3 Key Events That Will Drive The Market In March

These three events are what every investor should be watching closely. What happens with each will determine if stocks head up, down, or sideways in March, and if you keep a close eye on them will know if it is time to start buying stocks before the market rallies.

“Beware the ides of March” – Julius Caesar, William Shakespeare

It has been a rocky start for investors in 2016. January opened with deep losses during the first two weeks of the year before stabilizing somewhat towards the end of the month. Still, the S&P 500’s 5.1% decline in January was the 10th steepest drop for the month on record. The first two weeks in February again brought heavy losses before the market seemed to find a floor for the moment and rose to end the month largely flat, at least as far as the major averages are concerned. However, sectors within the market like energy, biotech, small caps, transports and emerging markets are all in bear markets; some of them quite severe.

So what will the beginning of March bring? I am watching three key items that could determine the direction of the market for the coming weeks and months.

High-Yield Credit Markets:

One of the major headwinds to equity performance in 2016 is the deterioration in the high-yield credit or “junk bond” market. New junk bond issuance has dried up to a trickle as total issuance is down some 70% from the same period a year ago. Most of the spike in volatility and yields in the junk bond space has been due to the accelerating rate of defaults from small and even mid-tier energy producers blindsided by the severe decline of both oil and natural gas over the past year and a half.

This fear has impacted almost every segment of the market and economy that depends on this type of credit. This includes small biotech concerns that have been hammered over the past six months as the market frets over developmental concerns not being able to raise capital to fund trials, or will have to pay a much steeper price to access these markets and the financing they provide. This has also impacted homebuilders, which tend to carry significant debt within their business models. Many are down 30% to 40% from their highs this summer even as housing starts in 2015 had their strongest year since 2007.

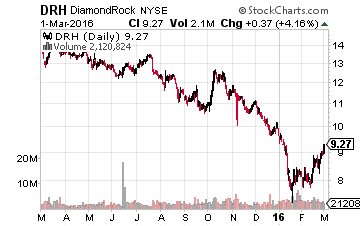

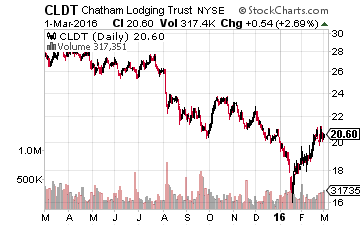

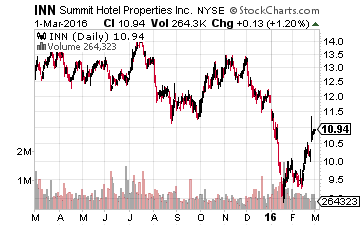

Also impacted are real estate investment trusts (REITs). Many high-quality names are down 30% or more from 52-week highs; although, they have behaved better in the past month. As I have said repeatedly in these pages recently, I like the lodging part of this sector and have significant stakes in Chatham Lodging Trust (NASDAQ: CLDT), Diamondrock Hospitality (NYSE: DRH), andSummit Hotel Properties (NYSE: INN). All are cheap, have been oversold, and pay dividend yields between four and six percent. If the high-yield market stabilizes or loosens up, these names will do well and the sectors listed above will start to bounce back as well.

Oil:

The price of oil is impacting the high-yield credit markets as well as the overall zeitgeist of the market. Crude started to stabilize at just over $30.00 a barrel in the back half of February, which is one of the key reasons stocks rallied off deep early losses in the month. The energy market is something every investor, trader, investment bank, and trading desk is watching intently right now. For most of 2016, oil and equity direction has been one and the same, and in all likelihood this should continue through March.

Key OPEC members and Russia have started to openly float the idea of production freezes; a key reason crude finally stopped its plunge after 18 months. However, given the nature of the geopolitical aims the major energy producers have in these discussions, an agreement may be a ways off if one can be hammered out at all given the contentiousness of the key parties involved.

I would look for volatility originating from the oil market to continue to be the main factor in the market’s direction in March. Expect a lot of “false starts” as rumors creep out from these back and forth negotiations between the participating countries. I remain totally out of the energy sector because even at $40.00 or $50.00 a barrel, many of the smaller shale producers will most likely need major restructurings and/or bankruptcies.

Central Banks:

The European Central Bank is meeting again on March 10th. Europe is already operating on a negative interest rate policy. However, the bank may take that policy deeper into negative rates especially after January numbers painted a picture of deflation across the continent. This will in all likelihood cause the dollar to strengthen and be a further headwind to S&P earnings growth.

The Federal Reserve also meets again in Mid-March. Everyone expects the central bank to stand pat given the anemic global economy, but investors and the markets will be tuning in closely to hear comments on how the Fed sees interest rate policy going forward. Part of this outlook will be influenced by how the monthly jobs report looks this Friday. Investors want the report to show to things. The first is that the U.S. job market is strong enough to withstand the current global economic environment and that it will not fall into a recession. And second, investors want to see the report be weak enough that the Fed can issue “dovish” guidance when it meets in two weeks. A fine needle for the Fed to thread indeed.

Given the volatility that has defined the markets throughout 2016 so far and should remain a factor into March, I remain on a cautious stance. I continue to have a higher than normal allocation to cash within my portfolio and the rest of my holdings are in lower beta large cap stocks with generous dividend yields for the time being.

Disclosure: Long CLDT, DRH, and INN.

Small Cap Gems analyst Bret Jensen has identified his top 3 takeover stocks for ...

more