007 and late 1999/early 2000. Not exactly great times to invest in retrospect.

No Growth:

Finally, and probably most importantly there is little in the way of revenue or earnings growth in the current market. This is one reason people are willing to continue to bid up the stock of Amazon (NASDAQ: AMZN) even if the shares already have astronomical valuations based on traditional metrics. At least the company is growing impressively and gaining market share.

In the last two quarters, we have seen profits for the S&P 500 decline year-over-year. We have not seen this occur since the economy was emerging from recession in 2009. True, take out the collapsing earnings from the energy sector and profits are increasing in the low to mid-single digits. However, they are doing so on less than a two percent rise in revenues. Large buybacks also play an important factor in what little earnings growth is occurring. Currently, Factset projects earnings will again be negative compared to the same period a year ago in the four quarter. 2015 overall is looking like it will be the first full year earnings have posted an annual decline since six years ago.

Outlook:

It is hard to see much of an acceleration in profits in 2016 given the state of global demand, a strong dollar, a coming interest rate hike and a domestic economy that continues to be muddled in the weakest post-war recovery on record. I am raising cash in my portfolio again. I started the summer with a 30% allocation to cash which got down to 15% as I bought the dip in the market in August and September. It is now back up to 20% and I expect it back up to the 30% by the time 2016 rolls around as the risk to the market is to the downside in my opinion.

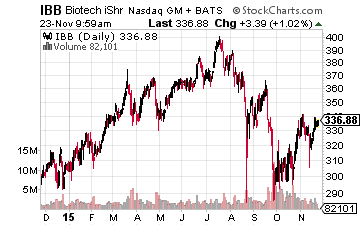

I am deeply underweight both the energy & commodity sectors as I feel we will need to see several high-profile bankruptcies before those areas of the markets truly hit bottom. The only sector of the market I am substantially overweight is biotech.

The sector already had it bear market this summer and looks like it put in a bottom in late September. Many of the large-cap growth names like AbbVie (NYSE: ABBV), Amgen (NASDAQ: AMGN), and Gilead Sciences (NASDAQ: GILD) that should make up the “core” of one’s biotech holdings easily beat quarterly expectations once again in the third quarter. They also sell significantly below the overall market multiple, have great balance sheets, pay solid dividends and more importantly can continue to crank out both earnings and revenue growth in spite of a difficult macro environment.

I have also upped my allocation recently to some of the smaller names in the space that declined 25% to 50% in the sector’s recent bear market. Market sentiment is starting to see a small improvement in this area of late and I believe M&A activity will remain very strong in this sector going into 2016.

The biotech sector is still my favorite for finding outsized returns and has even become more favorable to me in these no-growth market conditions. This is still the only sector where you can book single day profits in the double and even triple digits while the rest of the market stalls and sputters.

Disclosure: more

There is one reason this rally can last: Santa Claus. No, we don't have year-end rally every year, but we do most time. I don't think this year is an exception. I'm not selling into this rally, not until week before Christmas.