3 Lies About ETFs

As U.S. stocks register new highs and bond yields register new lows, the exchange-traded fund (ETF) marketplace keeps humming along. This is true of ETFs in virtually all asset classes, including not just equities (SCHB), but currencies (FXE), commodities (DBC), and real estate (ICF).

The total assets in U.S. listed ETFs and ETPs reached a record $2.25 trillion at the end of June 2016, while global assets hit $3.17 trillion, according to ETFGI.

Although the global usage of ETFs is clearly growing, the criticisms about them abound. Let’s examine some of these false assumptions.

ETFs are nothing more than short-term trading vehicles.

The claim that ETFs are one-trick ponies exclusively reserved for daytraders is sometimes used in an attempt to discredit ETF investing.

Although some investors do in fact use ETFs as short-term trading instruments, a significant portion also use them as long-term portfolio building blocks. They do this because ETFs offer significantly lower cost, broader diversification, and better tax-efficiency compared to alternatives.

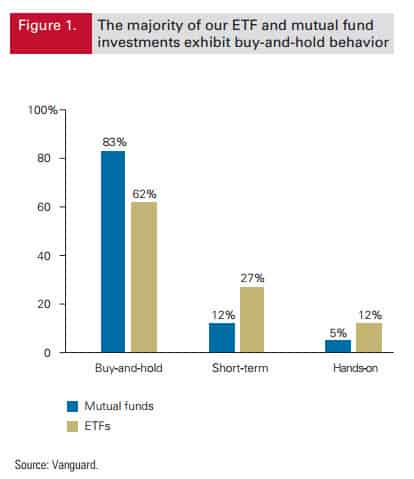

A 2012 study by Vanguard of its own shareholders found the majority were using ETFs as “buy-and-hold” investments rather than merely using them as trading vehicles.

More importantly, the trading activity of short-term ETF traders doesn’t negatively impact fellow ETF shareholders one iota. And that’s a huge advantage over traditional mutual funds where fellow shareholders can and do impact the tax and financial situation of each other.

ETFs induce self-destructive habits.

A popular argument against ETF investing is that they trick people into self-destructive behavior. This includes hyper-active trading, investing in non-core asset classes like volatility (VIXY), and investing in leveraged products that go long or short.

ETFs can be likened to the the modern day automobile. Is there anyone who would argue against the fact that automobiles have greatly increased the comfort, speed, and convenience of travel? Despite these significant advantages, car accidents happen. And in the vast majority of cases, it’s the drivers that are at fault for crashing – not the automobiles!

Similarly, ETFs are not to blame for improper application, mistakes, or other user problems that arise. Self-destructive behavior existed long before the invention of ETFs and its existence today most certainly isn’t because of ETFs.

Short ETFs are to blame when financial markets crash.

This particular claim made against ETFs usually surfaces whenever financial markets are in turmoil. Why? Because after running out of reasons to explain why financial markets are crashing, the “short ETFs are to blame” is a convenient crutch.

ETFs that short markets are designed to increase in value when the price of the assets they track declines. For example, the ProShares Short S&P 500 ETF (SH) aims for 100% daily opposite performance of the S&P 500. That means if the S&P 500 is down by 1% on any given day, SH should be ahead by 1%. Likewise, if the S&P 500 climbs by 1%, SH should be down 1%. Some short funds – also known as “inverse” funds – utilize 200% or 300% leverage to magnify their daily performance.

Short ETFs don’t trigger crashing markets any more than put options, another type of derivative, triggers crashing markets. These products merely exist to allow investors a way to express their opinion about the market.

Also, with just over $21 billion in assets, short ETFs listed in the U.S. represent a very tiny slice of the entire ETF market. In other words, it’s a very small non-market moving footprint in the global financial marketplace.

Summary

The many attempts to discredit ETF investing will not stop demand or usage of ETFs. They are flexible investment products that offer benefits for investors with a short-term, long-term, and intermediate time horizon.

While ETFs do offer significant advantages, they are not perfect. Why? Because the “perfect” financial product doesn’t exist.

Ultimately, the portfolio building blocks you use for your investment and retirement plan will largely depend on your personal goals and preferences – not by what critics say.

Disclosure: None

Disclaimer: Ron DeLegge has analyzed and graded more than $125 million with his Portfolio ...

more

Carol,

You're 100% correct, I'm biased! Glad you picked upon this. And more specifically, I'm biased toward a) indexing a person's core portfolio and b) using #ETFs as the building portfolio building blocks.

Finally, it's OK to have financial biases, so long as those biases are correct and firmly rooted in improving the odds of long-term investment success.

Beware of financial pundits or advisors that say they're "unbiased." Why? Because he who stands for nothing, will fall for anything.

Hooey- of course you're biased. #ETF's, since their existence have made the market far more volatile along with #algos and #HedgeFunds.